The Story:

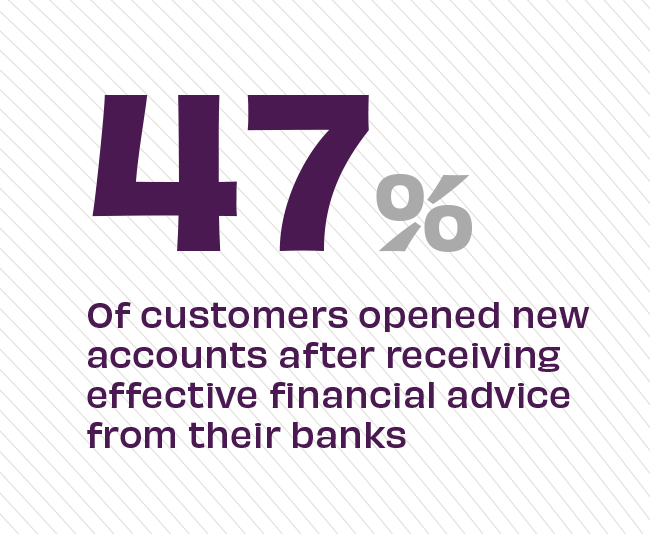

At a time when customers report a decline in their overall financial health – 9% YOY according to J.D. Power – valuable financial consultations are more important than ever. While 78% of customers say they plan to return to their bank when it delivers personal financial advice, only 44% of banks regularly provide this customer counsel at the branch. With branch usage increasing to pre-pandemic levels, nearly three-fourths of customers say they plan to use their bank’s branches at the same rate they did last year, providing banks with ample opportunities to step up with support.

The Takeaway:

We know that face-to-face interactions instill trust, so naturally consumers want to meet with their bankers at the branch to get needed expertise from their primary financial institution. “It’s no longer predominately about being fast, efficient or convenient,” says Jennifer White, senior consultant of banking intelligence at J.D. Power. “The preeminent performance metric with the biggest influence on customer satisfaction is ‘supporting customer during challenging times,’ and that means customers are expecting a personalized mix of financial advice, hands-on help with problem resolution and guidance on how to grow their money.”

Source: J. D. Power, “U.S. Retail Banking Satisfaction Study,” March, 2023