Principles for fostering relationships and enhancing trust in banks during an era of economic challenge and pandemic uncertainty

In our last feature on building better banking relationships, we addressed the critical role of trust in creating customized human-centric experiences. Personalized experiences will ultimately enhance trust and consumer confidence at the same time – as well as marketing ROI. In fact, research shows that 80% of consumers are more likely to transact with brands that offer personalized experiences. But financial institutions must have a well from which to draw upon to even begin those customization efforts. While it’s well understood that building trust in banks is a foundational pillar essential to the banking relationship – especially critical this year as the economic burdens of COVID-19 take their toll on the economy and the consumer – the financial industry must take steps in order to create a more trusting bond.

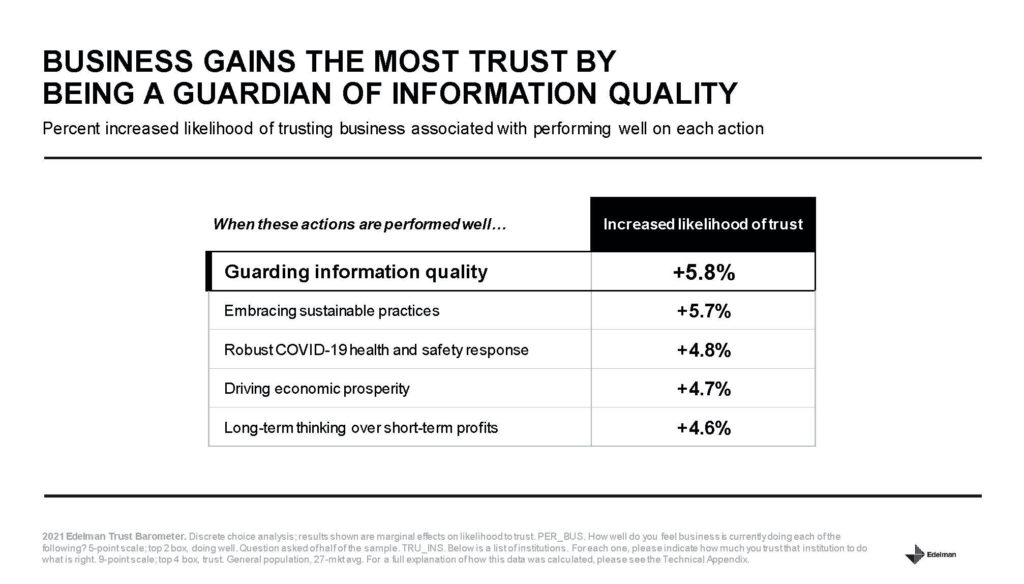

The good news is that while trust overall may have diminished in the past year, business has become the primary trusted institution for consumers in the pandemic era. According to Edelman’s Trust Barometer 2021: “While the world seems to be clouded by mistrust and misinformation, there is a glimmer of hope in business. This year’s study shows that business is not only the most trusted institution among the four studied, but it is also the only trusted institution with a 61 percent trust level globally, and the only institution seen as both ethical and competent.” With consumer confidence in two critical areas – ethics and competence – how can banking build trust even more?

Here is our roundup of five principles to enhance trust among consumers:

1. Ramp Up Personalization

Whether through customization via smart data deployment or personalized attention, consumers want to feel like they matter, especially in their primary financial relationship. As digital channels move toward automated transactions, banking customers and CU members need to be even better served through customized products, personalized marketing approaches, and, perhaps most importantly, personalized experiences. That kind of human-to-human attention matters. As Sean Keathley, president and CEO of Adrenaline, says, “Having a human you trust to provide you with a sense of stability, security and safety is huge. It’s a competitive advantage that community banks should understand and use.”

2. Put the Customer-First

Throughout the pandemic, consumers looked to their banks for stability, safety and security. Local branch staff provided essential services and customized solutions, reaffirming consumer trust in banks and credit unions. Now customer-centricity on an institutional level is taking that trusting relationship even further. Juliet D’Ambrosio, Adrenaline’s head of strategy, says, “The core idea around customer-centricity is that you put people at the center of your organizational decision-making. Customers lead, instead of the business leading, and you are always looking through the eyes of the person you’re serving – their needs, their pain points – and providing customized solutions for them.”

