Using data-based intelligence and optimized format strategy to maximize the power of the branch network, even in our new COVID reality

The recent weekly feature Banking on the Move: Why Branch Location Matters explored how data and insights on population trends are helping boost informed decision-making about branch network strategy, empowering banks to make smart judgments about growth opportunities at a time when they need it most.

Challenges to Change

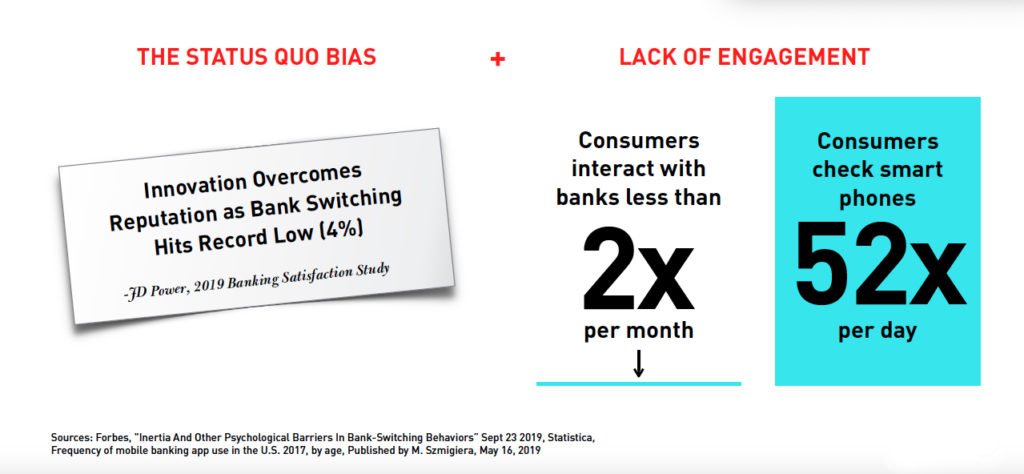

Pre-COVID, banks were continually challenged by dual factors – difficultly penetrating new markets for growth and consumer status quo bias. As outlined in Forbes, Harvard researchers William Samuelson and Richard Zeckhauser studied how people are psychologically biased toward keeping things as they are. Whether it’s loss aversion, regret avoidance, or opportunity costs, humans are hardwired to see change as a risky endeavor and something to avoid. In financial services, JD Power reported that status quo bias resulted in a record low of only 4% of consumers switching banks in 2018. A newer study from Resonate reports that 5.3% are considering switching, but since stated intent is typically eight times higher than action, the actual switchers could be even lower than before.

As the Forbes piece observes, “In financial services, this status quo bias is compounded by how infrequently we actually interact or use banking services. The reward of switching banks is markedly diminished on an experiential level, especially compared to a decision like upgrading to a new smartphone, which the average American checks 52 times a day.” The relative infrequency of interaction compounded by the status quo bias means people don’t switch until forced by a big change – like moving into a new market or, now, a pandemic that has the potential to reshift consumer priorities.

Chances for Change

In a recent weekly feature, we show how population trends and new growth markets represent positive turnover. With people moving to areas like emerging suburbs exurbs and secondary cities, there is a prime window of opportunity as consumers consider switching banks. Another factor working in banking’s favor is the expected number of storefronts available due to COVID’s impact on business, and the expected competitive rates from a shrinking commercial real estate market. Where many banks may have been closed out of large urban centers in the past, there may be new opportunities post-COVID.

Another development that’s good for banking is a renewed consumer focus on brand values. Recent data reveals people are responding to a global pandemic augmented by social unrest by reevaluating brand choice, preferring brands that align with their values with 62% of consumers now reporting that they will look at a brand’s inclusion practice before making a transaction. In fact, Deloitte is predicting bank-switching consideration will increase post-COVID thanks to these types of shifting priorities. In addition to enhanced customer experience expectations, brands who stand for more will win more loyalty and trust.

