Balancing digital adoption with customized human-centric experiences in banking

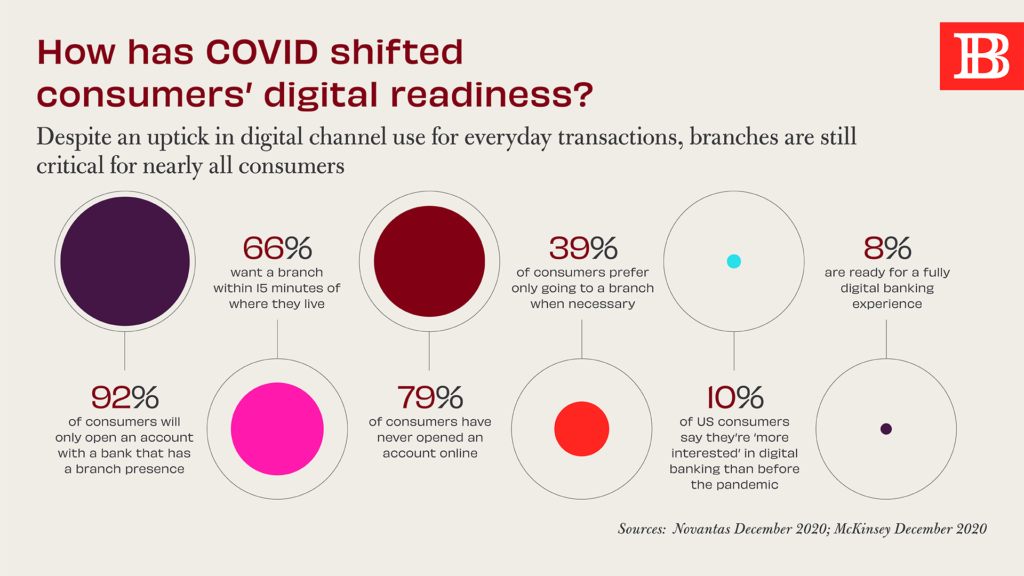

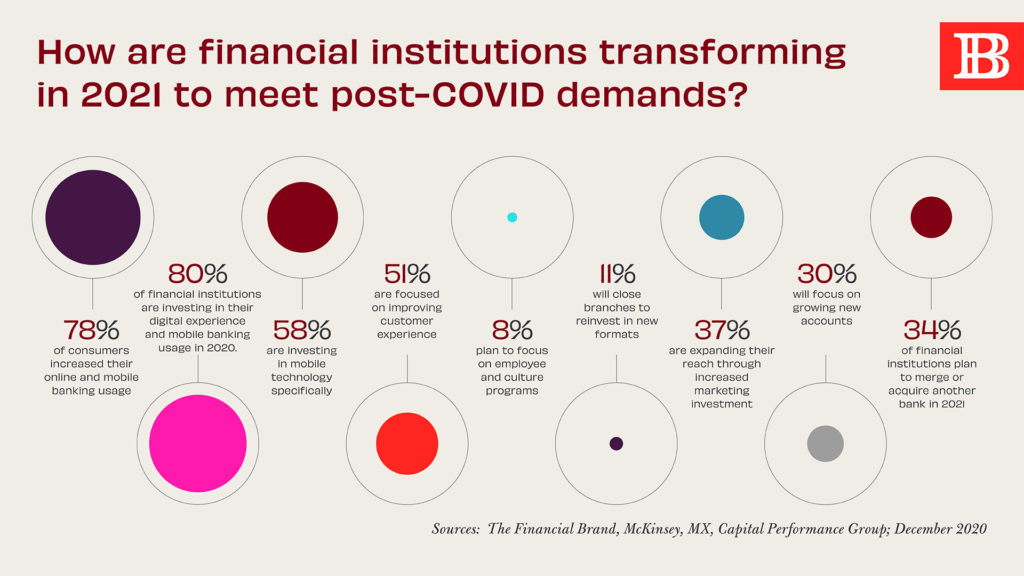

As consumer demand for digital hit an all-time high during COVID, eight out of ten of financial institutions understandably shifted investments into digital and mobile experiences. “With millions of people avoiding public spaces and many branches closed or reverting to appointment-only or drive-up operations for many months, use of digital banking channels soared while in-person banking transactions and visits sagged,” according to the Financial Brand. Looking ahead, while many consumer transactions will remain online, the branch will also continue to play a crucial, but changing, role. In fact, digitization is solidifying the branch as the locus of relationship-building.

