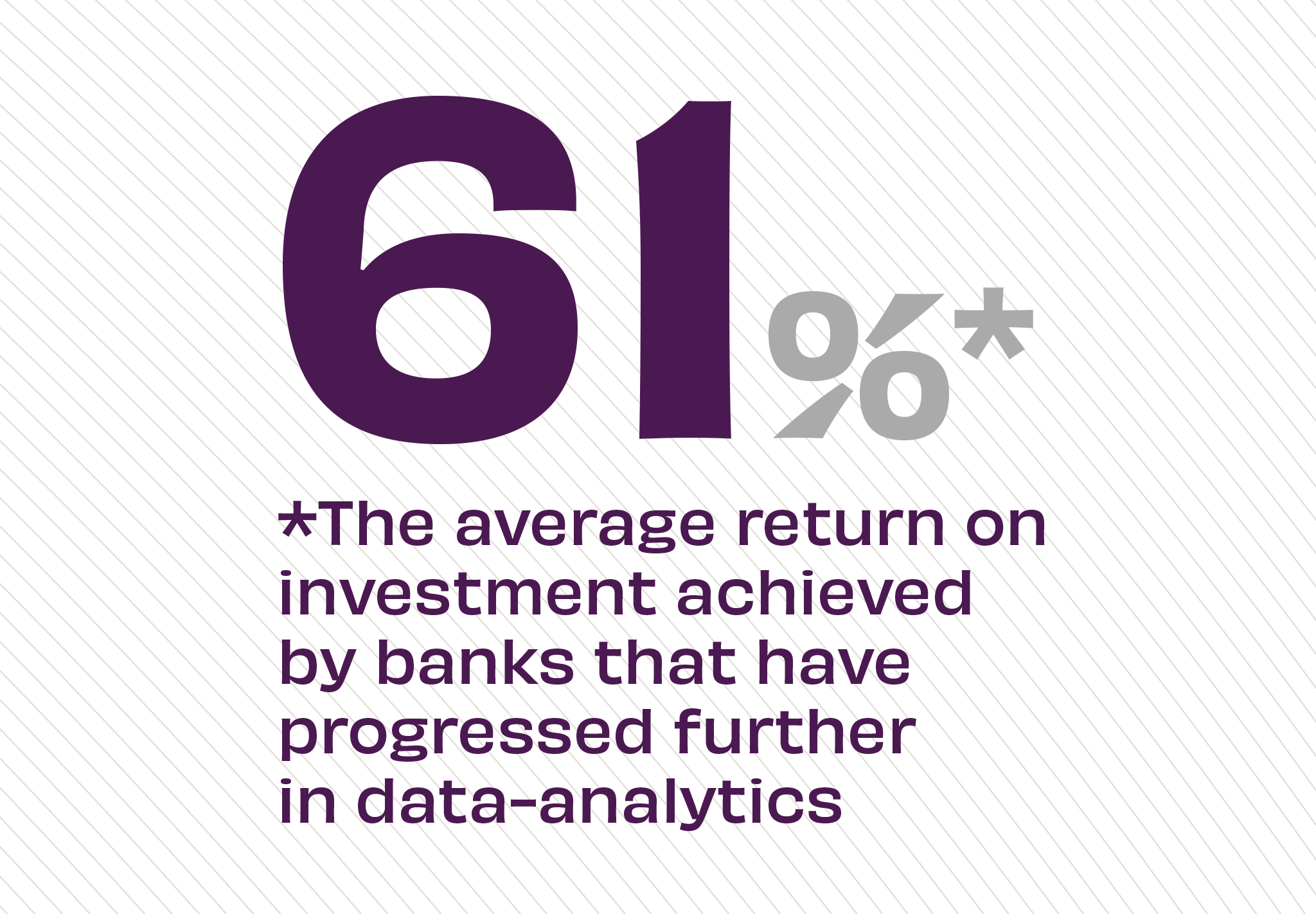

The Story: Recent insights from Accenture about data-driven analytics in commercial banking find that financial institutions that focus on advancing their data capabilities unlock more opportunities to grow their bottom lines, while reducing costs and customer attrition at the same time. Whether it’s automating transactions or developing new banking products, banks and credit unions should leverage the power of the data they already have to improve the banking experience for existing customers and acquiring new ones.

The Takeaway: For financial institutions, better decision-making relies on better use of data. To be more competitive with fintechs, payments companies and others who are taking a bite out of banking thanks to their digital-first approaches, FIs must focus on gathering useful data and effectively using it. For future-facing institutions, data empowers the entire banking process – allowing employees to enrich their consultations, making transactions more efficient and customizing banking products delivered to customers at the point of need.

Source: Accenture, “Data-Driven Mastery in Commercial Banking,” June 22, 2021