See how banks and credit unions meet the financial needs of a new generation of digital natives ready to save, spend, budget, and plan

Much of the news about younger generations and their money focuses on Millennials (many of whom are already in their 30s and 40s) and Gen Z (many of whom are going to college and entering the workforce). But another cohort right on their heels is set to remake even more of the banking landscape than the previous generations of digital natives ever could. With the eldest member Gen A turning 13 in 2023, they’re already “giving consumer brands a run for their money,” according to Forbes’ exploration of Gen Alpha. “They are a generation unafraid of money: making it, spending it, investing it, and budgeting it too.”

Already choosing where save their money, this young generation will soon be applying for their own credit cards, securing student loans and buying their first cars. Smart banks and credit unions understand that getting the jump on this generation’s financial needs will help their institutions by creating lifelong customer relationships. “We have the opportunity to do right by this generation, but we must take a preventative approach,” says Evan Leaphart in CU Insight’s article on Generation Alpha. “This generation is projected to have the greatest spending power in history and we would fail our youth to not give them the tools to protect it.”

Instilling good financial habits early is important not only to parents, but also to the banking and economic sectors as a whole, with long-tail implications for the future. Forbes puts it this way: “The pandemic exposed gaps in financial literacy and reinforced the importance of developing healthy financial habits for Generation Alpha, right at a time where they were in the earlier stages of learning the value of money.” So, what are ways Gen X and Millennial parents are preparing Gen A for their financial futures? They’re using a mixture of traditional tools, mobile apps, gamification, and leveraging the influence of social media to make their mark.

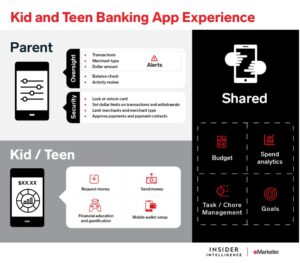

But not everything will be mobile or virtual. “Kid and teen banking apps must anchor financial education in the physical world,” finds Insider Intelligence in their exploration on how parents bank with their Gen Alpha kids. That means rooting financial literacy in “day-to-day household money skills” like allowance, chores, spending, and saving. “Banks and apps that serve parents and kids need to build their functionality around those dynamics.” And their features will need to evolve as kids grow up. Not only will apps need to include additional financial activities, banks will need to provide products tailored to “serve customers based on their life stage.”

For more information on banking with Generation Alpha, stay tuned to Believe in Banking’s continuing coverage of top trends and topics. For the banking industry’s best practices and perspectives, visit Adrenaline’s Insights. And if you’re a banking leader looking for brand-to-branch strategies customized for your institution, contact our banking and credit union experts via email at info@adrenalinex.com.