The Story:

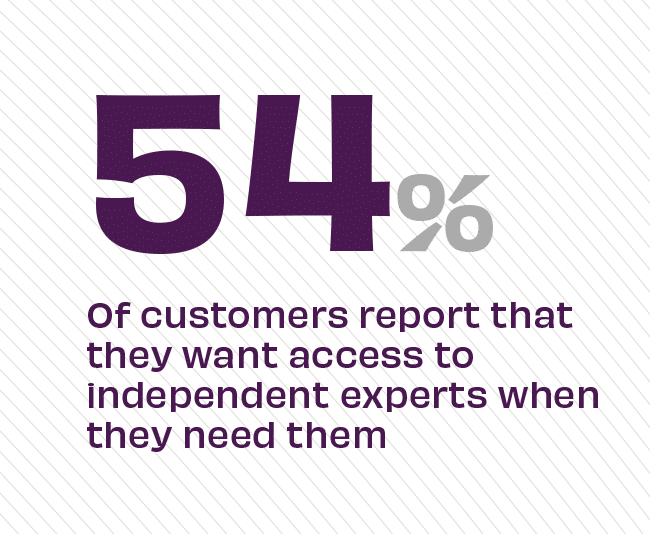

New data from CGI’s Financial Consumer Report outlines the key reasons consumers report they switch banking providers. Looking for financial guidance and support for saving and spending rank at the top of their wish list for a new banking relationship, with more than half of consumers wanting on-demand access to experts to help them. Understandably, many consumers say they want their bank to advise them how to pay off loans more quickly, something increasingly important in today’s rising rate environment. The five core categories for bank switching have risen in relevance to customers by an average of 5.6% since 2017.

The Takeaway:

While its essential to know what consumers are looking for as banks ramp up acquisition strategies for new customers, it’s equally important to know what would keep existing customers satisfied, so banks can retain them and sustain the banking relationship. Recent data from J.D. Power found that only one-fifth of bank customers report getting guidance from their bank over the last year, despite challenging economic conditions. The banks that did actively seek to help customers “reaped the rewards,” according to J.D. Power, with a significant proportion of them opening accounts after getting valuable advice.

Source: CGI, “Today’s Financial Consumer,” 2023