How financial institutions can capitalize on this “golden era” for strategic decision making – from evaluating branch purpose to innovative ways to deliver value and do good

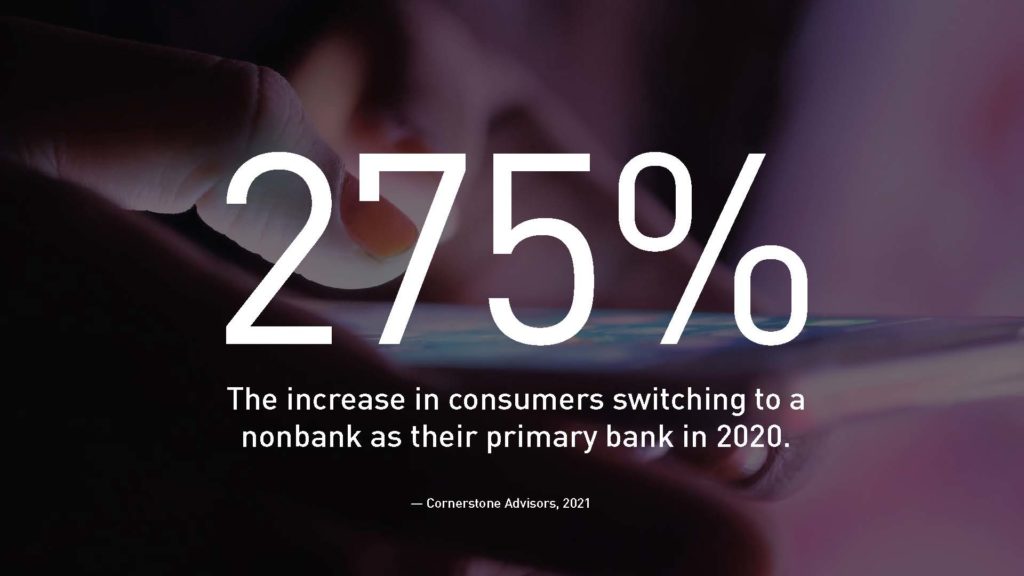

As we approach the end of our second year in pandemic mode, the banking sector remains resilient as consumer confidence and key economic indicators show strength in recovery. According to McKinsey’s year-end banking report, “Unlike the previous economic crisis, this time banks did not witness any abnormal losses, material capital calls, or ‘white knight’ acquisitions. In fact, bank profitability held up better than most analysts expected.” Although banks and credit unions are weathering the storm, that doesn’t mean it’s all smooth sailing ahead. Reducing revenue, pandemic pressures and demands for efficiency still have an outside influence on banking, especially as consumer switching activity heats up.

While it’s normally consumers taking stock of their financial lives as we turn the page of the calendar to a new year, we’re recommending that banks and credit unions do the same kind of annual review of their financial institution’s health and performance as we head into 2022. Whether it’s leveraging the local branch to deepen connections, delivering meaningful messages at the point of need or building a brand as a powerful platform for growth, how can financial institutions capitalize on this “golden era” for strategic decision making? We’ve rounded up four key categories for banking leaders to review.

