How human-centered banking delivers for people in our post-pandemic era

Despite increasing competition for their money and loyalty – from big banks to fintech and payment options – banking consumers have some decidedly old-school values when it comes choosing their favored financial institutions. Even during our pandemic era, people’s trust in financial services continues to rise, up three points in the last year alone, according to the most recent Edelman Trust Barometer. That’s why products and programs to enhance trust are getting notice and now, some significant support from the powerhouse in customer satisfaction, as it announces a new certification to banks, credit card issuers promoting financial health.

Trust Still Rules

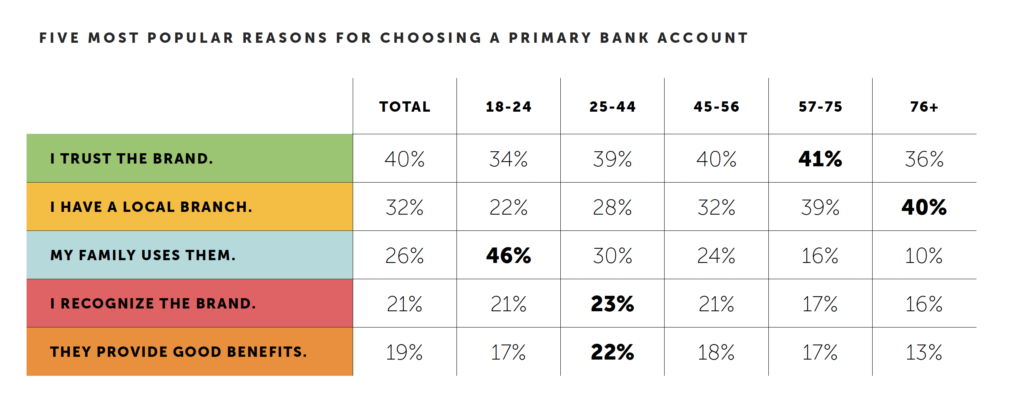

In account opening – a key metric for bank and credit union success – consumer trust continues to be the driving factor, and here, traditional financial institutions have a significant advantage over fintechs and other challengers offering financial and banking services. According to data from EPAM Continuum’s Consumer Banking Report which tracked consumer banking trends throughout 2021, consumers across the board point to trust as the most important factor influencing their decisions, with a whopping 40% say brand trust is the reason they choose a primary bank account.

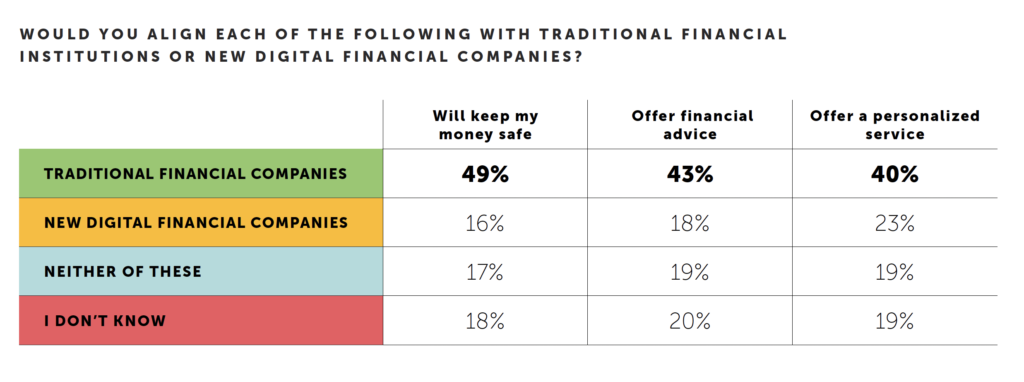

The differences between banks and challenger FIs become even more stark when you dig deeper into the data. The majority of consumers believe that not only are traditional financial institutions a safe place to keep their money, banks and credit unions are also a trusted source of financial advice and personalized service, while only a fraction of consumers report the same of fintechs. Once initiated, consumers overwhelmingly stick with their banks, so that upfront choice really matters. Further, the report finds that even if they were unhappy with their current bank, 80% of “people could be deterred from switching” through fostering trust.

Demand for Personalized Experiences

Once consumers begin a banking relationship, their expectations expand and endure. What consumers want from their banks is clearly focused on personalized experiences and relationships, and especially getting valuable financial advice and education. The Consumer Banking Report data confirms that 34% of people want more personal interactions around their finances. This doesn’t mean personalized offers from banks, but rather interactions that are customized to their individual needs. Further, they want a more personalized experience overall as consumers interpret personalization as more human and empathetic.

During challenging times, people want trusted institutions to mean more. Post pandemic, the consumer need for financial advice is on the rise across all generations, but especially among younger people. Now, more than half of 18 to 44-year-olds say they want better financial education from their banks. Further, 46% of Gen Z customers would be more likely to visit a branch that offered in-person financial advisory services, like financial education sessions. Other desired services from their banks include community hubs, financial experience centers, advice drop-ins with 61% of Gen Z wanting their bank to give them advice about managing their money.

Delivering on Customer Experience

While it’s clear that the future of banking brands will always include physical branches – as 55% of consumers report visiting one in the last 12 months – these locations will be more focused on customer experience and providing financial education for customers than on processing transactions. This is especially true as consumers continue their migration to digital channels for quick convenience. According to The Economist’s Branching Out, financial institutions also recognize the branch as a consultation hub that represents the wave of the future – with 81% of bankers reporting they believe banks will differentiate on customer experience rather than on competitive products.

How crucial is customer experience? In banking, it’s non-negotiable. According to PwC, customer experience ranks higher than price or product as the most important brand differentiator. In fact, 82% of consumers want more human interaction with the brands they transact with. In a very tactical way, this also shows up in research with 67% of customers reporting they would rather “feel heard” on a customer service call than have “a speedy resolution.” According to the Connected Customer Experience, CX excellence depends on omnichannel delivery married to the “branch locations that go above and beyond to provide services such as financial education, talks by financial influencers and interactive tools.”

Banking for What’s Next

For banking, it’s clear consumers want banks to provide convenience and counsel to make their lives better. Erica Moretti, Senior Director of Innovation Consulting at EPAM, says of their banking report: “Consumers are clearly looking for more support, guidance and education from their bank.” While transactions are table stakes, where banking really shines is in delivering on more human-centered, long-standing values. Moretti says, “A parallel set of services based on guidance, education and support must be delivered in a more empathetic way and in a more personal environment.” How consumers see financial services is not as a distinct product or service (was it ever, really?) but within the context of their full financial life.

For more data and insights on human-centered banking, be sure to stay tuned to Believe in Banking as it tracks the big trends, both inside and outside the industry, that are impacting financial services and informing the banking experience. To develop experience-based strategies for customers and members, contact Adrenaline’s experts at info@adrenalinex.com or (678) 412-6903.