Meeting delivery demands as channel platforms shift toward the consumer post-COVID

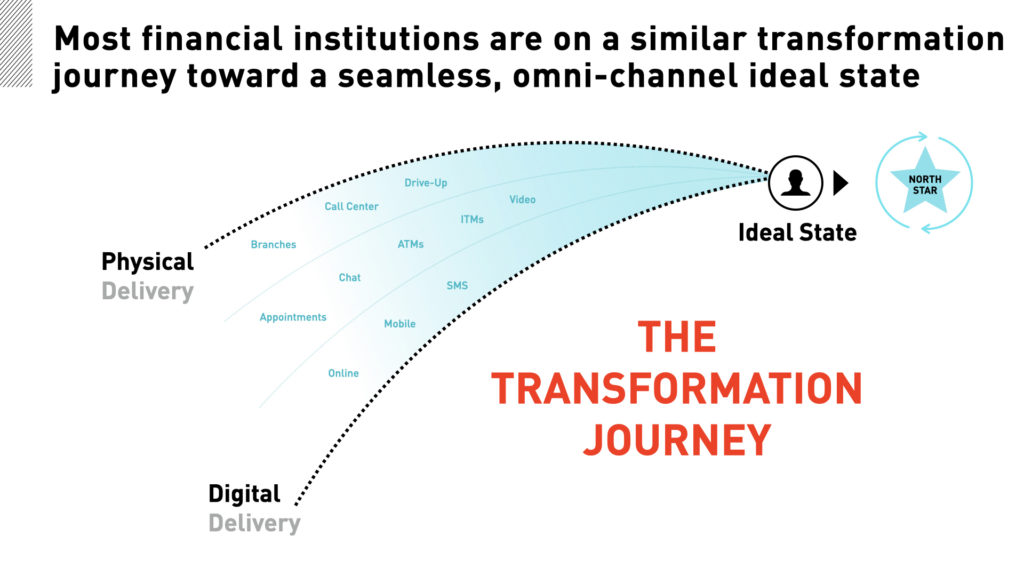

As consumers’ embrace of digital channels skyrockets – no doubt, supercharged by COVID – most financial institutions feel the pressure to optimize their digital experiences. But digital experiences don’t exist in a silo. Consumers expect digital and physical to seamlessly integrate into holistic banking experiences, not be defined by rigid, bank-defined boundaries between branch and mobile. Gina Bleedorn, Chief Experience Officer at Adrenaline, says, “Most financial institutions are on a similar transformation journey toward a seamless, omni-channel ideal state where all delivery is centered completely around the consumer. Most notably, two macro channels – physical delivery and digital delivery – are laddered into a transformational journey to always be headed towards an ideal state North Star experience.”

