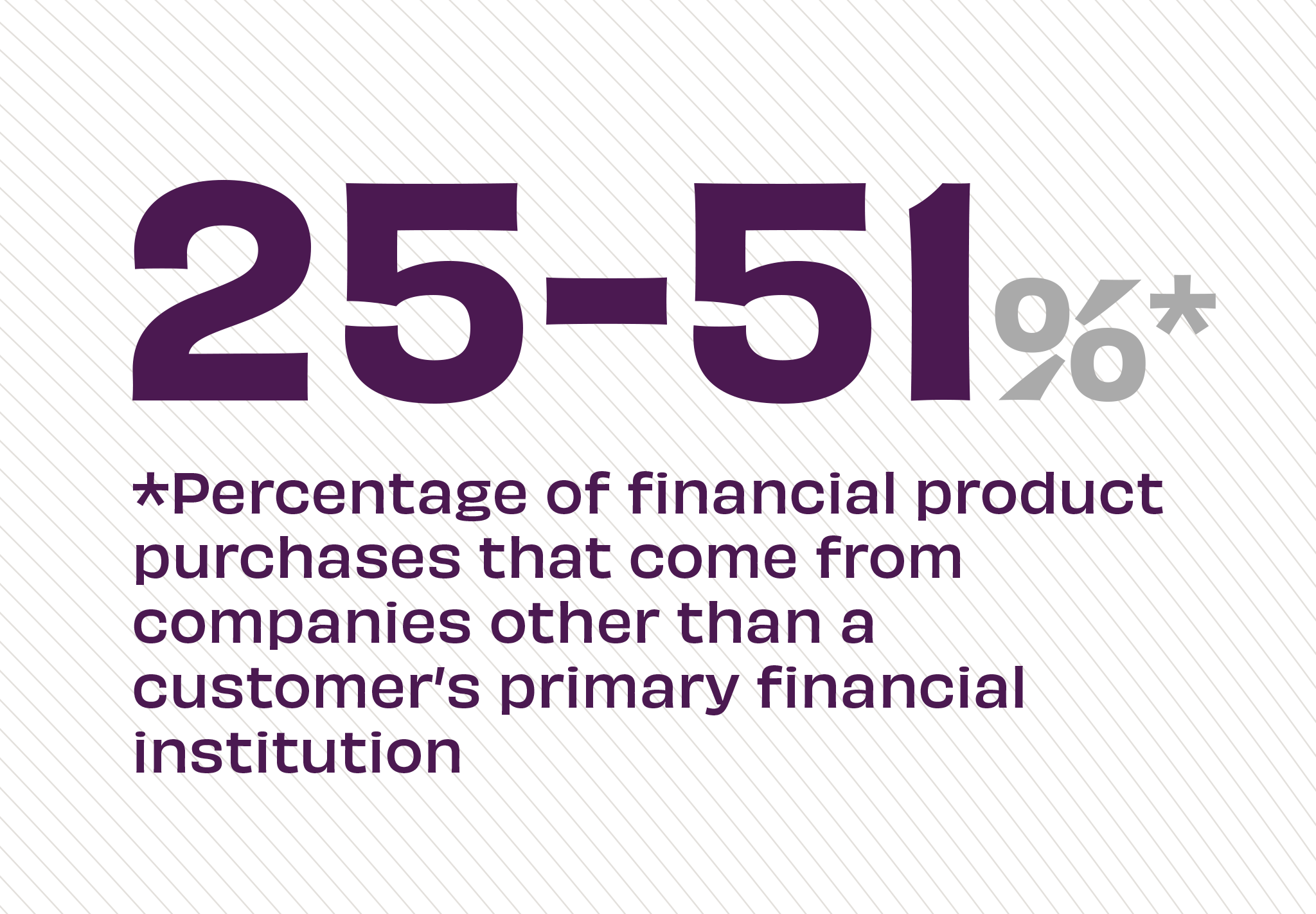

The Story: As fintech continues inroads into banking, FIs are discovering that their current checking and savings account customers may be going elsewhere for competing products, like payments, loans, credit cards and investments. In some cases, defecting customers cite better technology, more convenience, better brand recognition and superior security as reasons they opt for a challenger product. But 29% of these customers said they acquired these products after receiving direct offers from competitors. Most critically for traditional FIs, 78% of those customers said they would purchase that same product from their primary provider, if they had made an equivalent offer.

The Takeaway: FIs should focus on offering an expansive suite of products or services to existing customers. Banks and credit unions can lean on personalization – using data from their existing customers to predict (and recommend) products that will help their financial well-being. If customers are using Venmo, did they know their bank offers Zelle for payments, for example. Additionally, FIs should take notice of offers being made by fintechs to find new opportunities for growth in their own stable of products.

Source: Bain & Company, “Hidden Defection Of Consumers Is Rampant,” January, 2021