How financial institutions are setting themselves up for success through innovation culture and omnichannel delivery

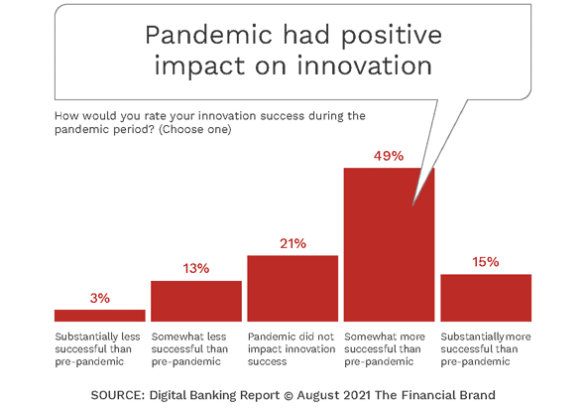

The dual demands of delivering on customer experiences and driving efficiency in banking are nothing new for institutions in the über-competitive financial services sector. But while COVID-19 brought unprecedented challenges to banking’s doorstep, it also sped up the pace of change. In fact, one of the most important pandemic-driven shifts inside the banking industry is the increased appetite for innovation. “In the past, banking lagged [behind] most other industries in the commitment to innovation,” according to Jim Marous in the Financial Brand’s article on the rise in banking modernization. “This trend changed as a result of the pandemic, as banks and credit unions began to significantly focus on innovation as a way to differentiate [themselves] in the marketplace.”

What COVID-19 did for banking was something it seemed less inclined to do on its own – significantly speeding up the pace of change. But how are financial brands turning that increase in innovation into meaningful action? Even more importantly, how are these increasing investments improving the banking experiences for customers, both now and into the future? We’ve rounded up five of the best future-focused trends in financial services and what banking decision-makers can learn from them.

1. Bridging Physical and Digital Delivery

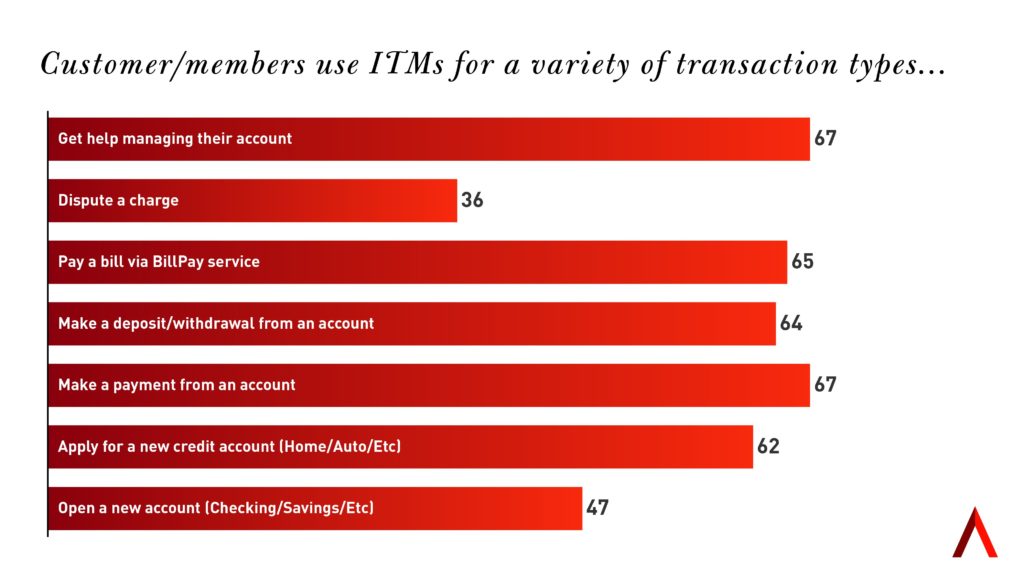

Finding the right mix of digital and physical delivery is one of banking’s stickier, long-standing challenges, but new research on ITMs is helping illuminate how banks are implementing hybrid technology that brings the best of digital functionality and human support. “For financial institutions, the benefit [of ITM] is clear – this self-service technology serves as a bridge between the physical and digital, improving customer experience and increasing revenue per customer,” according to Juliet D’Ambrosio, Adrenaline’s managing director of strategy. “It can serve dual purposes – automating routine banking activity while providing access to bankers for higher-value consultations.”

Deploying ITMs as a remote drive-up detethered from the branch helped organizations like Mississippi’s Guaranty Bank continue delivering even as COVID limited some branch access. With the ability to manage the ITM remotely, the bank benefits from efficiency and functionality, while “creating an opportunity to attract more customers and provide flexibility to our existing ones,” according to the bank’s president. Another community bank deploying remote ITM is FNBC at its Jonesboro branch. A new format for them, this standalone ITM serves to extend the brand presence in the new market and frees up staff from drive-up management, redirecting their focus to relationship building instead.

