How banks and credit unions can successfully translate data into meaningful insights to act on

Driving smart decisions for growth is a primary focus for banks and credit as they strive to maintain their competitive advantage in the post-pandemic economy. Realistically, however, data can quickly overwhelm even the most committed and focused financial institutions. In Adrenaline’s latest Financial Brand webinar, the company’s chief experience officer Gina Bleedorn, describes it this way: “We all know that smart utilization of data is key to growth, but the amount of data analytics available to most banks and credit unions often exceeds their ability to turn it into action.” McKinsey’s research backs that up with its 2020 findings of effective use of data and mapping it back to overarching business objectives.

Ultimately, it’s not data itself that’s lacking but the right processes for leveraging it, as well as an understanding of all the areas data, can inform across the organization. “Banks currently concentrate most of their analytics use cases in sales management (for example, next product to buy, digital marketing, and transactional analytics), financial risk management (collections), and nonfinancial risks (cybersecurity and fraud detection), according to McKinsey’s report on smarter analytics for banks. “These are logical first choices, but banks also need an analytics road map for the entire organization to ensure transparency and clarity on their aspiration for advanced analytics.”

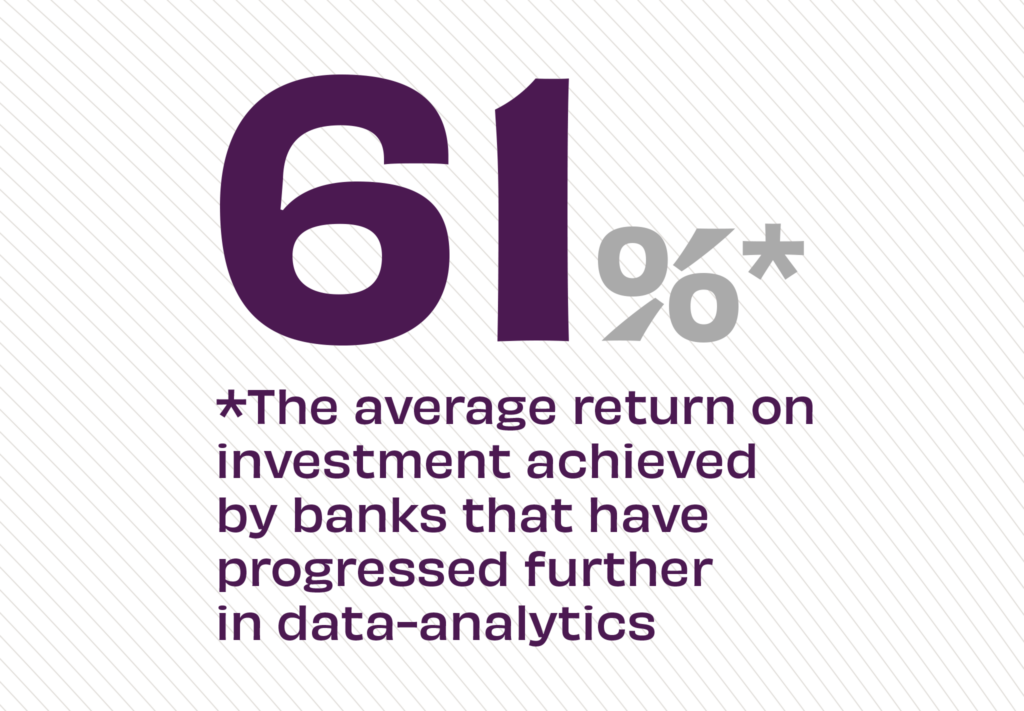

Not only do they perform better, but banks and credit unions with more advanced data operations generate more opportunities. “Recent insights from Accenture about data-driven analytics in commercial banking find that financial institutions that focus on advancing their data capabilities unlock more opportunities to grow their bottom lines while reducing costs and customer attrition at the same time,” according to Believe in Banking’s coverage of data’s impact on income. “Whether it’s automating transactions or developing new banking products, banks and credit unions should leverage the power of the data they already have to improve the banking experience for existing customers and acquiring new ones.”

Data-Based Decisions

Where the need for data often comes into focus first is in growth – specifically customer acquisition and market expansion. But what kinds of data are critical to driving effective decision-making? The first category of data financial institutions need is market data. This can reveal general trends about geographic areas, population growth and density and demographic segments. Market data is foundational to uncovering opportunities. Also critical to determining market opportunity is competitor data – their market share and their branching efforts – essentially, where they’re going and what they’re doing. This includes competitors’ marketing efforts, so financial institutions can understand how to differentiate themselves in relation to other FIs.