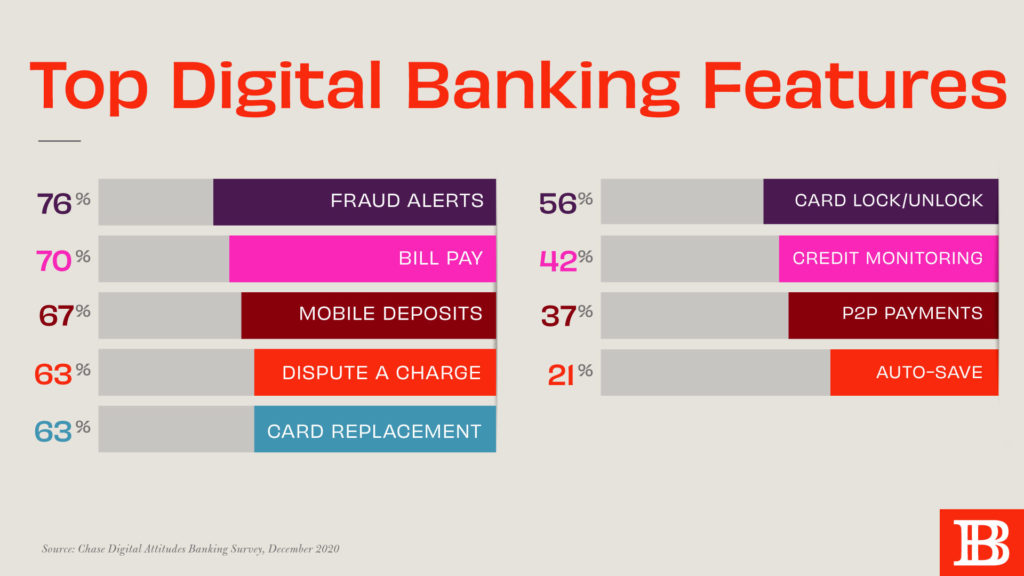

That ideal omnichannel state requires augmenting digital channels, to be sure. In fact, the Chase Digital Attitudes Banking Survey found that consumers wanted digital banking options to easily integrate into their lives and to deliver on their priorities: customers ranked fraud alerts, electronic bill payments and mobile deposits as their most used banking features. Further, 80% want to be able to track their spending and manage their money digitally, but don’t necessarily do that with their mobile device, instead moving to the computer for more time-intensive tasks like dispute resolution and paying bills online. Overall, mobile capacity must meet demand, and demand is high. Chase customers report that the pandemic has pushed them digital with 54% increasing their usage of digital banking over the prior year.

Branch Matters

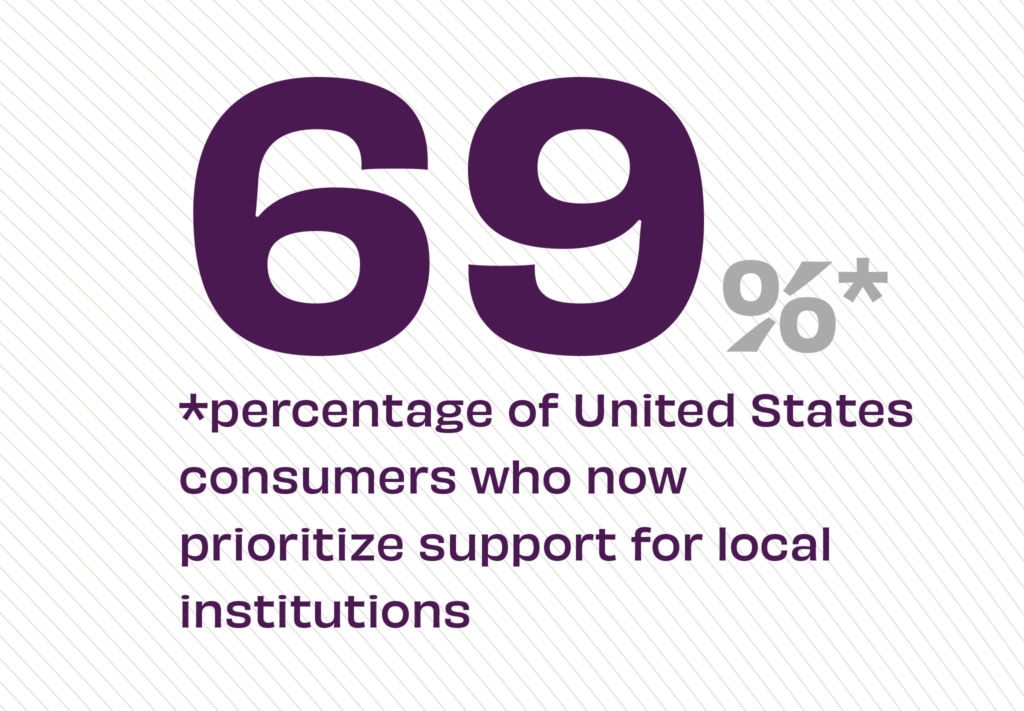

While increasing capacity for digital banking is non-negotiable, that doesn’t mean consumers have abandoned the physical banking channel. What’s interesting about these COVID times is that even as digital adoption is mushrooming, consumers simultaneously want to keep the physical banking channel close by, with 66% of consumers preferring to be within 15 minutes their local branch. Further, community banks and credit unions are well-positioned to acquire customers and members with a renewed focused on the value of banking locally. Paired with the rising preference for local brands, the branch presents rich opportunity for growth.

Given that the local branch continues to be crucial to consumers, banks and credit unions are focused on ways to make smart decisions for their branch networks – where to invest more and where to take cost out. To be positioned for success, banks and credit unions need to continually assess branches and optimize experiences for consumers. The reality is that the branch network presents unique challenges that require critical planning and significant time and resources to implement. Smart decision-making during and post-COVID is critical, and new data around optimization and how to drive even greater market share shines a renewed focus on the Network Effect.