In terms of high-value interactions like customer acquisition and consultation, consumers have made it quite clear that they want the branch and they want it close by. With a sizable majority of consumers reporting they want a branch near them, and only opening an account with a bank that has a local branch presence, consumers see the branch as a core element of the banking suite of services they expect. And branch-driven account openings are simply stickier: Digital-only account openings experience a 50% attrition rate within the first year. In banking, as in many industries, digital competence and retail presence is not Either/Or; it’s Both/And. While digital can handle most routine transactions, its overuse in solving customer problems puts the whole banking relationship at risk.

Building Relationships

Augmenting digital tools shouldn’t come at the expense of the relationship, a bond that 51% of banks are focused on making better. While banking increasingly shifts routine, predictable transactions to digital – responding to consumer demand– FIs should not move valuable and trusted counsel to these convenience channels. Consultation is where people want a more human touch. Gina Bleedorn, CXO of Adrenaline, puts it this way in a recent Believe in Banking podcast: “The first risk [of digitization] is commoditization. As there is increased competition and it becomes all about price and ease of digital experience that’s going to make it very difficult for a lot of institutions to compete.”

In a commoditized market, smaller FIs (with smaller budgets) will naturally lose ground to larger ones when digital tools are being compared head-to-head. But with digitization, there’s an even bigger risk than commoditization. Bleedorn says, “[T]he second [concern] is lack of trust. Trust in your bank to look out for your well-being is down by over half in the last two years. A recent Accenture study reveals that although most consumers were satisfied with how their primary financial institution supported them through the pandemic, only 29% trust them to look after their financial well-being.” That means widespread digitization via the pandemic has come at the steep cost of trust—an area in which community banks and credit unions typically shine.

An excellent example of enhancing digitization and trust simultaneously how PPP was implemented. The amplified focus on online lending and processing found smaller regional and community banks competing head-to-head with bigger banks in managing the Paycheck Protection Program (PPP) process, with surprising results. “Online services have allowed smaller creditors to push past their scale limitations and compete on a level beyond their inherent asset size via technology-enabled lending,” according to Banking Exchange. What happened with PPP was that all banks needed to have functional digital tech, but where community banks really thrived was through personalized customer attention in the technical process.

Nurturing Trust

Why is trust so important for financial brands? As recently as November, consumers ranked trust among the top priorities they’re looking for in a brand with 78% reporting they will actively advocate for brands they trust. Yet, as the Accenture study points out: “This lack of trust makes consumers increasingly skeptical about participating in digital initiatives, such as data-sharing, that could benefit both themselves and the bank. Only a small majority (53 percent) of consumers are willing to share more personal information with their bank in return for added benefits and a more personalized, relevant service.” In other words, the lack of trust will get in the way of developing a more personalized experience.

The role of trust is clearly at the center of delivering the customer-centric experiences consumers are looking for. According to Gina Bleedorn, “While there has always been a trust versus time divide in banking – with trust creating deeper, more valuable connections – what customer-centricity allows banks to do is bridge the divide between the two, building trust while optimizing time.” Customer-centricity represents a distinct growth opportunity for banks at the same time it delivers better experiences for consumers. And FIs know that customer-centricity is the key to driving growth, with 71% of them reporting its very important to their continued growth.

Delivering Experiences

The move toward commoditization and diminishing trust are twin risks that banks must address immediately for their institutions to be able to move forward in the post-COVID future, especially one that uses data-based smart marketing to deliver better banking experiences. According to Juliet D’Ambrosio, Adrenaline’s senior director of strategy: “[S]mart marketing builds a bridge for audiences between digital engagement and in-person branch interactions… The data on marketing’s impact is powerful, with half of account openings expected to be driven by brand and marketing activities… a powerful testament to marketing’s foundational role in supporting all customer channels.”

With a focus on personalized data, banks will be able to create products and services that clearly answer a consumer calling. “Armed with these insights, banks will be able to adapt around consumers’ new behaviors and preferences,” according to the Accenture report. “Key to this will be injecting humanity through a ‘digital brand personality’ and embedding personalized experiences in digital customer journeys at the moments that matter.” It’s those moments – triggered by consumer behavior at the time of need – that translate into real relationships on a human level. The end result is a holistic human experience: personalized and customized digital offerings supported by a real people at the local branch.

For more insights on digital banking, marketing strategy and leveraging data and analytics to powerful effect, stay tuned to Believe in Banking as it tracks the big trends that are impacting financial services and informing the banking experience. To develop experience-based strategies for customers and members, especially in the face of COVID, contact Adrenaline’s experts at info@adrenalinex.com or (678) 412-6903.