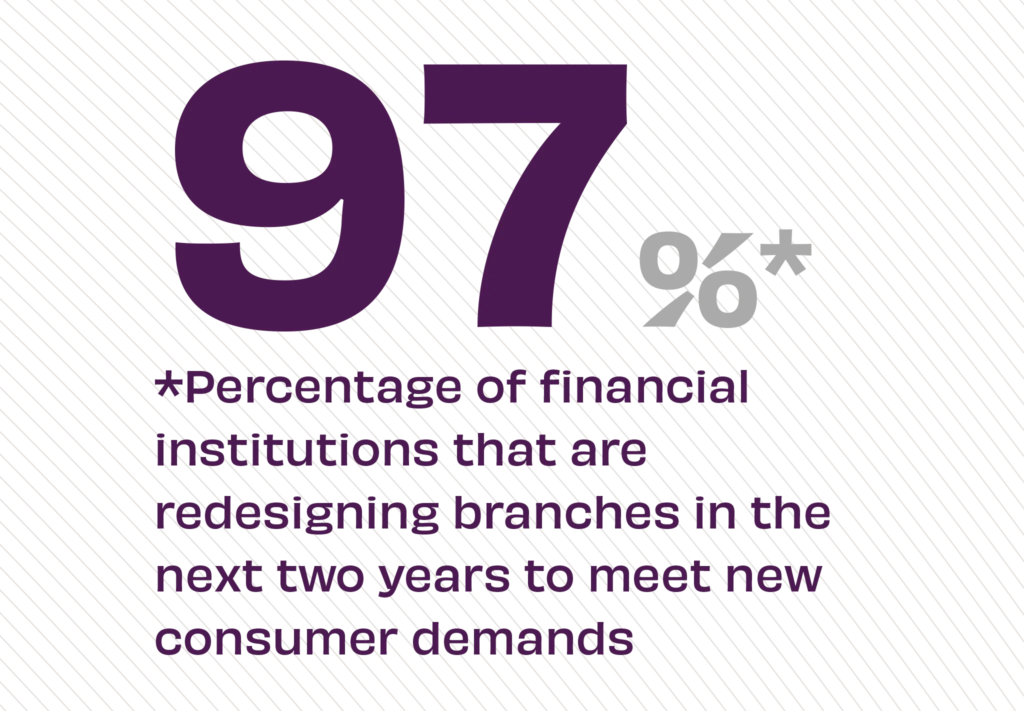

1. Evaluate Your Branch

From assessing the overall branch network to individual delivery taking place there, developing a cohesive branch strategy can’t wait. “In financial services, we are at a tipping point,” according to Gina Bleedorn, CXO of Adrenaline in her recent presentation at Future Branches. “While things are about to change more and faster than they ever have, there is good news.” Banks that embrace a challenger mindset will be in a better position heading into 2022 and beyond. Implementing some branch banking best practices and developing plans to redesign and reimagine the branch experience are good places to start.

2. Make Investments Now

With banks in a strong financial position as we close out the year, industry insiders are expecting to see the biggest bonus increases since 2009. While this kind of bonusing can be viewed as a staffing support strategy, most of that money stays at the top of the organizational hierarchy. As we discussed in the Impact of the Great Resignation on Banking, investing in people across the organization is key in this competitive environment. Evolving roles at the branch demand that “[r]ather than filling the same positions with the same candidates, smart banks and credit unions are using this opportunity to create better jobs and better workplaces.

