New data on economic conditions and banking satisfaction finds that banks have an opportunity to provide personalized financial advice, guidance and products for consumers

Amid stubborn inflation, rising interest rates and months-long debt ceiling discussions, U.S. consumers are understandably on edge about the overall economy. And in Canada, consumers are struggling with high household debt. But across North America, banks are in a prime position to help with essential advice and practical solutions that can bolster consumer confidence and boost people’s economic prospects, according to J.D. Power’s Banking Satisfaction Survey. “For banks to attain high marks in satisfaction and build the enduring loyalty that comes with it, customers need to feel supported through tough economic times,” says Jennifer White, senior director of banking and payments intelligence at J.D. Power.

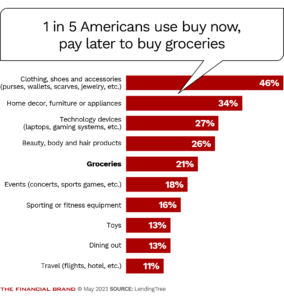

Even with customers reporting they’re struggling, only 21% say they received advice or guidance from their primary bank in the past year, according to J.D. Power. Looking elsewhere for financial resources can result in some financial behaviors that may not be in consumers’ best interest. “The banking, payments and savings habits of American consumers are shifting in an environment of continuing economic turmoil and some gaps in their financial knowledge,” according to the Financial Brand. Data finds that more 9 out of 10 people keep some level of cash at home for a rainy day, while others use short-term lending like Buy Now Pay Later to pay for necessities.

With the recent bank failures adding even more uncertainty over the economy, it’s important for banks to step up with support. One standout example of digital to physical customer-centered solutions is JP Morgan Chase which is “doubling down on customer acquisition with an aggressive branch strategy” according to Insider Intelligence. Since 2017, the banking giant has opened 650 new branches, with most new locations in new markets. “Though the bank invested large sums of money in developing its digital banking capabilities, it says those tools, paired with in-person branch locations, allow it to reach more customers,” reports Insider Intelligence. Through this strategy, Chase serves 30% more customers today than it did in 2019.

If you’re a banking leader looking for strategies customized to your financial institution, get in touch with Adrenaline’s banking and credit union experts. And, don’t forget to subscribe to Believe in Banking to stay up to date with the latest news impacting the banking industry.