Investing in brand marketing to create connection and cohesion between digital and physical customer channels

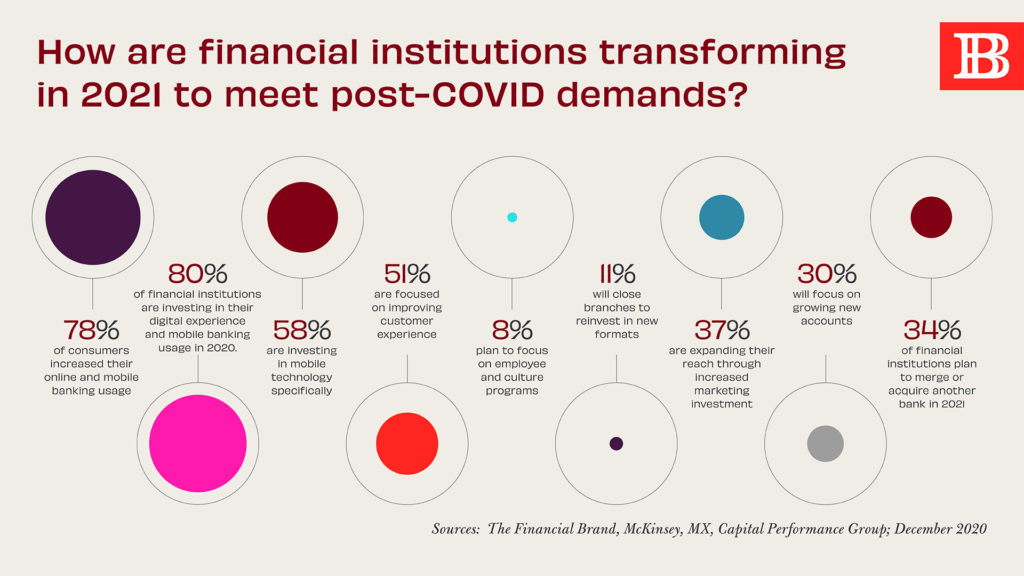

In our last feature on Digital + Physical Delivery in Banking, we addressed how consumer expectation for seamless integration of digital and physical channels is moving the industry toward developing better banking experiences. While this focus on digital and physical puts the industry on the path towards an ideal omnichannel state – undoubtedly accelerated by COVID – the financial services sector cannot overlook the critical role of smart marketing to drive growth through new customer acquisition and meaningful cross-selling and promotion.

Juliet D’Ambrosio, Senior Director of Strategy at Adrenaline, says, “Marketing data affirms what we already instinctively know: That as transactions migrate to digital channels and branch purpose evolves, brand and marketing is the connective tissue between channels.” As the primary driver new customer relationships and new account acquisition, marketing is increasingly crucial as our new normal progresses toward a post-pandemic future. Both brand and product marketing helps support the digital and branch channels with its targeted, consumer-focused, and relevant messaging.

Amping Up Marketing Investment

While investment in the branch and digital channels will yield strong, tangible change for banks and credit unions, marketing investment is also key in delivering increasingly significant results – not only in acquisition, but higher overall sales. According to D’Ambrosio: “To drive sustainable growth, (re)investment in channels and marketing aren’t Either/Or – they’re really Both/And.” That means financial institutions have to simultaneously focus on augmenting their digital capacity, optimizing their branches AND investing in customer-centric brand and marketing messages. That’s because meaningful, effective marketing is the fuel that runs the acquisition engine, no matter where the account is opened.

According to SaleScape, checking and savings account openings in the branch make up 48% new account volume, compared to half that at 24% via digital channels. While in-branch account opening is still driving higher volume and higher-quality accounts, that doesn’t mean that marketing doesn’t happen inside the branch. In fact, brand and marketing messages – when delivered in the consultative setting by a trusted financial expert in the branch – are likely the reason that those deeper, lasting and ultimately more profitable relationships come from the branch channel. But as digital increases, targeted marketing can also enhance its effectiveness in acquiring customers.

