From personalized marketing to branch banking, how financial institutions can invest where it matters and deliver better banking experiences

A new year in our new normal, the banking sector is prepared for 2022 to bring more challenge and change, but also ready to take advantage of the silver linings that have emerged as a key to resiliency. “[A]s local economies continue to stabilize and many challenged industries bounce back, 2022 may be the year community bankers put the rubber to the road by revisiting goals and turning them into action items,” according to Independent Banker’s Community Bank CEO Outlook 2022. In fact, a focus on activation and innovation positively positions banks and credit unions to make the most of what McKinsey calls the “golden era” for strategic decision-making.

Despite the fact that the banking industry as a whole seems obsessed with the “to branch or not to branch” narrative, bankers on the frontlines understand that assessing all of your assets and delivering good banking experiences is what makes for resiliency in these uncertain times. “While things are changing more and faster than they ever have – with an acceleration of the gap between the haves and have-nots in banking – there is good news, and we’re here to share some of it,” says Gina Bleedorn, CXO of Adrenaline, in a recent presentation on Your Branch As Your Superpower. With an eye on opportunity, banks will continue to grow if they evolve.

To help financial institutions activate smart strategies, we’ve rounded up some of the best practices banks are implementing today to ensure their fortitude for tomorrow.

1. Tap Into the Enduring Power of the Branch

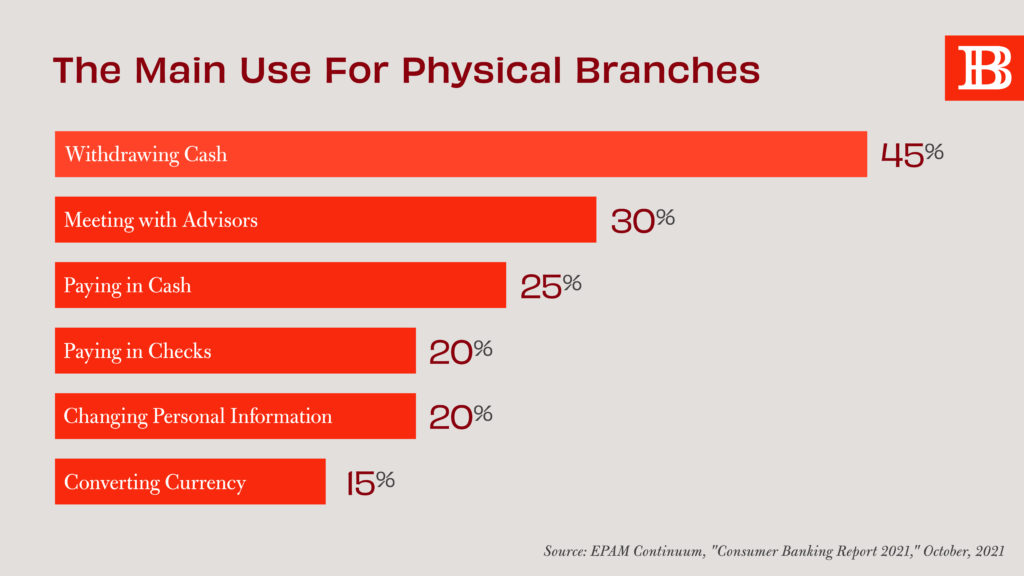

Despite bank branch foot traffic declining by 35% over the past five years and the dizzying rise of digital-mobile banking and competition from fintechs and neobanks, consumers still want their financial institutions’ to have physical locations. According to the recent Consumer Banking Report, four out of five banking customers used a physical branch in the past year, with 35% of U.S. customers visiting monthly. That’s because consumers of all generations still prioritize the branch for key transactions and consultations. In fact, fully one-third of consumers use the branch to meet with local banking advisors for financial advice.