2. Better Banking via Meaningful Mobile

Mobile banking is table stakes, as consumer expectations for seamless banking experiences continue to rise. To be sure, having a sleek app is significant, but consumers are looking for more than slick tech from their primary financial relationships, In fact, nine out of ten Gen Z consumers reporting they “still prefer traditional banking providers to competitive neobanks and fintechs,” according to fintech company Marqeta outlined in a recent Sharing Successes. While Bank of America may win out as the primary bank for 31% of younger consumers – no doubt fueled by its mobile-savvy – Forbes’ analysis of digital banking competition finds that personalization and innovation in product and service delivery are what matters most. In other words, a more holistic view of banking experiences.

3. Smart Data Deployment

Whether financial institutions use data for smart marketing or branch network decision-making, we understand that data is critical for banking relevance and growth as financial institutions strive to expand their competitive advantage in the post-pandemic economy. “We all know that smart utilization of data is key to growth, but the amount of data analytics available to most banks and credit unions often exceeds their ability to turn it into action,” according to Adrenaline’s chief experience officer Gina Bleedorn in the company’s latest Financial Brand webinar. Data’s influence is undeniable – it powers personalization and creates meaningful messages delivered to the consumer at the point of need. But operationalizing ways to gather and activate data is what will truly spell success for banks and credit unions.

4. Fostering an Innovative Culture

Whether they’re using digital technology to strengthen relationships like most forward-thinking FIs or implementing ways to expand their knowledge about new tools like another regional bank in Texas does with its technology tours, fostering innovation is critical to making the most of opportunities in banking. “Some organizations had already embraced a culture of innovation as part of their overarching digital banking transformation efforts, making this response to revised customer expectations more seamless,” according to the Financial Brand’s Jim Marous. But even if they have to build digital banking from the ground up, it’s the innovation mindset that defines an organization’s future. “To build an innovation culture, size doesn’t matter; it’s focus that drives success.”

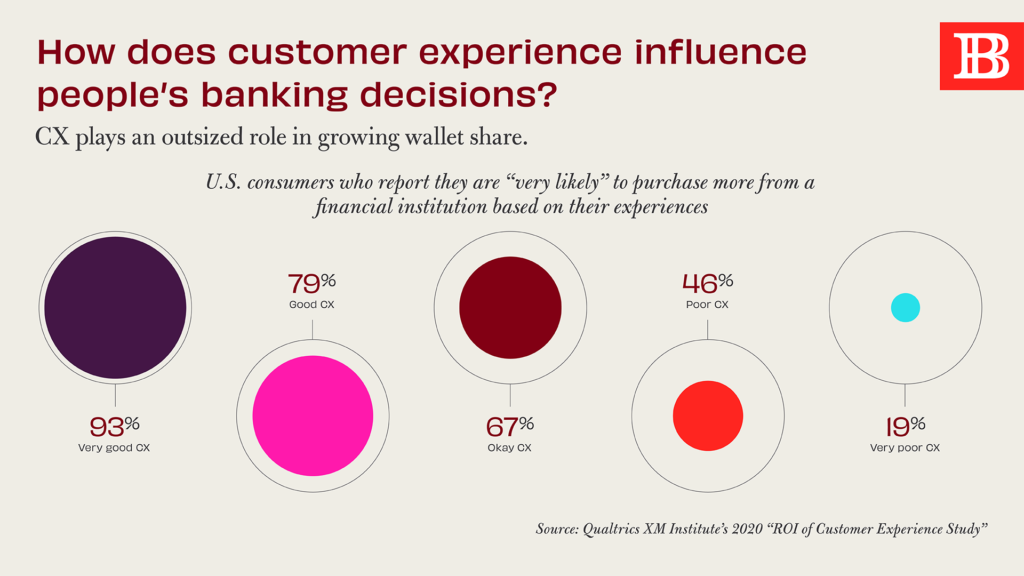

5. Omnichannel Strategies Drive Better CX

Regardless of channel, people expect good customer experiences from their financial institutions. In fact, good CX plays an outsize role in growing wallet share, with 93% of consumers reporting they’re very likely to purchase more from FIs that deliver it. As transactions migrate digitally, a keen eye on CX is critical. According to McKinsey in their report on the customer experience imperative: “Brands and retailers must invest in creat[ing] an elevated, enjoyable and connected shopping experience,” regardless of delivery method. Taking inspiration from omnichannel leaders like Lovepop and Scotiabank, FIs can learn how successful brands are deploying connected digital and physical channels that ultimately deliver on their customer-first strategies.

For more insights on the future facing developments in banking, stay tuned to Believe in Banking as it tracks the big trends that are impacting financial services. To develop meaningful experiences for customers and members, contact Adrenaline’s experts at info@adrenalinex.com.