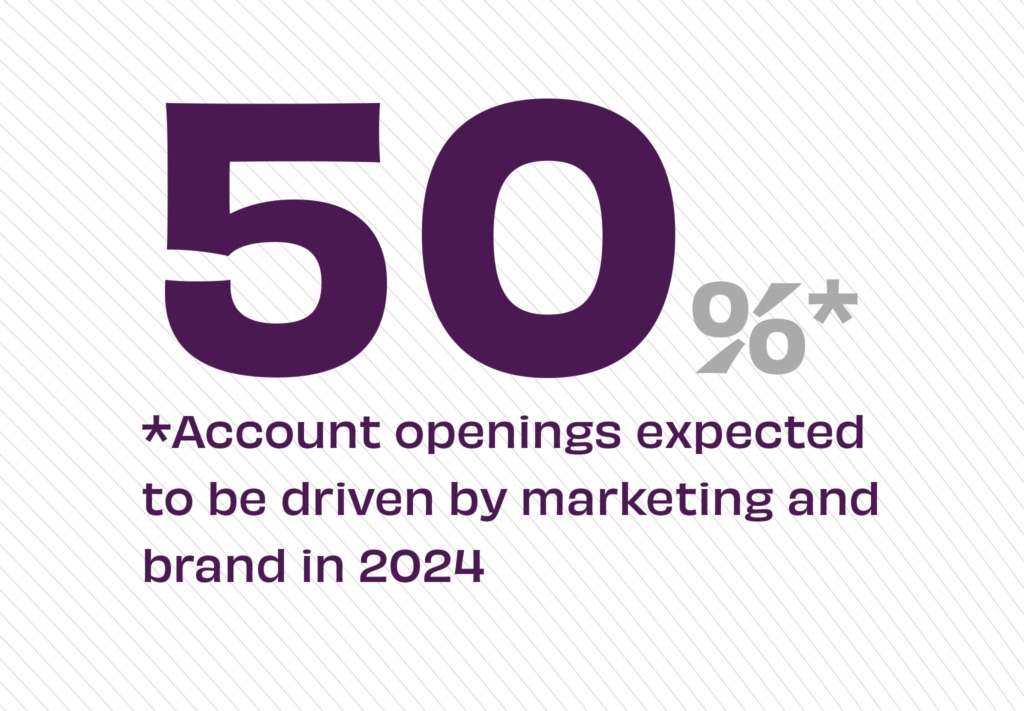

The Novantas December Retail Banking Report consumer research reveals that a full 50% of account opening will be driven by brand/marketing in the short-term future. But what does that look like? While current data finds that fewer than 25% of consumers have opened an account digitally, those numbers are expected to continue rising, especially among younger demographics. Even as other groups are slower to adopt digital and the local branch remains a critical customer touchpoint, smart marketing helps connect the dots for consumers.

The Novantas December Retail Banking Report consumer research reveals that a full 50% of account opening will be driven by brand/marketing in the short-term future. But what does that look like? While current data finds that fewer than 25% of consumers have opened an account digitally, those numbers are expected to continue rising, especially among younger demographics. Even as other groups are slower to take to digital and the local branch remains a critical customer touchpoint, smart marketing helps connect the dots for consumers.

Data-Forward Marketing

This dot-connecting and bridge-building is why 37% of FIs are increasing their marketing investment in 2021. As Novantas says, “In a digital-first world, marketing and brand replace branches as the primary driver of customer acquisition.” That’s because marketing supports all other channels – the branch, online and mobile – rather than being a customer touchpoint itself. Every interaction a customer or potential customer has with a bank or credit union should be informed and influenced by meaningful marketing messages. But what ensures marketing is meaningful and hits the mark? Data does.

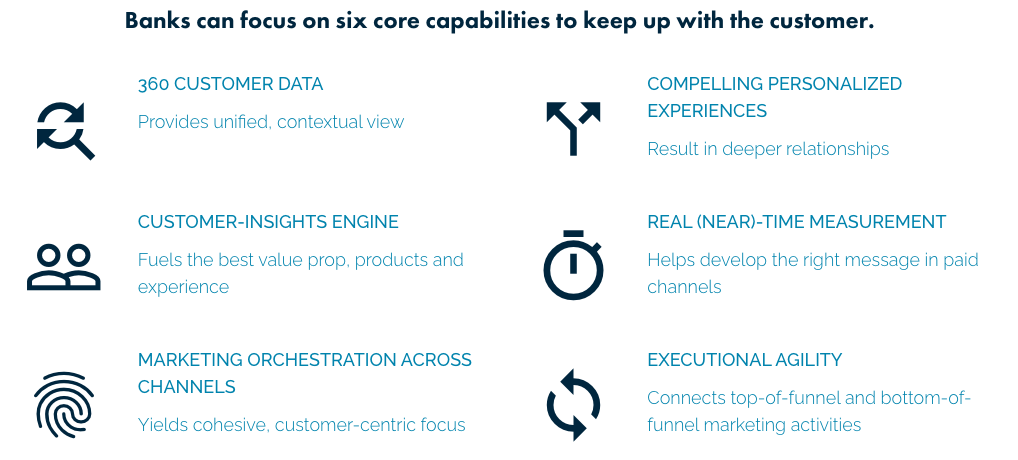

While brand and marketing categories may be known more for creative message development than for its robust datasets, smart marketers focus first on gathering, analyzing and leveraging powerful data before beginning to craft messaging. This robust data-first approach helps marketing ‘see’ each customer in their unique financial journey, unlocking a ‘segment of one’ effectiveness that aligns marketing messaging to consumer needs, lifestyles, behaviors – and often some untapped opportunities. Data is often the first place FIs identify customers who are ready for new products and service offerings that are more helpful to them – and more lucrative to the bank.

From serving up the right promotion in the branch to having the right tone and topic via social, powerfully targeted marketing and brand communication reveals and reflects customer needs-states like nothing else. But what that kind of right-place, right-time, right-person messaging requires is good data – and even with so many sources of data, that can be hard to come by. Or, as it’s put in this Financial Brand headline: “Financial Marketers Can’t ‘Personalize’ Anything with Junky Data.” With AI, personalization and external and internal information, deciphering and decoding data and then turning that into actionable intelligence requires critical focus in 2021 and beyond.

In an upcoming feature, Believe in Banking will take on the critical role of Connected Intelligence for bank marketing campaigns. For more insights on marketing strategy and leveraging data and analytics to powerful effect, be sure to stay tuned to Believe in Banking as it tracks the big trends, both inside and outside the industry, that are impacting financial services and informing the banking experience. To develop experience-based strategies for customers and members, especially in the face of COVID, contact Adrenaline’s experts at info@adrenalinex.com or (678) 412-6903.