The Story:

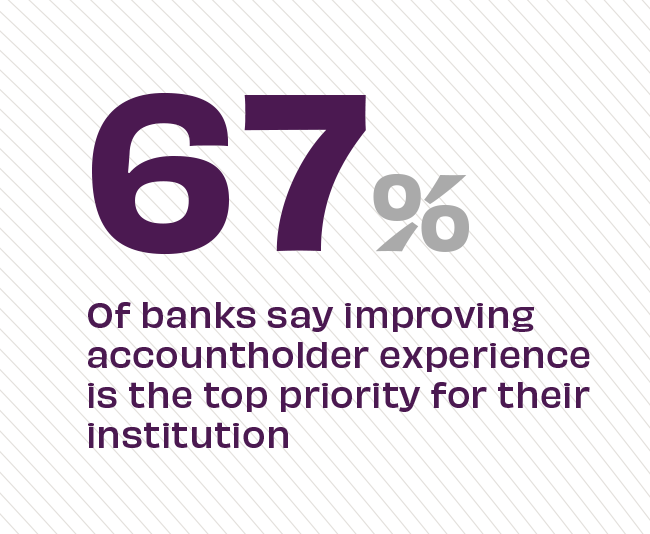

Survey data from Jack Henry finds that banks want to create better experiences for their customers. In fact, 67% of banks and 70% of credit unions say that better accountholder experience is THE top priority for their institutions in the coming year. That’s no surprise, especially given the demands on consumers in our current economy. Although experts say we’ve accomplished a soft landing and averted a recession, many banking customers aren’t feeling the fiscal benefits just yet. In fact, 1 in 3 adults report the national economy is a major source of anxiety for them.

The Takeaway:

In this climate, customers are looking for real solutions to their economic concerns. For banks looking to improve customer experience, streamlining processes and deepening relationships is core to their charge. Going beyond generic financial advice around saving and spending and routine banking products, new approaches by banks are gaining steam. “At its best, the banking sector has the potential to not only protect consumer assets, but also to design products and services that bolster customers’ financial stability,” according to Forbes, “Giving them the tools to address liabilities responsibly and create wealth.”

Jack Henry, “Five Keys to Exceptional Accountholder Experience,” May 2022, AP-NORC, “For Many, Their Personal Finances Are A Source of Major Stress,” August, 2023, and The Financial Brand, “5 Ways Banks Can Help Consumers Cope With Inflation,” July, 2022