Operationalizing Optimization

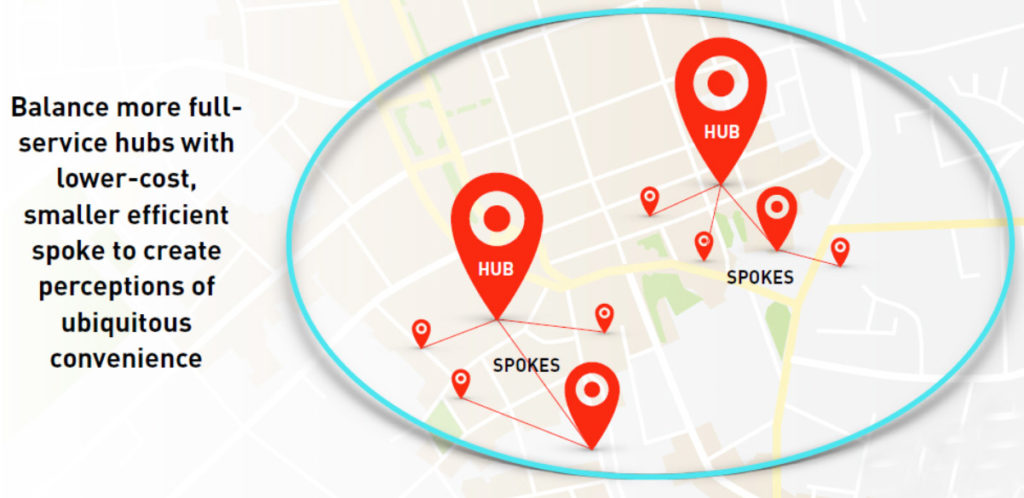

As banks look at local opportunities to expand, operationalizing efforts in all of their local areas allows them to invest where it matters most and deepen consumer relationships at the local branch. That means an optimized network of hub-and-spoke clusters in key growth markets. When banks right-size per market, they can maximize perceived presence with the right amount of service tailored to each local area. Using powerful data, banks can determine how to balance service formats – from full-service hubs to smaller and more efficient spokes – to create perceptions of ubiquitous presence and customized convenience.

It’s well understood in banking that locations are primary acquisition drivers, so the more locations a bank has in a concentrated area, the more consumers will choose them. The Network Effect in banking means that a ten-branch network would capture more than double the deposit volume than a five-branch network, so each branch in a larger network delivers more than a single branch alone. Banks should consider the Network Effect in developing their branching strategy, but decision-making around locations within the branch network must also be balanced with market opportunity and potential for growth.

In consideration of the Network Effect, it likely makes more sense to put three branches in one market than one branch in three separate markets, because banks are trying to achieve that threshold of concentration, which is typically 8% to 10%. So, if a bank has above 8% of the branches in a market, they will begin to realize the upside of that network effect curve, meaning they will start to pull in a disproportionately larger share of customers because of their local presence. Interestingly, though, not all of those customers will walk into the branch. That’s where banks begin to realize the power of the Halo Effect.

When consumers have good perceptions of a bank brand in their home market at the branch, they will begin to have positive associations of the brand as a whole across numerous channels. This is why, for example, the Capital One cafes results in more customers than the market data alone would indicate, and why others like Chase have built an empire on this type of branching strategy. A robust branch strategy powered by market intelligence allows banks to optimize their network with a range of branch formats, ensuring that a brand name is top-of-mind with perceived presence in market.

The Takeaway

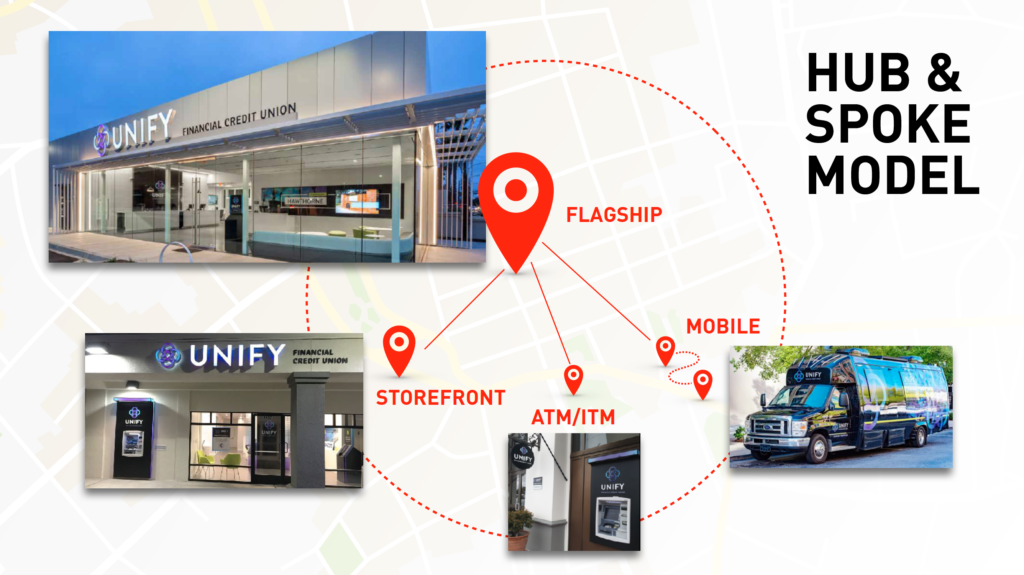

Pre-COVID, successful banks were using data and insights to develop a branch network that over-indexed in a concentrated area with great growth potential. The result is multiple hub-and-spoke clusters, with a more full-service hub and spokes that provide for the largest number of routine transactions. The hub has multiple service lines, integrated technology, and is a consultation center for advice and longer dwell times. Typically this hub is aligned with a bank’s North Star as the more ideal embodiment of their brand and exists in locations where there is the most opportunity.

In the spokes, the branch formats are smaller, more efficient manifestations of the bank brand meant to be extensions of that hub. They are simultaneously serving transactions, but also represent the brand in markets where brands are keeping customers. Whether it’s a micro-branch, a cashless or a remote beacon that’s an ITM or ATM only, these spokes are an emanating beacon of a brand. In short, an effective branching strategy boils down to deploying a powerful hub leveraging the power of its brand (Halo Effect) and effective spokes leveraging the power of local branches (Network Effect).