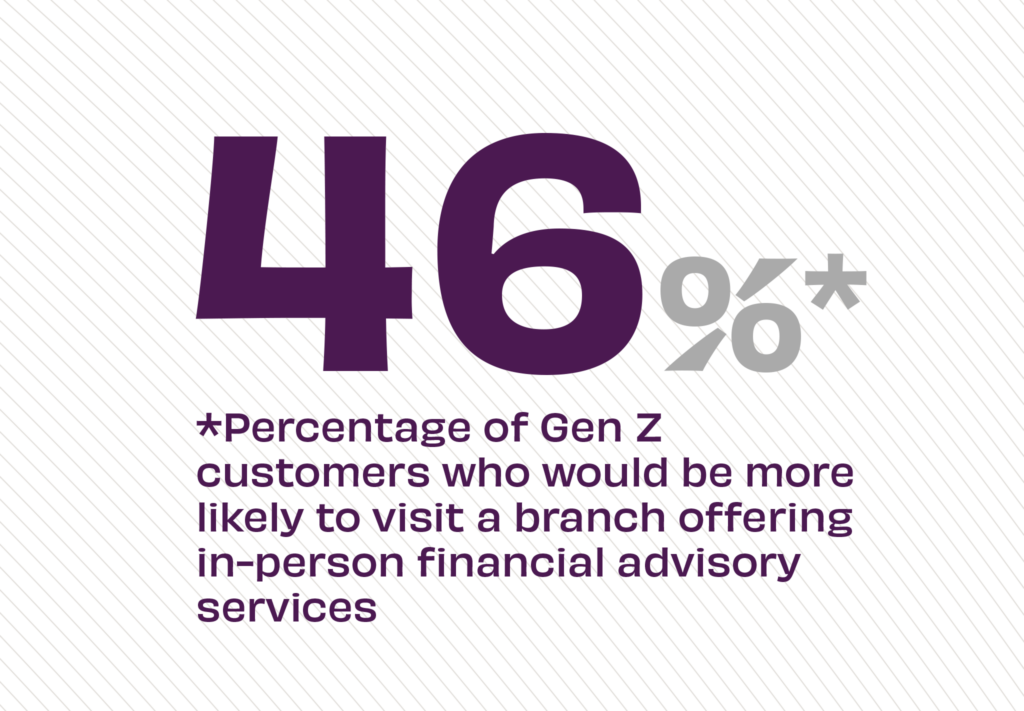

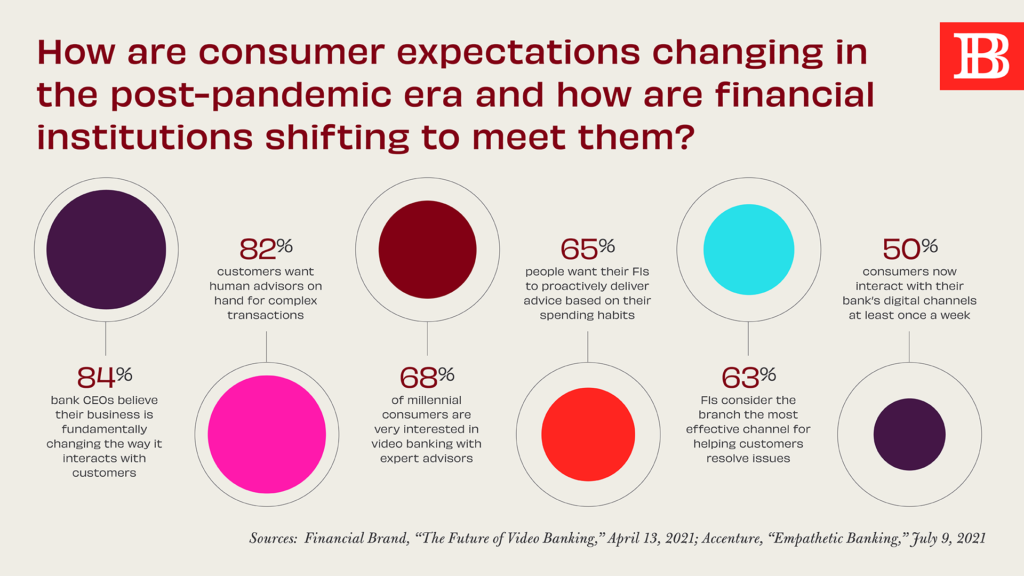

3. Center Customer Experience

Even in the midst of change, banks and credit unions with their eyes on the customer experience prize will always fare better than their peers. “That’s because good CX is not just good business, it’s good for business,” according to Top-5 Ways to Drive Good CX in Banking. Better customer satisfaction scores “can be attributed to the goodwill the brands built with customers – their CX equity – in creating experiences.” Whether it’s focusing on the connection between employee experience and customer experience or understanding how to successfully leverage the branch, consumers continually expect good experiences, and it’s banking’s job to deliver them.

Banks have a real advantage when they start to combine the trust they have from the consumer and some creative ways to do good.

4. Always Deliver Value

Even as the overall economy rebounds, the economic impact of COVID-19 on families at their kitchen table or in their wallet is where it matters most. Consumers may have a harder time saving now or need more customized advice about their financial futures. This is where a bank’s purpose comes shining through. “All these [consumer] challenges are a great opportunity for banks,” according to Adrenaline president and CEO Sean Keathley. “Americans trust traditional banks more – more than the government, far more than fintech. And thinking about who has their best interests in mind, who is going to safeguard their data, who believes in them and wants to help them… Banks have a real advantage when they start to combine the trust they have from the consumer and some creative ways to do good.”

For more insights on driving and delivering better banking experiences for customers and members, stay tuned to Believe in Banking as it tracks the big trends that are impacting financial services. To develop strategies for success for your financial institution, contact Adrenaline’s brand to branch experts at info@adrenalinex.com or (678) 412-6903.