A roundup of six best practices the financial services industry is deploying during the global health crisis and beyond

Like schools and retail, bank branches across the country are in various stages of reopening. Depending on the local conditions on the ground, each branch is coping with a tenuous balancing act – keeping customers and staff safe AND meeting consumer expectations for access to the branch and their local bankers. Surprisingly, banks aren’t maintaining the steep spike in mobile they saw at the beginning of the pandemic, nor are they seeing a continued desire by consumers to avoid the branch. In fact, in July 57% of retail banking sales continue to be originated in local branches. But just because banks aren’t experiencing an acute and sustained wave of disruption at the branch level, that doesn’t mean they should maintain the status quo.

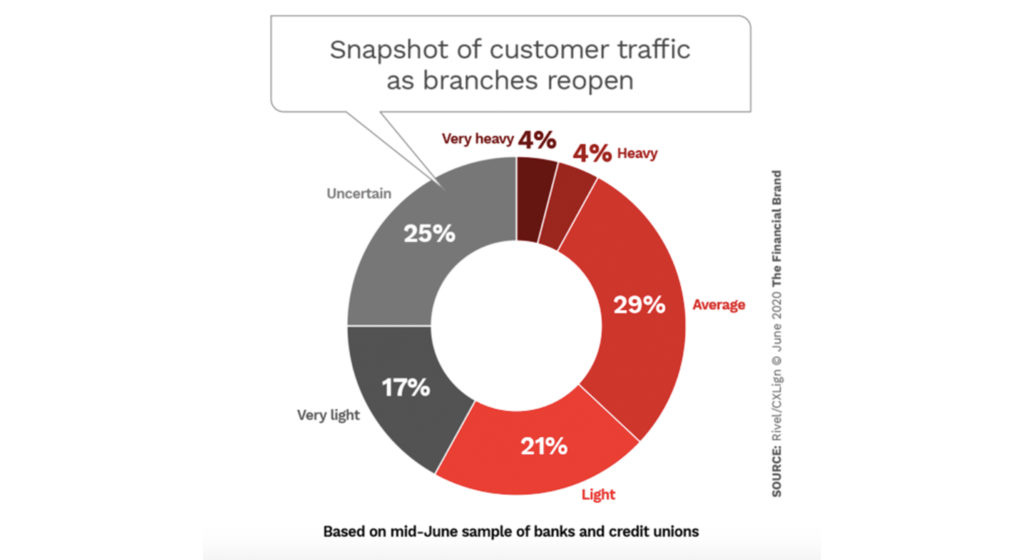

The Financial Brand outlined this conundrum in their recent article highlighting research with community banks and credit unions conducted by Rivel’s CXLign Banking Unit. They found that in early June, “nearly half (46%) had at least three quarters of their branches currently open for in-lobby banking, while about one-third (31%) had yet to reopen any branches. By July 1, however, only half as many (15%) expected to have no branches open.” While lobby traffic will certainly resume in some form in the coming months, the banking industry is taking the pandemic as a trigger to assess their branches and plan for a more optimized, post-COVID network.

To help financial services brands prepare, we’ve rounded up a series of considerations for the bank branch that will help them future-proof their networks.

