Learnings for the banking industry from advances on the healthcare frontlines

In our last article on COVID as a catalyst, we looked at how our new work-from-home life was poised to extend beyond the workplace, addressing relevant parallels for banking from the challenges and the changes implemented in response. While remote working and the technology that powers it are becoming more widespread every day, finding ways to get healthcare to people when they need to be socially distanced may be one of the biggest challenges in the modern era of healthcare.

In an industry that hasn’t markedly changed in its mode of delivery in decades, how are healthcare providers getting care to people in the middle of a pandemic, and what can banking learn from its adaptations and innovations?

Rise of Remote Delivery

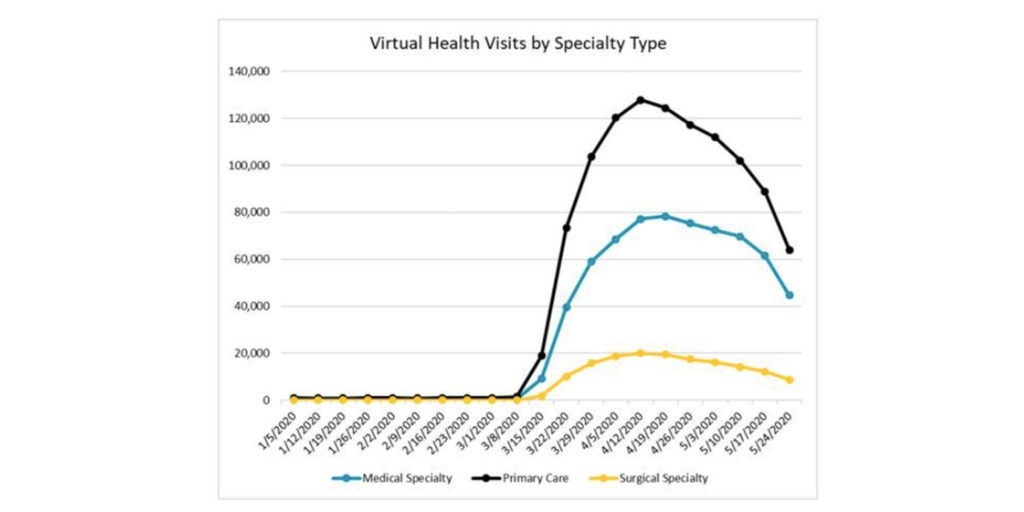

Before COVID, telemedicine was either not widely accessible or not used by patients, with awareness and adoption low among key audiences. In fact, up to 82% of consumers report not using the technology, although providers like Kaiser were investing heavily in it. Then, within just a few weeks once COVID hit, the entire health system went from 15% to 85% tele-med usage, testing the capabilities of private providers and validating its public sector advocates. Now, massive investments are being made in virtual healthcare, from a $3 billion pre-pandemic to a whopping $250 billion now.

In a roundup of COVID impacts in Politico, Ezekiel J. Emanuel, chair of medical ethics and health policy at the University of Pennsylvania says “For years, telemedicine has lingered on the sidelines as a cost-controlling, high convenience system. Out of necessity, remote office visits could skyrocket in popularity as traditional-care settings are overwhelmed by the pandemic…There would also be containment-related benefits to this shift; staying home for a video call keeps you out of the transit system, out of the waiting room, and, most importantly, away from patients who need critical care.” Telemedicine reduces stress on the system, streamlines processes, and provides patients a safe way to see their provider.

- In banking, remote or distanced channels have long been a delivery channel – with drive-ups and ATMs facilitating transactions – but not an area of heavy investment. Just like healthcare, we expect to see a greater demand for remote or socially distanced transactions post-COVID, augmenting drive-ups, and deploying ITMs with remote staffing. These enhanced channels will not replace the branch but will extend the services that the branch provides. Just like mobile and online banking before them, expanding delivery channels provides customers with more choice, convenience, and safety.

Focus on Security

Even as telemedicine advances, challenges like fraud are also on the rise. According to Health Affairs, “Allowing for flexibility in the health care system and an economic stimulus package are both reasonable responses to the ongoing crisis, but law enforcement and regulators must be vigilant for bad actors who exploit these responses to defraud consumers and payers.” While the government has taken steps to reduce fraud and expand capacity in healthcare, “In so doing, unethical and fringe providers will have the opportunity to engage in wasteful and fraudulent activities in new ways.” While extensive regulatory changes are unlikely now, updated guidance is imminent once the COVID crisis passes.

