From smart data strategies to products and services at the point of need, banks are maximizing their prospects

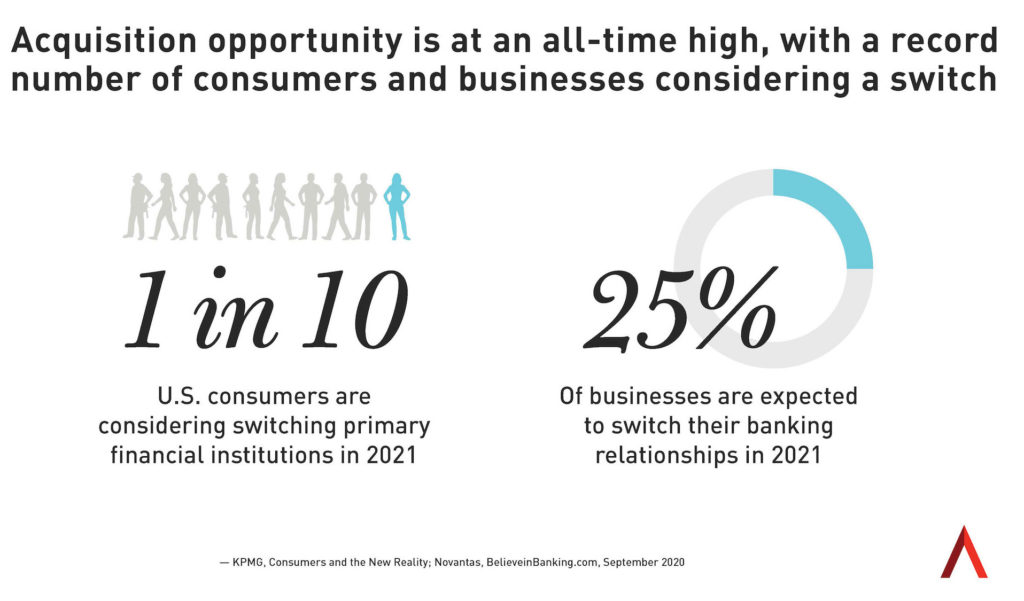

With the economy on the rebound, financial institutions have a bounty of opportunities right at their doorsteps. Consumer trends are pointing to new moves and new expectations, and banking is stepping up with customer-centric approaches to capture competitive advantage. “As the pandemic impacts come into sharper focus, most financial institutions understand that their need to foster growth is mission-critical,” according to Adrenaline’s on-demand webinar on growth. With acquisition opportunities for both retail and business customers at an all-time high, now is the time for banking to make bold moves that will set them up for success.

Whether it’s making investments in the branch network or upping their digital and data game, smart growth-minded financial institutions don’t wait for the winds to change before making a move. To help banking anticipate areas for growth, we’ve rounded up the top-five ways banking is making the most of its opportunities now.

1. Develop Data Strategies

There is no doubt that data is table stakes, and its importance grows more critical each day. As Believe in Banking has noted, “Recent insights about data-driven analytics in commercial banking find that financial institutions that focus on advancing their data capabilities unlock more opportunities to grow their bottom lines, while reducing costs and customer attrition at the same time.” Adrenaline’s Gina Bleedorn puts it this way: “We all know that smart utilization of data is key to growth, but the amount of data analytics available to most banks and credit unions often exceeds their ability to turn it into action.” Whether it’s customer data, market data or mobility data, it’s critical for FIs to develop strategies for activating it.

2. Data-Based Campaigns

Smart marketing relies on smart data to deliver hyper-targeted messaging and campaigns. Recent campaigns by leading FIs are unleashing the power of proximity marketing to support branch locations. One example is United Bank’s digital marketing campaign, launched as the mid-Atlantic bank expanded its reach even further into Washington, DC. The campaign tapped into data to deliver performance, as we covered recently on Believe on Banking. “Driven by data into audience demographics, needs and behaviors both online and off, the campaign featured creative that targeted the right message on the right channels at the right time,” an approach that clearly paid off. “Programmatic display and video and paid search ads generated huge interest. Click-through rates soared almost 150% above the industry average, and the campaign delivered nearly 18 million impressions.”

3. Products at the Point-of-Need

Lending is turning into a big opportunity for banking, especially as small business growth reaches historic highs. “Even as COVID support programs for small businesses close up shop, banks and credit unions are taking their best practices from 2020 lending programs – like SBA and PPP – and activating them in the post-pandemic era,” according to recent coverage on lending. As new businesses spring up at the fastest pace on record, business lending is filling the gap where PPP left off. “With the economy flush with cash and concerns over credit and payback easing, financial institutions now have a unique opportunity to customize their products and services for a post-COVID economy and support small businesses and the local economy at the same time.”

