Consumer faith in the financial services sector buoyed by their primary institution’s stability and recent deals strengthening the country’s banking system

The British maxim to “Keep Calm and Carry On” continues to have massive appeal across the globe, even aptly describing current American attitudes toward their primary financial institutions regardless of recent bank failures. “Americans still trust their banks despite the historic run on deposits that caused the bank(s) to collapse,” according to USA Today reporting. “And most bank customers say they are at least somewhat confident that their money is safe despite two other bank collapses and warnings that more collapses may come.” That enduring level of trust in banking is the conclusion of a Morning Consult survey of American consumers taken only days into the banking industry’s short-term setback in mid-March.

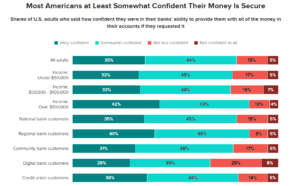

Digging into the data even more, 79% of adults are somewhat or very confident that their money is secure and their bank would be able to give them all of their money if they went to withdraw it. That level of trust in people’s primary financial institutions has so far blunted any wider impact to the larger banking industry in the wake of the second-biggest banking failure in US history. That’s because most people perceived Silicon Valley Bank and Signature as different from their own institutions. “The average consumer has been able to differentiate what’s happening at SVB from what’s happening at their bank down the street,” says Charlotte Principato, Morning Consult’s financial services analyst in USA Today. “That’s why we are seeing relative calm.”

Even as some people felt compelled to change their mix of depository accounts after the regional bank downfalls, most people’s primary banking relationship remained status quo. “Only 5% of consumers said they changed their primary bank provider as a result of the bank failures,” according to a recent industry analysis on diversification. “But 23% are considering starting a relationship with a new bank in the next six months, an 8-point increase from February.” While this openness to new banking relationships provides an opportunity for community banks and credit unions to show their strength, the fact that so many people are staying put also provides the industry with the sense of stability it needs to weather the storm.

Recent moves are also reinforcing the foundation of the country’s banking system, including First Citizens Bank’s just-inked deal to buy most of Silicon Valley Bank and New York Community Bancorp’s purchase of key pieces of the failed Signature Bank. Both deals blessed by the FDIC begin to reaffirm to people that their trust in banking is well-placed. “The financial system is like a boat,” says Aaron Klein, a senior fellow at the Brookings Institution and a former official at the Treasury Department, in his recent interview with Fortune on rising trust in banking. “SVB’s collapse has rocked the boat, but the ship is righting itself.”

For more news on the consumer response to regional banking turbulence, stay tuned to Believe in Banking’s continuing coverage of top trends and topics. For the industry’s best practices and perspectives, visit Adrenaline’s Insights. And if you’re a banking leader looking for strategies customized for your institution, contact our banking and credit union experts via email at info@adrenalinex.com.