How Interactive Teller Machines are empowering banks to remain human-centered in a socially distanced world

While COVID’s impact on our everyday life presses onward, service sector and retail brands are exploring how to continue meeting the needs of consumers during these extraordinary times. In our COVID as a Catalyst series, we shine a light on how some changes either begun or sped up in response to our new normal that will likely stick around. One such trend is remote delivery. From retail to banking, industry leaders are striving to stay customer-centric even as we remain socially distant. One way banking is doing just that is by repurposing the drive-up and augmenting more remote self-service channels with newer approaches like ITMs (Interactive Teller Machines).

Human + Technology

More than simply another way to process transactions, ITMs have the potential to extend the retail channel into underserved areas more cost-effectively than any size branch – even the smallest micro-branches. With live-staffing, ITMs humanize technology in a way ATMs never could in the past and can be staffed remotely as needed – an added value during times when people should necessarily be apart. Interestingly, we’re beginning to witness financial brands that invested in ITM technology reap their rewards. According to the Credit Union Times, “Credit unions that have invested in interactive teller machines are seeing some positive returns during this crisis.”

Even with its obvious cost-savings and flexibility for consumers, ITM penetration in banking prior to the pandemic remained somewhat anemic. In fact, the ABA Banking Journal highlighted a Bancography survey finding, “Despite widespread conversation in the industry about ITMs, only 14 of the responding institutions, or about one-fourth of the respondents, have implemented the technology. However, 60 percent of the remaining respondents cited some level of interest in ITMs, varying from the research phase to concrete plans for implementation in the next year or two.” One reason for the cautious approach could be the relatively low consumer awareness and adoption of this technology and the additional effort and resources banks would have to put into education.

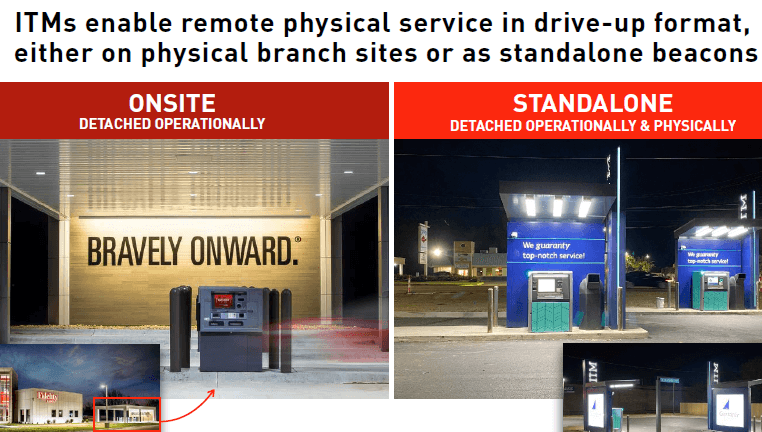

ITM Deployment

Like the ATM decades before it, the ITM may feel foreign to consumers because they haven’t yet experienced one to know what it can do for them. Less a transaction tool and more a teller or banker extension, the staffing element of the ITM means that consumers can bring their more complex needs and queries that fall somewhere between the empowerment of basic self-service banking and the more consultative experience that happens inside the branch. It is a teller window extension without tethering to a branch. It can also exist as a brand beacon in markets to expand banking services and extend the Halo Effect of market presence.

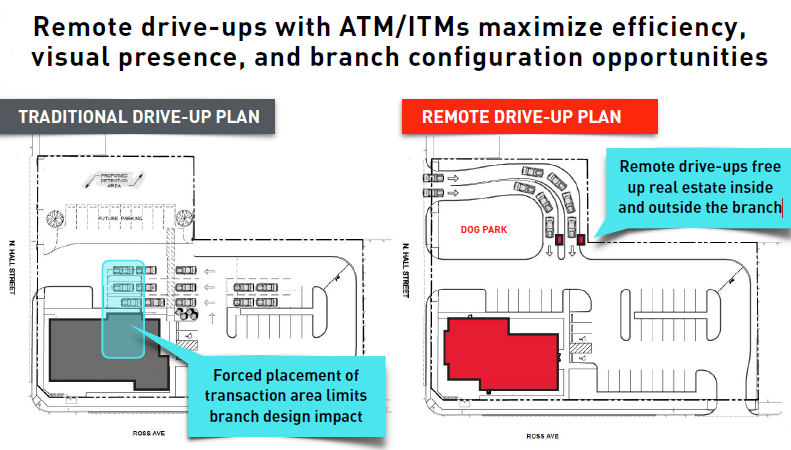

When banks deploy ITMs as part of the branch network, remote drive-ups with ITMs maximize operational efficacy and flexibility, allowing the financial institution to optimize the use of physical space both inside and outside the branch. Further, as Sean Keathley discusses in our Ask an Expert Series, banking must find a way to bridge the digital and physical worlds, especially now. He says that ITMs are one way that banks can implement a more progressive vision of drive-up, detached from the building and staffed remotely, ultimately unlocking more efficiency for the bank and a more frictionless experience and channel-less approach for the consumer.

Investing in innovation at the network channel level is a win-win, empowering banks to build resiliency into their networks, which ultimately positions them to better deliver financial services to consumers. Fully remote ITM drive-ups provide the most operational efficiencies for banks while still retaining that brand-critical community presence. Intrinsically flexible, they can initially operate with ATM utility, eventually migrating to ITM functionality as the bank facilitates a consumer awareness and adoption campaign. ITMs can also support an institutional shift to a drive-up or remote strategy.

Fully remote ITM drive-ups:

- Provide the most operational efficiency

- Retain community presence

- Operate with ATM/ITM functionality

- Support migration to drive-up only

- Serve as branded day/night beacons

- Can be left behind after branch closers

Building Branding

Consumers need help understanding the benefit that these hybrid human-powered, tech-enabled machines will bring to their banking experience. From a brand deployment standpoint, banks are taking different approaches, and there is no one right answer as they introduce them to the market. Given that the majority of consumers are not yet aware of the full scope of ITM capabilities, some banks are implementing a migration strategy, branding as the familiar ATM first, then gradually turning on video functionality. The challenge of this approach is that the bank is not conveying to consumers that this is more than an ATM. The challenge of consumer education still exists – it’s just delayed.

Other banks use a functional approach by branding ITMs under their larger umbrella and use proprietary branded names that evoke the purpose by explicitly naming it “Video Teller” or “Live Banker.” While some banks have chosen to implement ITMs inside their branches as extension of tellers, best practice is to deploy ITMs in a remote setting where human-based customer service is not available. This remote setting is ideal for brand communications approaches that employ explanatory and brand-aligned language to support the consumer adoption of these channels that bridge the digital and physical divide.

In an upcoming feature, we’ll take a deeper dive into consumer awareness and perceptions of Interactive Teller Machines, along with adoption and branding campaigns supporting implementation. We’ll also explore and highlight learnings from the market introduction of the ATM, a wholly new technology at the time when it hit banking in the 1970s and became widely available across the country by the 1980s.

To develop experience-based strategies for customers and members in the face of COVID, like deploying tools that bridge the physical and digital divide, contact Adrenaline’s experts at info@adrenalinex.com or (678) 412-6903. For more information on bank branch operation in the post-COVID landscape, download the Roadmap to Reopening.