The Story:

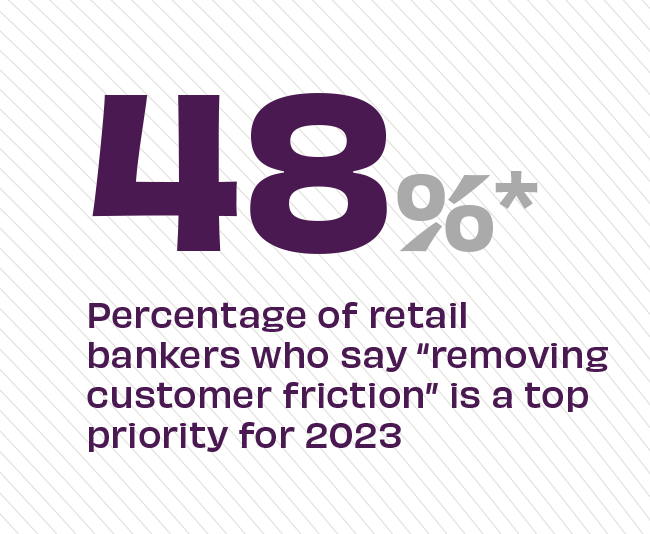

Retail banking leaders continue to prioritize seamless customer experience as a key improvement they want to make in 2023. Even more, 24% cite improvement of integrated multichannel delivery as a primary way to remove barriers for banking customers. “While the overarching theme for the top trends focused on digital banking transformation,” finds The Financial Brand. “The top priority for 2023 was the improvement of digital banking experiences through the elimination of friction.”

The Takeaway:

Additional data in the same survey points to the ‘how’ of reducing customer friction, including nearly three out of four bankers who prioritize the expansion of digital products and payment capabilities for customer convenience. Finding the right balance of banking channels means that customers can seamlessly hop from digital to physical and back again. What some might call omnichannel, this more mature experience is what Adrenaline’s Ben Hopper calls a “smoothie” that blends digital with physical channels, taking the best aspects from each.

Source: The Financial Brand, “Top Retail Banking Trends and Priorities for 2023,” January, 2023