“Especially as you’re thinking about expanding into a new area, you should consider competitive density, the types of competitors and how they deliver their products and services,” according to Gina Bleedorn. “If you’re a community bank, you have a slightly different value proposition than a credit union, a regional bank or even a national bank, and you should leverage that.” What’s important is identifying areas of opportunity that other competitors are not meeting. Gina Bleedorn continues, “Banking is an industry where most people have a single financial institution that they consider their primary, but they also have multiple accounts, which is why competitive share really matters.”

The next mission-critical data-set is an organization’s own data – which can get tricky. While market data and competitor data exist outside an organization, an FI’s own data is highly variable both in quality and quantity. “Some financial institutions are just starting their data journey with warehousing and cleaning up their data, and others are much further along with more advanced analytics capabilities,” according to Gina Bleedorn. “But when it comes to where to expand, understanding existing customer data, existing trends, existing product adoption rates and segments, that’s really critical in predicting how you can get a new market share based on those same insights.”

Data on the Move

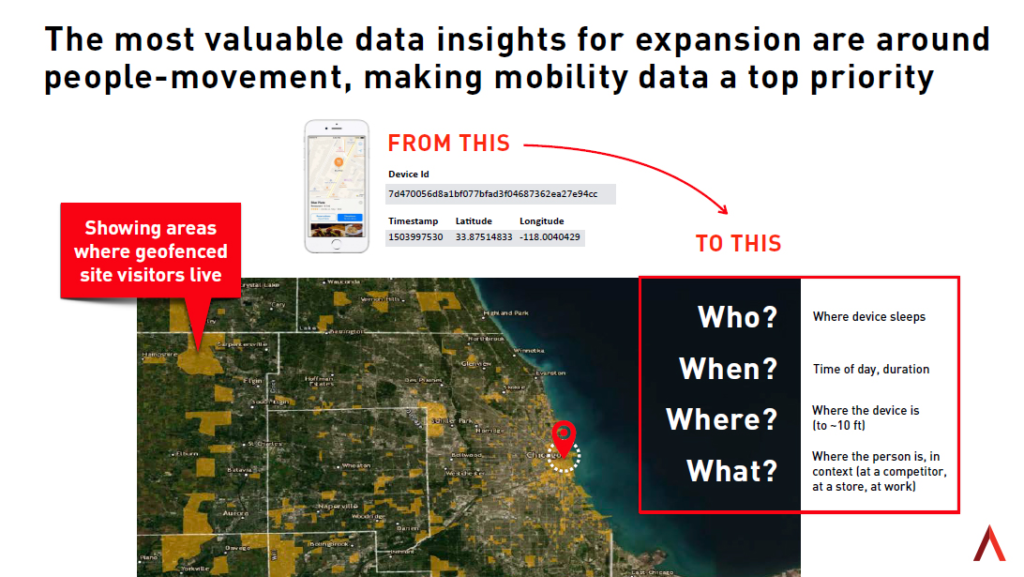

While all other forms of data are fundamental to success, human mobility data brings real-time movement to an organization’s insights operation. It’s not just data on where people are moving to live, but it’s where are they moving about day-to-day. Mobility data takes anonymous mobile phone data – with no personally identifiable information – and aggregates it into more macro trends to help banks make decisions. With a device ID, timestamp and location accuracy of around ten feet, anonymous mobile data is extracted to allow FIs to see where and when people go places and the full context around that movement. Gina Bleedorn says, “Not only are they in a branch lobby, a branch vestibule or a branch drive-up, but are they also near a Target? Are they adjacent to another competitor?”

With this ‘people mobility’ data, banks and credit unions have a powerful tool that fills in the gaps. “Now you can look at a geo-fenced site in a crowded metro area with pedestrian and vehicular traffic flow and people moving to and from work and home,” according to Gina Bleedorn. “With this, we are able to calculate the overall population draw and the demographics of people passing by a potential site. That, of course, allows us to translate data into all types of insights about how to market around that site and how to properly invest in it.”

Insights Led

With the right data in place, organizations must develop the right process for activating it. Financial institutions are awash in data from multiple sources, but it’s the act of transforming it into clear, actionable insights to inform the decision-making process that stumps many organizations. “Most banks have successfully launched single, stand-alone initiatives in advanced analytics, but few have developed them into efficient, large-scale operations,” according to McKinsey. “Early on in analytics planning, banks should consider how the insights will be delivered and contribute to decision-making and larger organizational goals.”

For more insights on uncovering opportunities in banking by leveraging data analytics, stay tuned to Believe in Banking as it tracks the big trends that are impacting financial services. Also see the free, on-demand Financial Brand webinar How to Expand into New Markets and Thrive for information on leveraging location data to drive new market growth. To develop meaningful experiences for customers and members, especially post-COVID, contact Adrenaline’s experts at info@adrenalinex.com or (678) 412-6903.