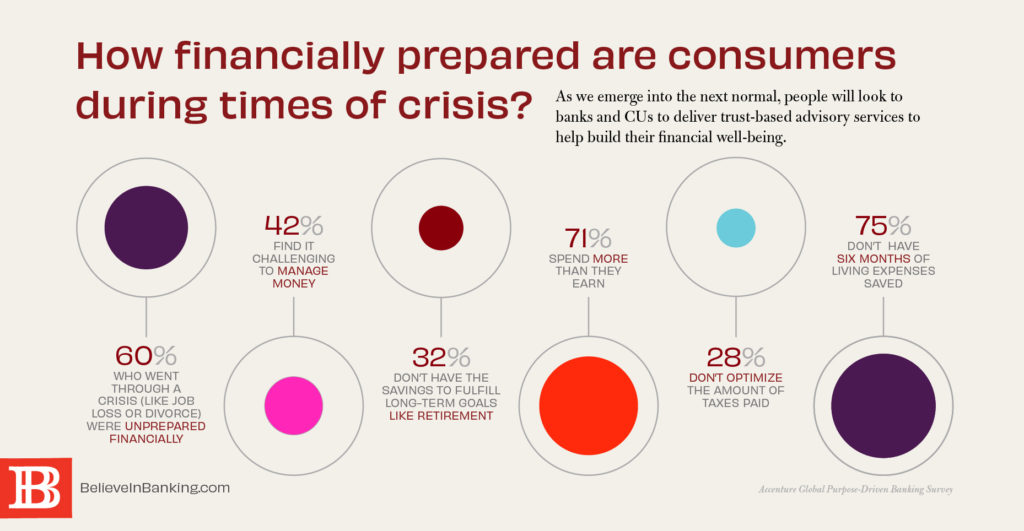

3. Lean into Consultation

Trust is at the heart of every relationship. In banking, trust is expressed through consultation. As we emerge from the pandemic, consumers need even more advice in planning for what’s next. “Not every customer has the same level of knowledge when it comes to [knowing the difference between] an annual percentage rate (APR) from an application programming interface (API),” according to PYMNTs article on customer knowledge gaps. “While every bank customer wants their data and deposits secured, not all of them share the same level of sophistication.” From security to money management, consumers want trust-based consultation to help them prepare and plan for their financial well-being.

4. Take A Stand

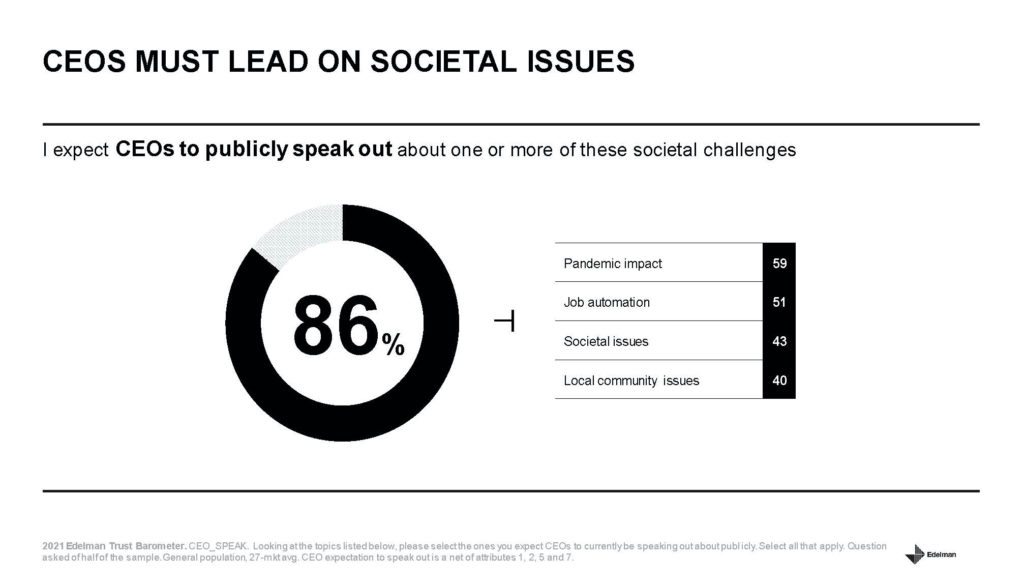

As we move into a post-pandemic future, brands should resist the urge to return to business-as-usual and embrace the opportunity to champion purpose. Data in the 2021 Edelman’s Trust Barometer finds with the rise of trust in business comes the expectation that companies also stand for something and use their influence for good. A whopping 86% of consumers expect CEOs to “publicly speak out about one or more” social issues, including the impact of the pandemic, job automation, societal issues or local community issues. Especially in times of uncertainty, we know that purpose-driven brands drive trust and loyalty and consumers seek out brands that play an active role in improving society. With the pandemic spurring changes to long-held consumer preferences and brand relationships, taking a stand is critical to building better banking.

5. Operate Transparently

Trust is predicated on consumer expectations that their financial institutions will do what’s right—that means doing what’s in the consumer’s best interest. Transparency is so foundational to trust-building that missteps like the massive ones made during the 2008 financial meltdown resulted in catastrophic consequences for financial institutions and economy at large. While the industry has spent the last decade repairing its reputation, buttoning up its processes and meeting regulatory guidance, compliance alone is not enough. Banks and credit unions must have transparent and open decision-making as their guiding principles. A critical part of that transparency includes offering timely, crystal clear information as well as delivering economic responsibility.

For more insights on building trust in banks, stay tuned to Believe in Banking as it tracks the big trends that are impacting financial services and informing the banking experience. To develop trust-based experiences for customers and members, especially in the wake of COVID, contact Adrenaline’s experts at info@adrenalinex.com or (678) 412-6903.