2. Invest in Better Marketing

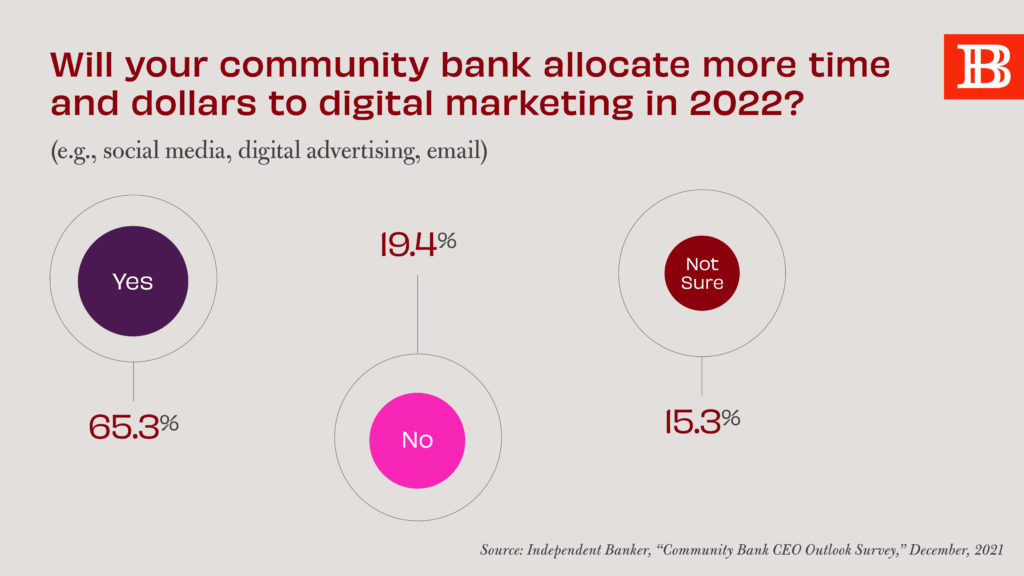

Understanding the role between customer experience and marketing is table stakes as banks innovate for the future. While data is critical for understanding the customer and meeting them at the point of need, personalization alone won’t make marketing matter. What consumers want from banks is clearly focused on personalized experiences and relationships, with a special emphasis on financial education. Smart marketing messages tailored to deliver value rather than sell products will result in better engagements – as consumers perceive personalization as delivering trust and a more “human and empathetic experience.”

3. Focus on Evolving the Branch Experience

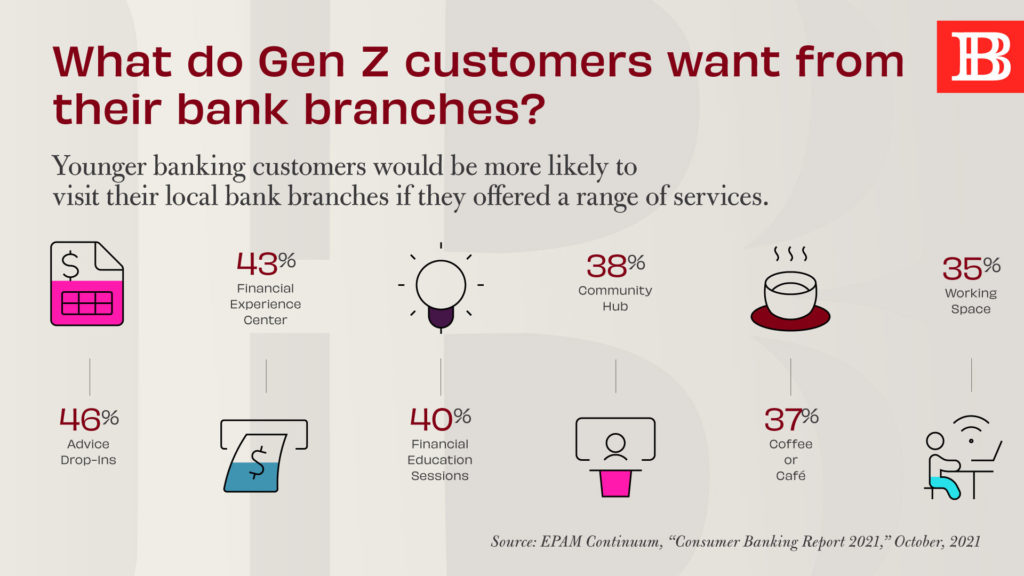

While it’s true that customers and members continue to visit the branch, that doesn’t mean the branch is delivering everything they want. In fact, the sought-after younger demographic reports they would be more likely to go to a local branch if the bank provided a broader array of services like financial education, advice drop-ins and a financial experiences center. That means having the right kind of branches in the right locations. Rather than a branch-less future, it’s more critical than ever for banks to get smarter about network strategy. Delivering a balance of efficiency and experience to maximize presence and growth takes planning and preparation.

What Comes Next?

As banks drive their businesses to evolve, it’s crucial to build flexibility and a framework for change. In fact, The Economist finds that “continued pressure from non-traditional competitors have triggered a wholesale rethinking of banking priorities.” For banks, embracing an innovation mindset and digital to physical solutions in an ecosystem will help them better deliver for consumers. This standard of excellence in customer experience will depend on an omnichannel approach, where the convenience of digital platforms will exist seamlessly with physical branch locations that go above and beyond to provide real value to consumers.

For more insights on powerful banking approaches and driving better banking experiences for customers and members, stay tuned to Believe in Banking as it tracks the big trends that are impacting financial services. To develop strategies for success for your financial institution, contact Adrenaline’s brand to branch experts at info@adrenalinex.com or (678) 412-6903.