- Bridge Physical and Digital

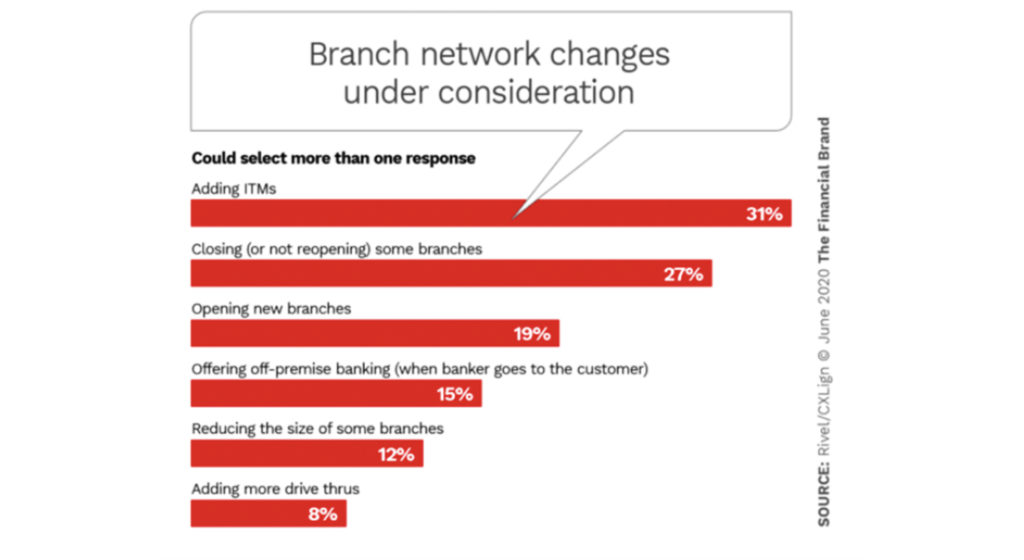

Choosing to deploy ITMs has been one way that banks have immediately pivoted in the pandemic. Staffed with a banker, customers may access via video chat, so many of the same transactions and consultations that take place inside the branch can be facilitated with an ITM. This more progressive vision of drive-up can be detached from the building and staffed remotely, so the team member doesn’t even have to be tied to the local market. As staffing needs ebb and flow based on transaction volume and consumer demand, these units can serve a market without steep staffing costs.

- Consider Closures

Closing a branch is never an easy decision. Whether because of reducing transactions or waning market opportunity, closures can be necessary—healthy, even— and evaluating them right now is key. While branch efficiency is critical, reinvesting those savings back into the network is what will really move the needle. Designating a receiver branch for current customers will show you’re not abandoning them and identifying optimized ways of serving current markets will continue to extend the branch Network Effect and the brand Halo Effect.

- Open New Branches

Population trends are constantly on the move, so banks should be continually assessing prospects. Using data and analytics will help drive informed decision-making about the branch network, identifying growth opportunities at a time when banking needs it most. The latest data on populations shows that pre-COVID trends are not only holding now but are expected to amplify post-COVID. Movement to emerging suburbs, exurbs, and secondary cities provide an opportunity to drive acquisition and consideration among new consumers, as relocation is one of the only times people think about switching banks.

- Relationship Banking

Finding ways to deepen the relationship during COVID is the way banking is living up to its ‘essential’ role in society. As Ryan Kilpatrick from Origin Bank pointed out on the recent Believe in Banking podcast, whether bankers are going to the customer, offering alternate ways to bank, or just touching base with them via the phone to check on them, finding ways to build bonds speaks to community banking’s purpose and power. A prosperous future relies on banking’s core competency – brand resiliency and relationships built at the local branch that are extended out at every touchpoint.

- Optimizing Size

As noted in Adrenaline’s recent Future Branches webinar, you just can’t close your way to profitability. Yet having big branches that no longer serve their original purpose isn’t sustainable either. Network optimization is an essential exercise designed to mitigate risk while maximizing opportunities. On a branch-by-branch basis, decision-makers must focus on: retaining and growing earnings by reinvesting savings into existing branches and right-sizing and prioritizing optimization activities in alignment with a bank’s current market opportunities and fair share.

- Drive-Up

As the COVID crisis wears on, consumer banking needs continue to grow. With more than 99% of branches retaining their ‘open’ status during this time, new ways of using old channels are emerging as a best practice. The most visible of these is the drive-up window, which is gaining new prominence as a way to successfully bank while social distancing at the same time. Looking at service sector leaders, banking can emulate people-powered approaches to overcome the reputation of drive-up as a forgotten channel and create a vehicle for continued engagement.

In our next weekly feature, we will revisit where retail banking is in their reopening process and look at the branch and the brand from the lens of what’s happening now, what comes next, and a North Star for the future. To develop strategies for brands during these challenging times, contact Adrenaline’s experts at info@adrenalinex.com or (678) 412-6903. For more information on bank branch reopening in the post-COVID landscape, download the Roadmap to Reopening. If you need support preparing your staff for post-COVID branch operations, see the Frontline Staff Engagement Training series.