From audiences to messages, how to develop core strategies for success in bank marketing

In our recent feature, we discussed the critical role of bank marketing for FI brands as the primary driver of new account acquisition and deepening customer relationships. A chief means to creating connections, smart marketing builds a bridge for audiences between digital engagement and in-person branch interactions, something in short supply during COVID. The data on marketing’s impact is powerful, with half of account openings expected to be driven by brand and marketing activities in the short-term – a sea change for financial brands, and powerful testament to marketing’s foundational role in supporting all customer channels.

Prioritizing Marketing

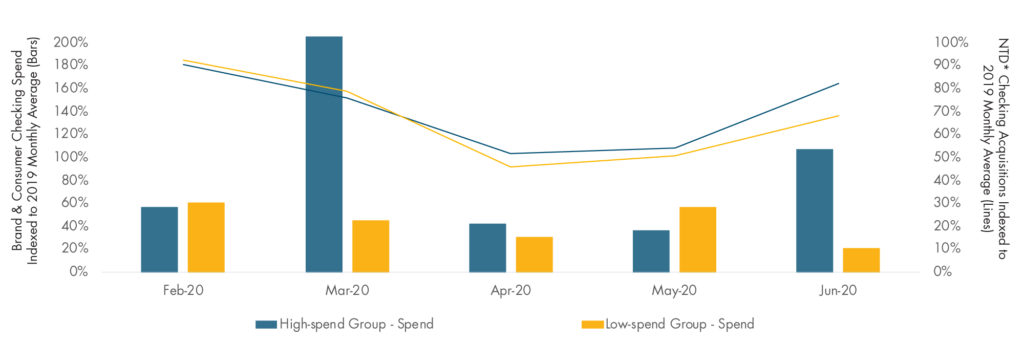

In what seemed like a logical approach during the pandemic, many FIs paused their marketing efforts, waiting for the uncertainty to subside. Yet, as COVID and its impacts endured, what was planned as a short-term pause turned into a year’s long strategy instead. That steep drop in 2020 marketing budgets had the unintended consequence of deepening the financial impact of COVID for banks. According to Novantas: “The one-two punch of restricted customer movements, coupled with the pullback in spend, contributed to the decline in new-to-bank acquisitions in the first half of 2020.”

As many banks struggled during COVID with reduced marketing budgets, those FIs that steadied on in their marketing investment through spring 2020 realized tangible results in new account openings by early summer. Novantas data finds that while COVID hit all FIs relatively equally between March and May, those banks that at least maintained their marketing spending saw their acquisition numbers bounce back more quickly, greatly outpacing their lower-spend peers by June and July. That means that as banks plan for their post-COVID investments, marketing should rise up as a key priority.

Understanding Audience

While we addressed the importance of data-gathering and sourcing, banks and CUs must ladder those efforts toward understanding what data says about audiences and translating data into meaningful brand messages that will resonate. Often, FIs are awash in customer data from varying sources, but since the data isn’t connected into a holistic picture, it’s nearly impossible to translate them into meaningful insights that can help to target the right customer with the right product and the right message at the right time. Having an organized and holistic approach to data is the first step toward developing marketing that speaks to individual customers across channels, whether digital or in-person in the branch. This kind of connected intelligence collects data from numerous sources and distills it into actionable insights in a single, easy-to-understand dashboard.

These data insights should be related to customer need-states and structured so that a targeted, highly relevant marketing message is triggered when a consumer exhibits a certain behavior. These behavioral triggers ensure customized and memorable content is served up based on what consumers are looking to do. For example, if a customer’s online behavior shows an uptick in search for wedding venues, we know they may be considering marriage – and that mortgage offers should quickly follow. Or by clicking on information about an auto loan while a customer is in the bank’s online portal results in a personalized email to the customer providing more information about loan products available to them.

Meaningful Messages

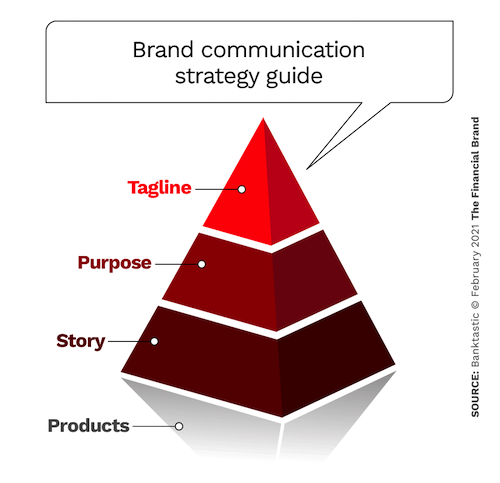

Still, bank marketing is about more than communication around products and services. In the Financial Brand’s Want Your Financial Institution Brand Story to Pop?, Martha Bartlett Piland says, “In an abundance of enthusiasm, many marketers list every fact about their institution. And they inevitably lose their audience in the process.” What she recommends instead is a process that starts with a short, memorable message, and adds layers to the brand story as you go. “That’s how to connect with audiences, bring them along, then resonate with them so they want to hear what the brand has to say.”

Creating resonant messages depend on not only knowing your audience members from data and insights, but contextualizing their experiences into personas, behaviors, mindsets, and preferences. In short, it’s critical to understand your customers and potential customers as people first, so you can create opportunities to engage. That’s the kind of customer-centricity so critical to successful brand growth, where successful FIs “put the person at the center and look at that human with all their complexity, their needs, motivations and pain points” and using the point-of-view to guide decision-making. The best bank marketing should always demonstrate that people-first approach.

In an upcoming feature, Believe in Banking will take a deeper dive into communication channels for bank marketing campaigns. For more insights on marketing strategy and leveraging data and analytics to powerful effect, be sure to stay tuned to Believe in Banking as it tracks the big trends, both inside and outside the industry, that are impacting financial services and informing the banking experience. To develop experience-based strategies for customers and members, especially in the face of COVID, contact Adrenaline’s experts at info@adrenalinex.com or (678) 412-6903.