Smart Networks

A new analysis of FDIC data from December 2020 finds that the critical threshold of S-curve appears to have been reset at 6% for banks to get their fair share of banking deposits in a given market. So, while bigger may be better for some things, in branch transformation, smarter is better. For most mid-size community banks, that means a branch network strategy should focus branch presence in fewer, more geographically concentrated areas, expanding into net new markets only once that 6% threshold has been achieved. Maximizing existing markets means a focus on formats, matching the type of branch with the opportunity. In this case, smaller can be better, dot-connecting between larger more full-service branch markets with remote channels and micro-formats.

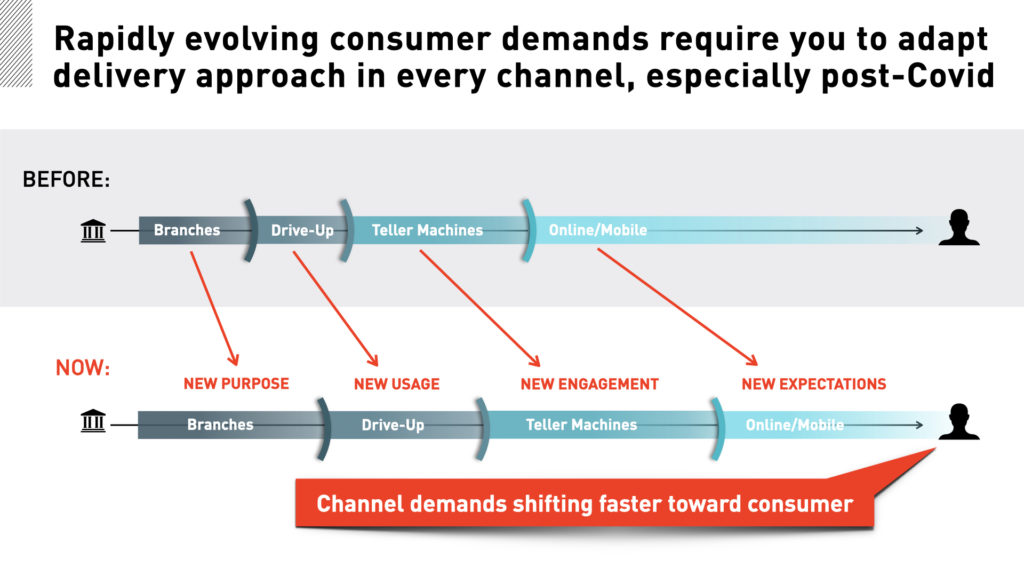

Importantly, these targeted markets do include significant closures (taking cost out) but doing so in the right places. McKinsey’s 2020 Global Banking Report identifies two of six critical pillars of banking resilience as reconfiguring branch networks and redesigning the branch footprint, saying, “Trends are going against the branch. But capturing productivity gains is not a matter of bluntly reducing the branch network. Branches still serve a purpose, but customer needs are evolving.” These rapidly evolving consumer demands require you to adapt a delivery approach in every channel, especially post-COVID. As banks look at the local branches as consultation centers, opportunities for growth arise out of an optimized network.

Focused on branch network transformation as a way to drive productivity, customer experience and revenues, the McKinsey report finds that transactions may make up as little as 5% of banking at the branch, so branches must focus on more complex consultation needs of the consumer. McKinsey says, “One bank developed an algorithm that considered the ways branch customers accessed seven core products. It found that 15% of branches could be closed while still maintaining a high bar on serving all customers, retaining 97% of network revenue, and raising annual profits by $150 million.” While positioning for the long-term requires a focus on delivery both digital and physical, it also requires an investment in brand and marketing. This (re)investment in branch networks and marketing aren’t either/or – they’re both/and to drive critical growth.

In our next feature, we’ll take a deeper dive into the healthy mix of branch and brand investment needed to drive perceived presence so important to maximizing growth opportunity. For more insights on branch and brand strategy and leveraging data and analytics to powerful effect, stay tuned to Believe in Banking as it tracks the big trends, both inside and outside the industry, that are impacting financial services and informing the banking experience. To develop experience-based strategies for customers and members, especially in the face of COVID, contact Adrenaline’s experts at info@adrenalinex.com or (678) 412-6903.