How a strong economy and open banking are positioning the credit union sector for heightened merger and acquisition activity

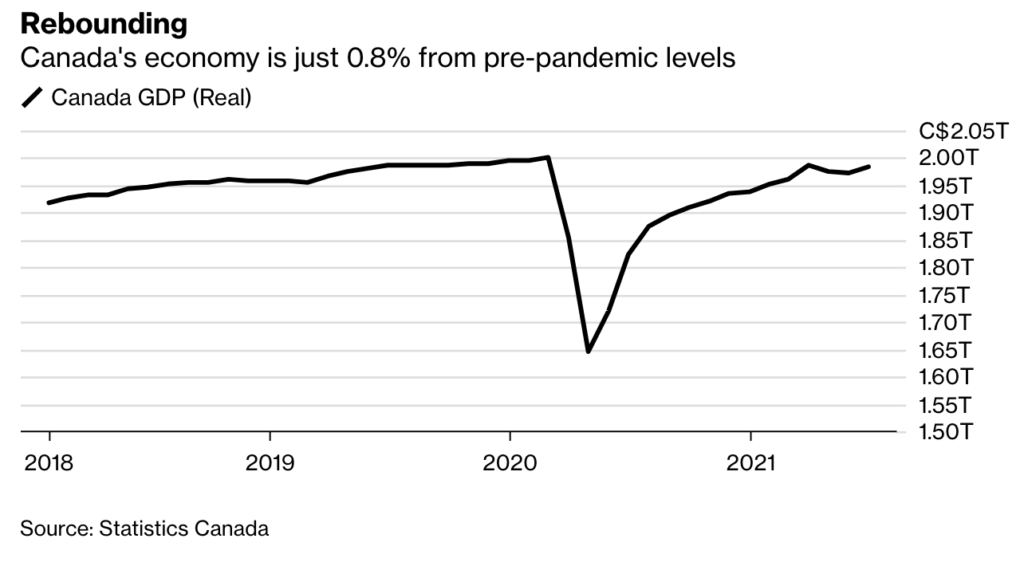

The economic rebound is well underway with Canada’s economy expected to grow as much as 6% in 2021. According to Statistics Canada, they are just .8% away from their pre-pandemic levels to be exact. That’s thanks in large part to the countrywide easing of COVID restrictions in June. “Last month, broad-based reopenings across the country allowed businesses to resume operations after months of shutdowns,” according to Bloomberg’s reporting on the economic rebound. “As a result, high-contact sectors returned to growth, along with manufacturing.”

For Canada’s credit unions, this kind of growth represents good news and good opportunities. Unique in North American financial services, Canadian credit unions already boast larger membership over their neighbor to the south. “We in Canada enjoy the world’s highest per-capita membership in the CU sector, with more than 10 million members, or about a third of the Canadian population,” according to Rob Palin, general manager for Fiserv Canada, in CU Management. The recent moves in open banking will further spur new growth as consumers can more easily switch their primary financial institutions.

With Canadian Credit Unions growing slightly under 3% annually, growth continues to be a primary focus for the sector. “Interest in membership is not at all wanting, but market dynamics are making M&A activity increasingly attractive,” Palin says. “This activity will be catalyzed by such technologies as APIs and open banking, which can greatly enhance the ability of a Credit Union to close a merger quickly and efficiently by making integration of external parties easier.” Just in the last week, two Canada-based credit unions announced their plans to merge.

Stay tuned as Believe in Banking continues to provide news and insights on the industry’s latest developments, like credit union growth, open banking and new opportunities for financial institutions.