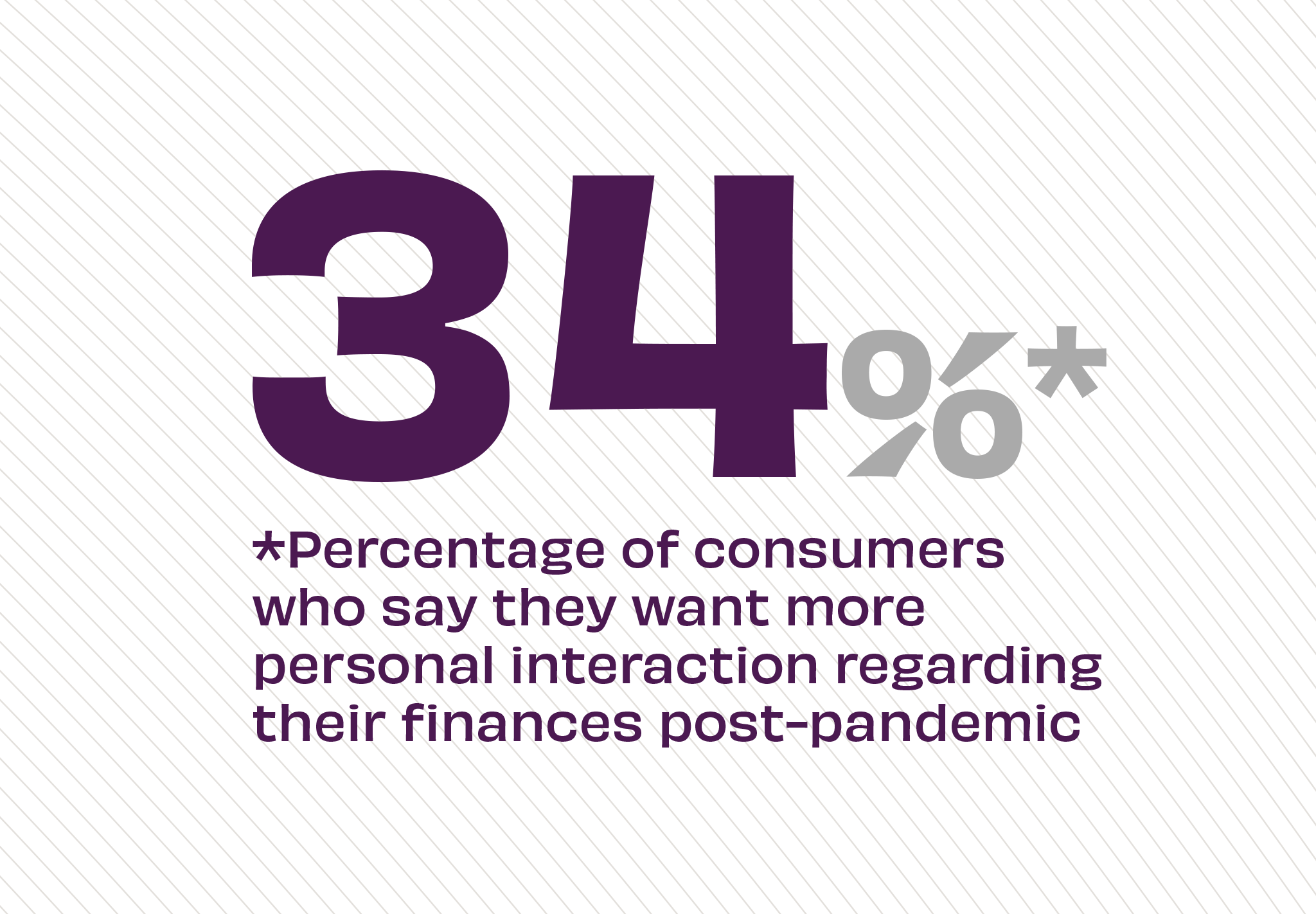

The Story: Though new digital tools can personalize a customer’s experience by using marketing automation to offer products and services at the point of need, a new survey finds that customers prefer a personal interaction over a “personalized” one. Even digital natives like Gen Z still want to interact with real people about their real financial needs.

The Takeaway: As banks and credit unions create communications that show off their digital tools like mobile apps and online banking, they should be sure to also leverage personal human interaction between customers and bankers for training and support. Further, new tools like ITM that are a hybrid of both provide innovative ways to bridge digital and physical channels and prioritize customer connection.

Source: EPAM Continuum, Consumer Banking Report 2021, October, 2021