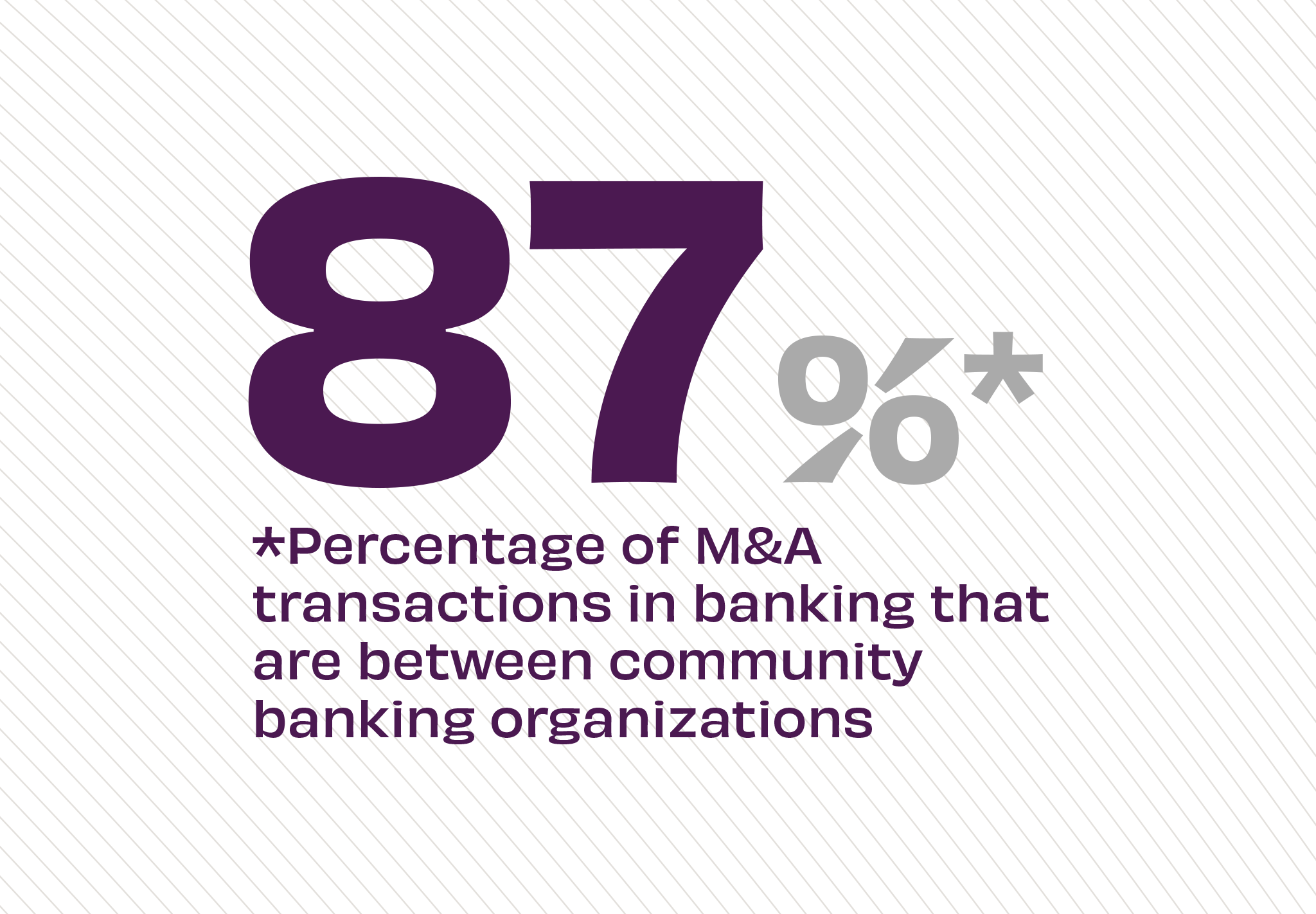

The Story: As M&A activity in banking soars, hitting its highest level in nearly 15 years, fresh data from the federal banking system of the U.S. sheds more light on which financial institutions are coming together. The Federal Reserve reports that amongst all completed commercial bank mergers, nearly nine out of ten of them are between community banking organizations (CBOs). Further, as banks have grown so too have the asset sizes of both target banks and buyer institutions, creating larger FIs with more resources for consumers.

The Takeaway: As community banks use M&A as a primary driver for growth, they’re leveraging their newfound scale for good. Despite consumer fears of widescale branch closures and consolidation efforts post-merger, data finds that community banks that merge actually serve more and serve better in communities of all sizes than their individual pre-merger institutions did.

For the latest data, news and trends in financial services, like M&A activity in banking, stay tuned to Believe in Banking. For insights on best practices in banking and meeting consumers at the point of need, contact Adrenaline’s banking and credit union experts at info@adrenalineagency.com.

Source: The Federal Reserve, “National Information Center and Reports of Condition and Income,” February, 2022