Financial services sector supports consumers coming out of COVID with valuable money management tools and financial planning counsel

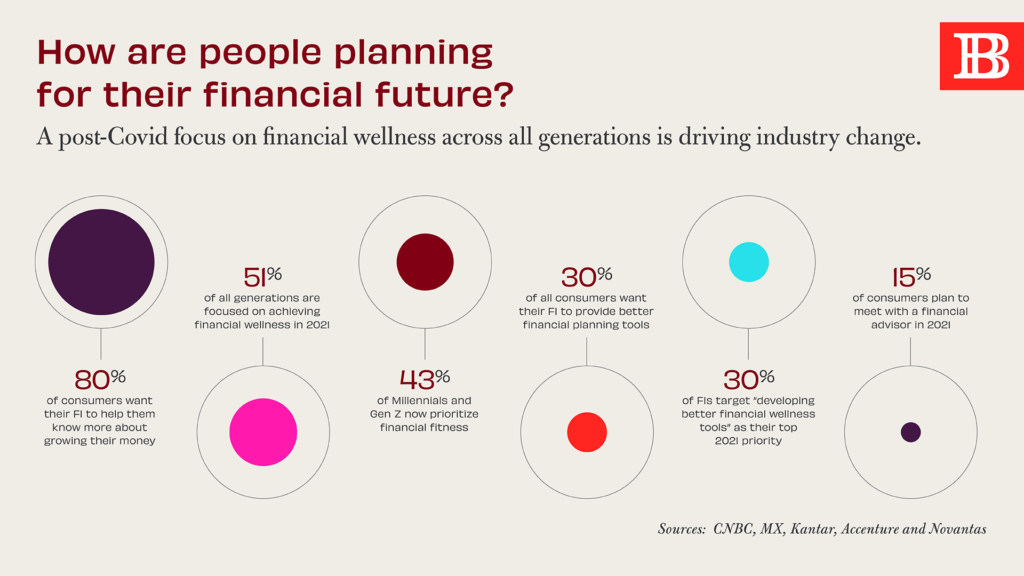

A renewed focus on financial wellness is spurring the banking industry to provide more tools and guidance for consumers as they emerge from the COVID economy. With news of a Spring renewal, consumers are putting financial planning at the top of their to-do lists. As Novantas reports, nearly half of consumers intend to start financial wellness planning this year, but only 15% plan to meet with a financial advisor. And most consumers currently get their financial advice from outside their bank. Lest we think only older generations need planning and support, 43% of Millennial and Gen Z consumers acknowledge a need to be more proactive about personal financial planning, according to Kantar.

With people of all generations squarely focused on preparedness and personal financial literacy in 2021, how is the financial services industry responding? So far, not as well as consumers would like. A recent study by MX notes that nearly 30% of consumers want their personal financial institutions (PFIs) to focus on offering better financial wellness tools to help them plan. But as we know from Accenture’s Banking Consumer Study, only 29% of consumers report they trust their banks to help look after their long-term financial well-being, as compared to 43% just two years prior. Clearly, there’s a gap in what people want from their banking relationships and what financial institutions currently deliver. However, the tide is beginning to turn.

On the banking side, we see the beginnings of a shift responding to this consumer focus on financial literacy and wellness. Most notably, the same MX Study finds that 30% of FIs now rank developing better financial wellness tools as their top priority for 2021 – even beating out their digital experience initiatives. McKinsey also notes the expansion of financial planning beyond high net-worth individuals, saying “Instead of sticking with the traditional markets of affluent consumers and small businesses, banks can target new segments, such as lower income or younger consumers” with financial tools. Fintech is already doing that with a plethora of cool options for budgeting, according to Nerdwallet.

While other challengers step up to meet consumer demand for financial planning, none of these providers have the inherent consumer trust that community institutions do. Banks and credit unions should focus on helping consumers achieve financial fitness and strength by elevating and actively marketing their existing financial literacy programs and planning and budgeting tools. They should also look to fortify their existing offerings, like low-interest loan and refinancing products; enhance personalization efforts through smart marketing; and build more consultative advisory services into their digital tools. Building on the trusted relationship primary FIs have with their customers, banks and credit unions can earn even more distinction by providing consumer value in this moment of resurgence and economic optimism.