How banks and credit unions can optimize opportunities for growth by meeting people where they are

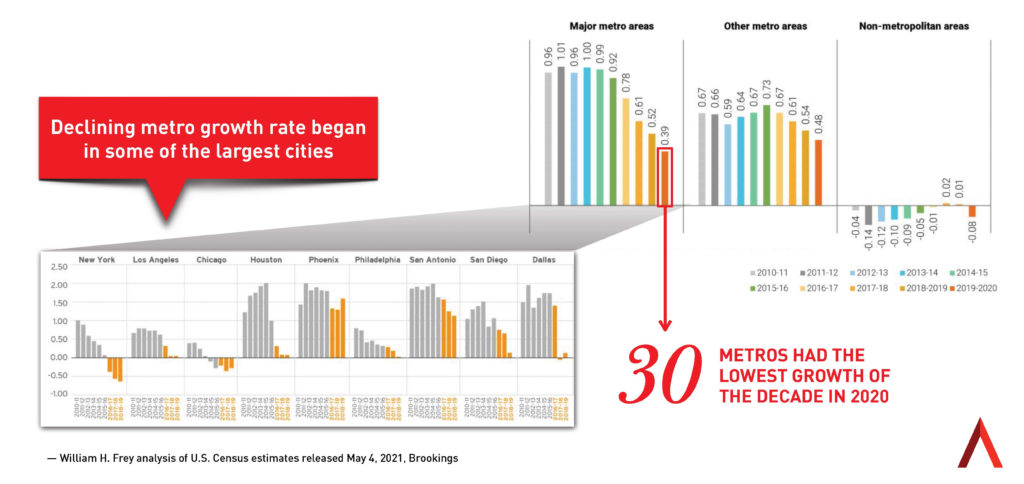

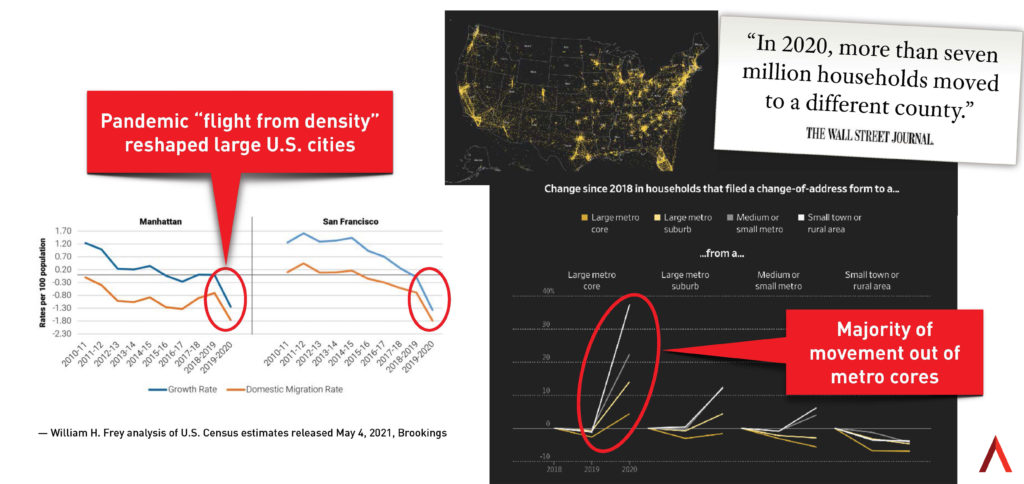

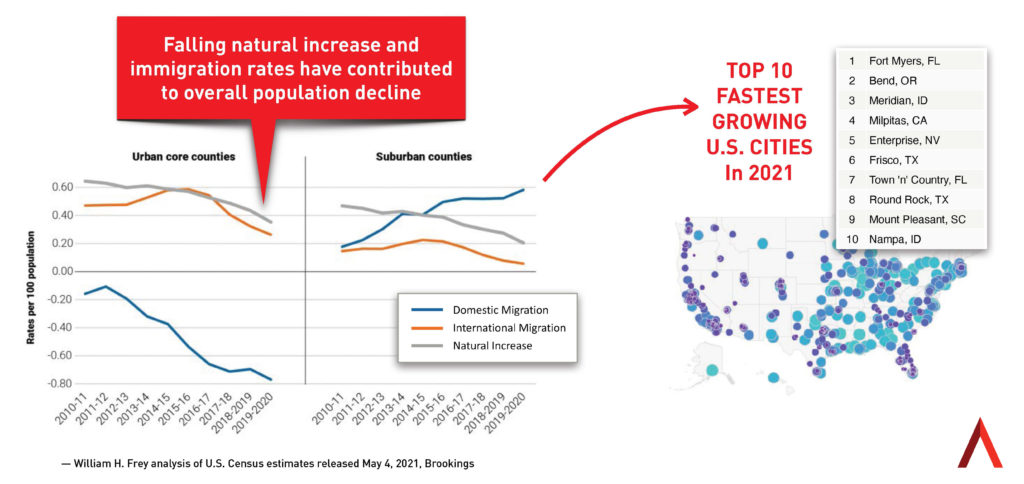

The pandemic prompted widespread changes in American life, many of which are coming into sharper contrast as states around the country loosen restrictions and reopen their economies. One such shift is population moves away from the urban cores that defined corporate concepts of opportunity for decades. “Much attention has been given to COVID-19’s impact on population losses in the nation’s largest cities, raising questions about a potential urban ‘exodus’ and the shape of the post-pandemic city,” according to Brookings’ analysis of new census data. And while the city center’s growth slowed, a new frontier is rising in the suburbs. “The most recent year’s city growth declines gave further impetus to the suburban growth advantage that took root midway in the 2010s decade.”

In the new Financial Brand webinar about expansion into new markets, Gina Bleedorn, chief experience officer at Adrenaline describes the phenomenon of suburban counties replacing cities as true opportunity corridors, leading to a rise in secondary and tertiary cities as a focus for many industries’ retail expansion, including financial services. She says, “Consumers are really wanting fewer fees, better rates and they’re moving. All of that presents really high acquisition opportunity for banks.” In order for banks and credit unions to grow, they must be where the people are, and the people are increasingly found in the suburbs and exurbs.

Go to Grow

This population migration presents a challenge to banking at an especially complex moment, as the country emerges from COVID. Driven by the need to realize immediate cost savings, some banks and credit unions are using their branch network as the locus of reduction. But those cuts don’t come without a cost, as frustrated consumers line up at the only branch left to serve them. Recognizing the continued importance of the branch channel, other FIs are taking a different approach, making strategic investments in their branch networks. As outlined in Believe in Banking News: “While reliance on digital banking continues apace following a pandemic year, millions of consumers – more than 60% of them – still expect to visit their local bank branch well into 2025.”

Beyond merely serving transactional needs, bank branches represent convenience for consumers and a bank’s deeper commitment to continue providing consultative services in the local community. That’s why 97% of FIs plan to redesign their branches in the next two years, as people remain deeply connected to the physical experience of banking. In the same Financial Brand webinar, Sean Keathley, president and CEO at Adrenaline, describes why branches matter, stating that the consumer “preference for presence” means the “branch network is incredibly important” for financial institutions. “The role of the branch is certainly changing, what’s going on in the branch is changing, but the importance of the branch is not.”