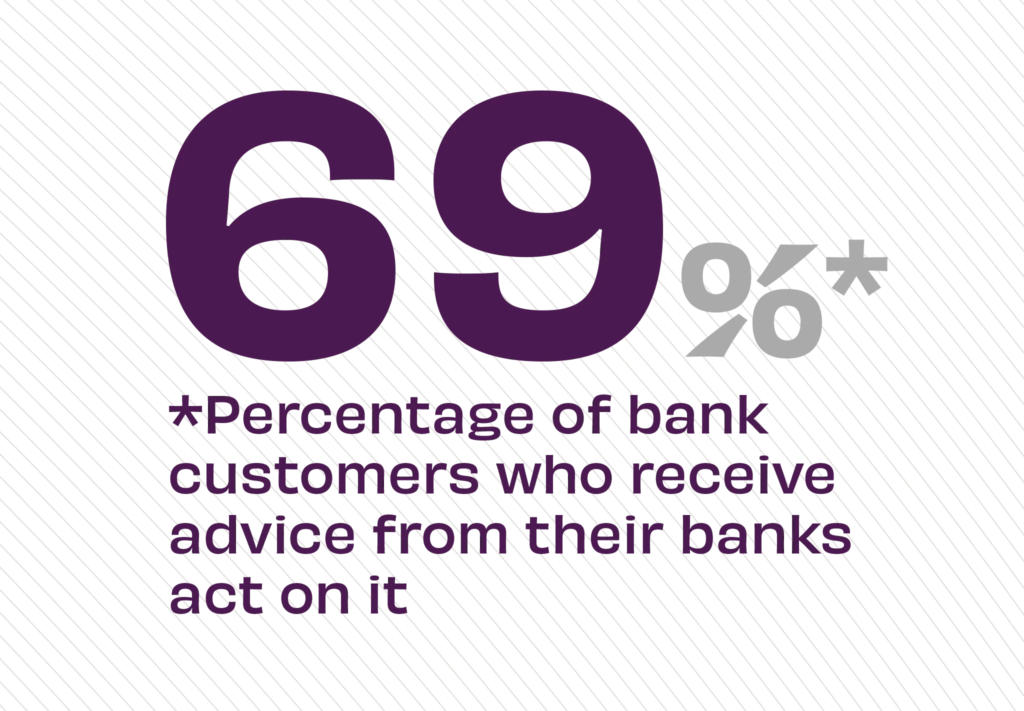

4. Service to Provide Value

In our recovering economy, consumers have more specialized needs for consultative advice, whether it’s to secure lending or make the most of their finances. And when banks and credit unions provide advice, J.D. Power reports that consumers are inclined to act on it. “Post-COVID consumers are understandably reassessing their long-term financial goals as the economy rebounds,” according to data on financial guidance from FIs. “With banking customers actively planning for their financial futures, banks have a rich opportunity to build deeper, longer-lasting relationships by providing critical consultation right at the moment of need,” showing the trust that consumers place in their primary banking relationships.

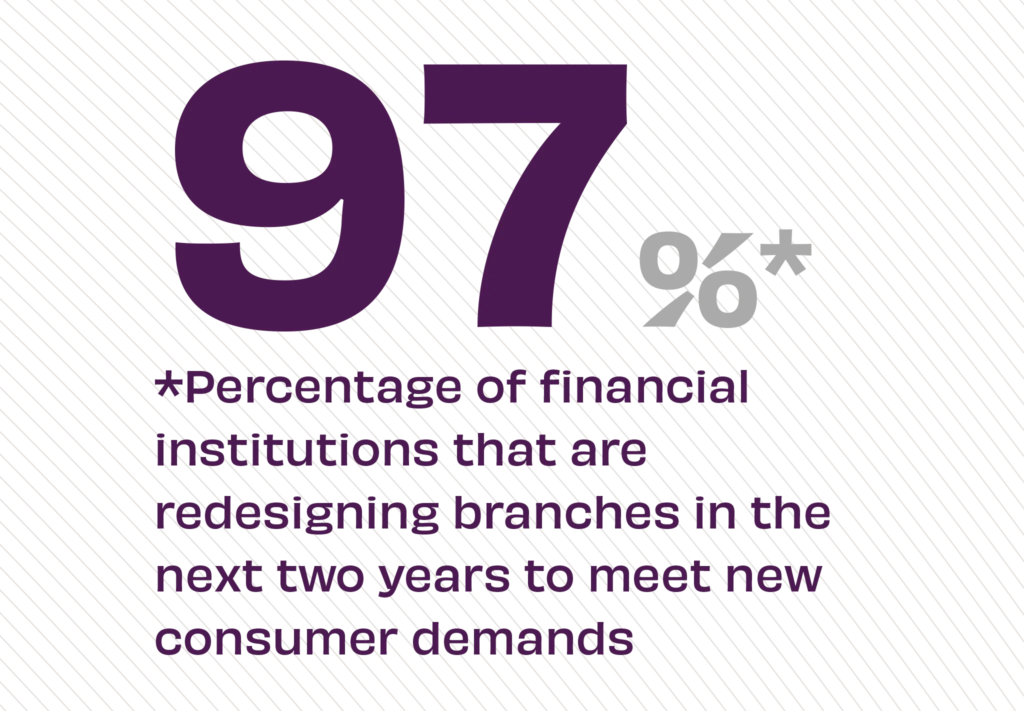

5. Optimize Branch Banking

Despite headlines to the contrary, research consistently shows that one of the most important points of differentiation for FIs continues to be the branch channel. “While the number of account holders visiting a bank branch continues its slow year-over-year decline as digital uptake increases, a still significant number of consumers – 166.6 million of them – expect to access a branch through 2024,” according to recent tracking data on branch banking. That’s why nearly all banks are planning to make changes in the next three years to their branch networks. As people have adapted to more digital methods of transacting, they’ve remained deeply connected to the physical experience of their financial institution at the same time,” according to data on FIs reimagining the branch to better meet consumers where they are.

For more insights on optimizing opportunities in banking, stay tuned to Believe in Banking as it tracks the big trends that are impacting financial services. To develop meaningful experiences for customers and members, contact Adrenaline’s experts at info@adrenalinex.com or (678) 412-6903.