Beyond customer acquisition, new branches help widen and deepen local banking relationships

As others in financial services continue contraction of their branch networks to cut costs, a growing number of banks are beginning to execute expansion plans instead – in addition to Chase’s well-publicized branch commitment. This week, Bank of America (BofA) opened three new locations in Lexington, KY “building on its existing services in the state, which include Merrill Lynch Wealth Management and 27 ATMs,” according to Business Insider Intelligence. “[B]ranches remain useful for complex transactions, which points to an opportunity for BofA to capitalize on playing an advisory role in clients’ bigger financial decisions.” BofA’s format diversity is poised to serve complex consumer needs.

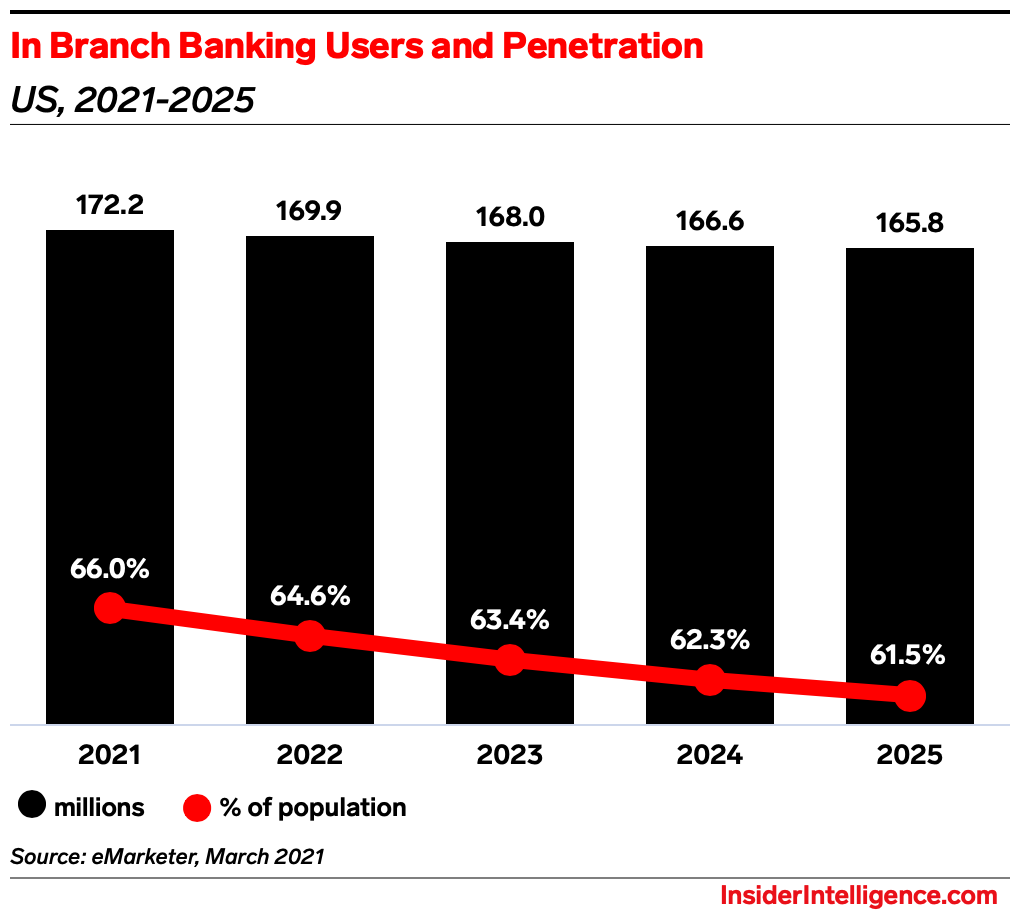

While reliance on digital banking continues apace following a pandemic year, millions of consumers – more than 60% of them – still expect to visit their local bank branch well into 2025. As we explored in our article on leveraging local influence, the branch represents an essential acquisition medium for banks. But even more importantly, the branch is a critical connection channel for consumers. Consumers may not visit often, but data consistently shows they want their local branch close. On the significance of the branch, The Financial Brand puts it this way: “Branches aren’t just a place to open new accounts. In fact, the majority of branch platform staff’s time is spent servicing existing account holders.”

Additional household bank brands are joining the expansion game, include Fifth Third, which just announced plans to open three additional branches in the competitive Charlotte banking market, and BBVA USA, which is opening 11 de novo branches across five key markets in the opportunity-rich state of Texas. Not satisfied with legacy locations, BBVA’s efficient branches are 2,600 square feet spaces, conveniently located in existing well-trafficked retail centers, and staffed with banking experts who know their customers. “All branch bankers also have data-driven customer insights for the ability to provide personalized recommendations and have deep, meaningful conversations based on the customer’s transactional behavior and relationship,” BBVA says of its branch approach.

In a recent BankThink article, Simon Powley, head of advisory services for self-service company Diebold Nixdorf, describes how the branch is part of an expanding ecosystem. He says, “Technology is transforming consumers’ expectations for their banking experiences… [Y]et, speculation that branches are on the verge of extinction fails to acknowledge the important role they continue to play for numerous customers, including small businesses and older consumers.” FIs with a more nuanced and laddered approach are poised to grow. Powley says, “Banks’ operations, particularly when it comes to their engagement with customers, are constantly evolving, and financial institutions that integrate the benefits of in-branch, personal interaction within their digital offerings will continue to remain competitive.”