With news that banks are recommitting to the branch network, questions about format arise. Do all of those branches need to be full-service? Gina Bleedorn says they don’t. “Perceptions of scale really matter, because people want to feel like you are physically wherever they might need to be.” Hub and spoke models work on this premise, providing key flagships and dot-connecting with smaller, more efficient branches like micro-branches for the perceived “Halo Effect” in a market. Gina Bleedorn says, “Whether it’s an ATM or a branch, the network [needs to be] big enough to meet their needs, which could be just being perceived to have good technology because you’re big enough to have good technology.”

Go Local

Even throughout the pandemic, the data consistently demonstrates that the branch network is key to growth. Sean Keathley says, “Transactions in the branch may be going down, but the deposits are growing. So it’s really more about quality visits and the role of the branch than it is counting the transactions themselves as a measure of success.” As population data shows people on the move, their expectations represent new prospects for banks. Gina Bleedorn says, “There are great opportunities for growth sitting in many of these cities that you might not expect, especially for the community as these secondary and tertiary cities rise.” As the pandemic reshaped the U.S. landscape, banks need strategies for activating location analytics and mobility data more than ever before.

Maximizing presence where it matters is a smart strategy for banks. Even with post-pandemic mobility, people assume local branches will be there to continue serving them where they are. That’s good news for FIs because the branch represents opportunity. “While we expect the downward trend of the branch footprint to continue in the post-pandemic area, we do not expect branches to disappear completely,” Accenture’s recent report notes on the key roles of the branch network after COVID. “Indeed, they will continue to play an integral role in the customer interaction model,” notably for complex transactions and face-to-face brand experiences and education, and especially with products and services focused on delivering consumer value.

For more insights on optimizing opportunity using location analytics and mobility data, stay tuned to Believe in Banking as it tracks the big trends that are impacting financial services. Also see the free, on-demand Financial Brand webinar How to Expand into New Markets and Thrive for information on leveraging location data to drive new market growth. To develop meaningful experiences for customers and members, especially post-COVID, contact Adrenaline’s experts at info@adrenalinex.com or (678) 412-6903.