- Banking is no stranger to bad actors during moments like these, but much like healthcare, no new regulations have been put in place for current or future fraudulent actions. What the government is doing, however, is drawing attention to safety in banking by monitoring activity, issuing warnings, and providing industry guidance for monitoring and remediation. Further, an expected uptick in M&A activity as a result of COVID and short- and long-term implications for the economy may result in an increase in government action for banking during COVID and beyond.

That said, we don’t expect an expansive raft of regulations while the banking sector bounces back post-COVID, as it has proven itself both resilient and responsive to customers and community. In the short-term, banks and credit unions can focus on keeping customers and members’ data and information as safe as possible – and communicating with all those they serve about the need for heightened awareness around security.

Increasing Innovation

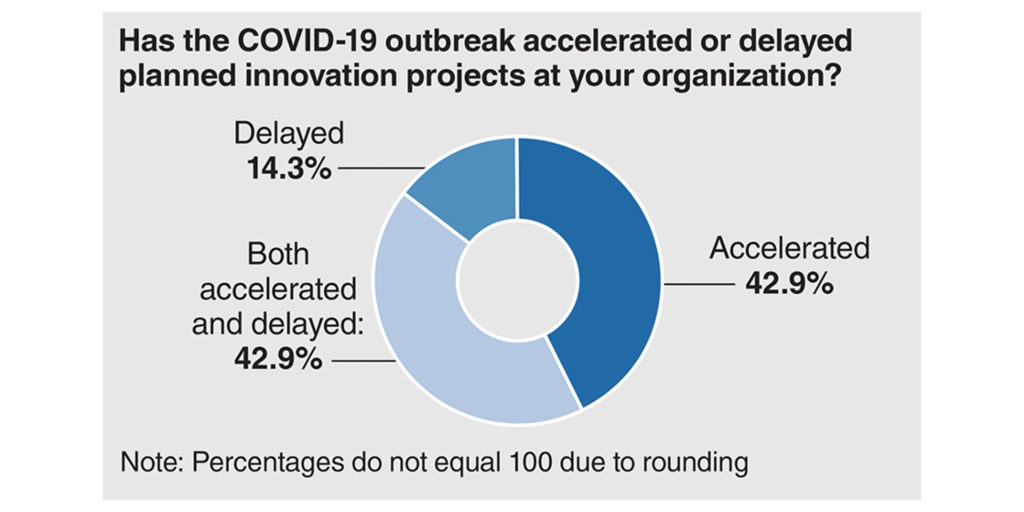

In what some healthcare analysts are calling a “moonshot” because of COVID, the American healthcare system is expected to undergo a massive overhaul in the coming years. One prognosticator – Kevin Scott, CTO at Microsoft – is predicting a huge burst of healthcare advances. He says, “I think our reaction to this horrible pandemic we’re having now could produce a wave of investment and innovation in biotechnology that defines the next 75 years. The way that the industrialization of the modern world post-World War II has defined the past 75 years.”

From the urgency to get effective therapeutics and the rush for a safe vaccine all the way through to how providers deliver care, COVID is sparking innovation across the global healthcare system. McKinsey finds healthcare innovation sits at the intersection of biology and technology, saying, “A confluence of advances in biological science and accelerating development of computing, automation, and artificial intelligence is fueling a new wave of innovation.” Not only will the impacts be felt in the healthcare sector, but society-wide as McKinsey states, “Advances in biological science could transform economies and societies, helping to tackle global challenges from climate change to pandemics.”

- While banking is not charged with treating people with COVID or developing treatments, bankers have taken up the mantle of providing strength and stability to the consumer and the economy through needed financial services, powered by a mixture of insight, iteration, and innovation. Thus far, the sector is forging a successful path forward by placing the customer at the center of organizational change, building upon core brand resiliency, and leveraging the power of the branch and local relationships.

One look at banking’s commitment to its communities through PPP and consumer lending demonstrates just how critical banking’s role is in coping with COVID. In an upcoming feature, we will take a deeper look at one of those innovations – the ITM – and how it’s perfectly positioned to serve consumer and institutional needs during COVID and beyond.

For more insights on healthcare’s response to COVID, visit Adrenaline’s article Healthcare Responds to Covid-19 with Resilience. Stay tuned to Believe in Banking as it tracks the big trends – like COVID as a catalyst – that are impacting the world outside the financial industry and are informing the banking experience. To develop experience-based strategies for customers and members in the face of COVID, contact Adrenaline’s experts at info@adrenalinex.com or (678) 412-6903.