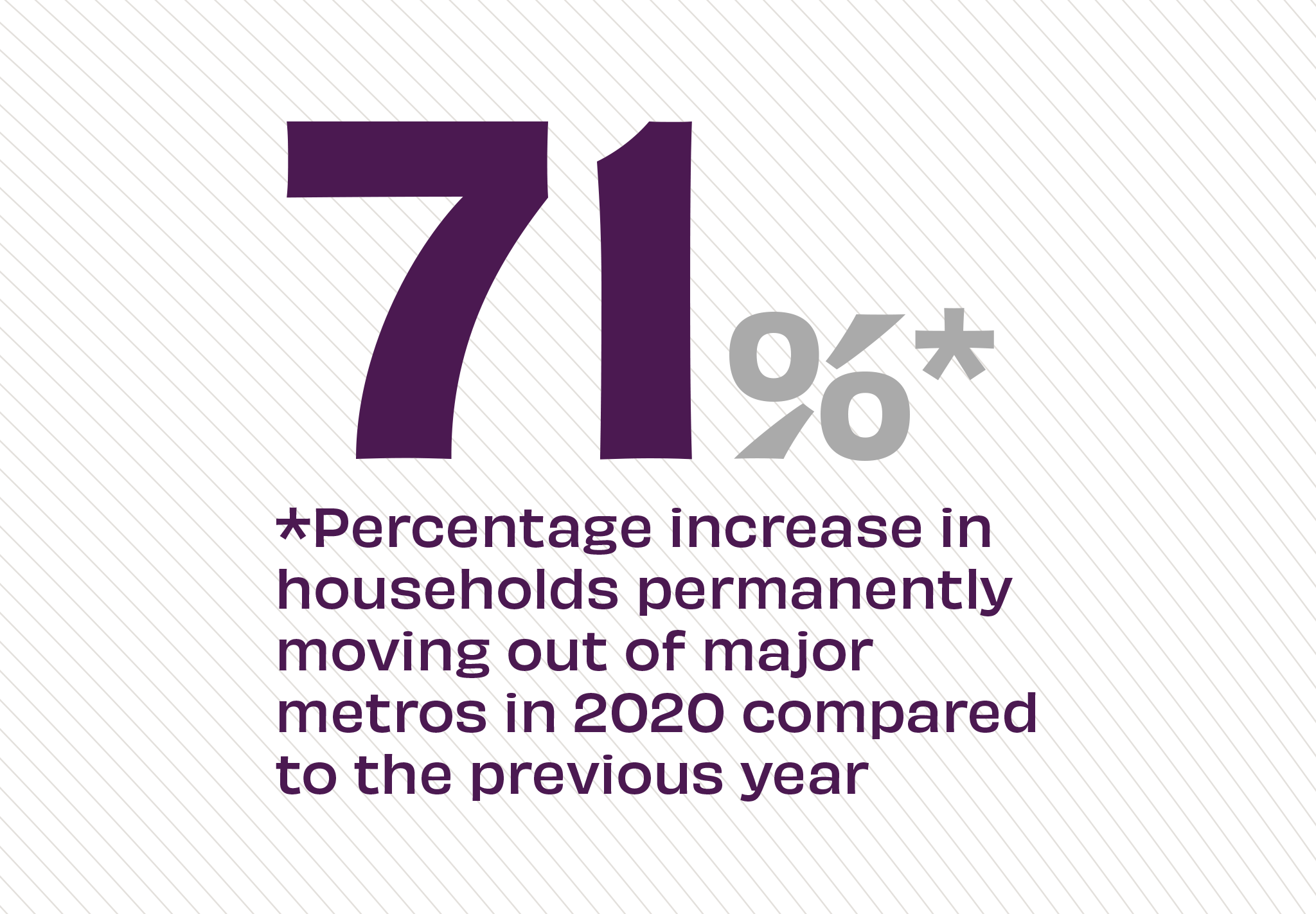

The Story: As reported in the Wall Street Journal, the pandemic sparked massive migration across the U.S. In 2020, as a record number of people left major metro cities like New York, Boston, San Francisco and Chicago in search of more affordable and relaxed lifestyles, they mostly headed to the suburbs, which saw a whopping 43% rise in net new households last year.

The Takeaway: Local matters in banking. Despite the sharp rise of digital banking, most people still want to be within 15 minutes of a branch. With this migration away from city centers, banks and credit unions now have an opportunity to grow by reshaping and expanding their branch networks – to go where the people are. A rigorous, analytics-driven network strategy that identifies prime areas of opportunity by tracking human mobility data can help financial institutions thrive today and position well for the future.

Source: U.S. Postal Service Data, April, 2021