Why consumers still prefer cash for some purchases and how financial services companies are creating solutions for hard currency in an increasingly digital world

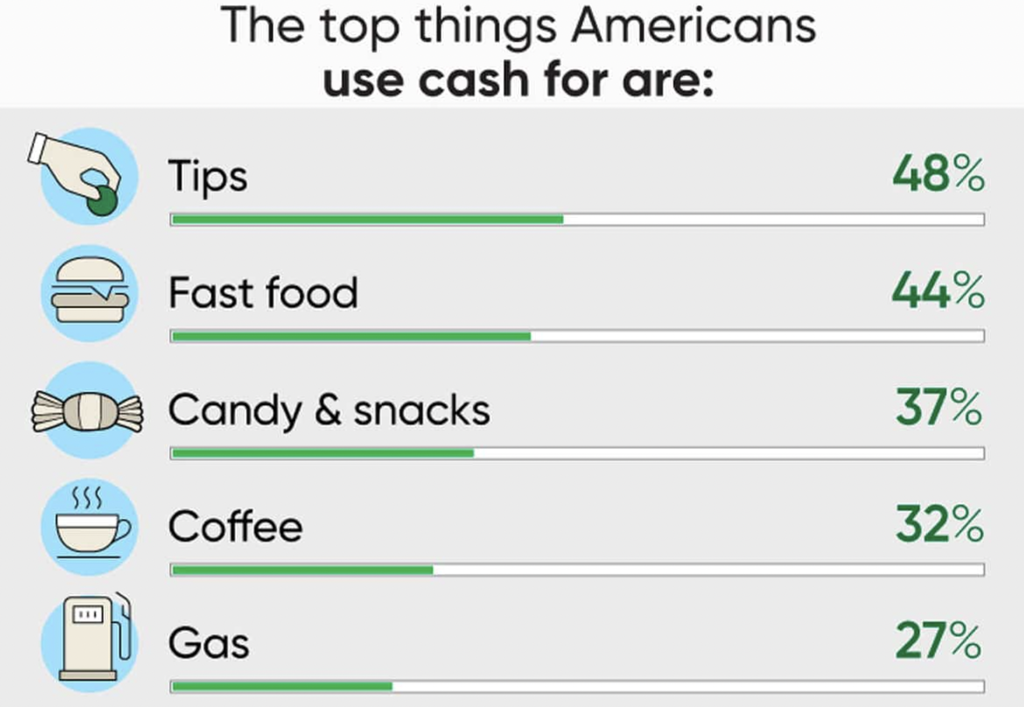

Despite the upsurge in digital banking and P2P payments, Americans haven’t gone nearly as cashless during the pandemic as some industry insiders expected. New data on consumers and cash have some surprising findings: People still prefer cash for small purchases and budgeting purposes – and likely will for the foreseeable future. For purchases under $20, both businesses and consumers prefer cash currency despite the availability of options like credit and debit cards and mobile payments. The survey also finds that more than half of consumers report “using cash helps them a budget,” with Gen Z topping out at 58%, leaning on cash to help them keep spending in check. According to the survey, on-the-go purchases drive the most cash use.

Source: WSFS Financial, September 3, 2021

“Cash usage is showing signs of surpassing pre-pandemic levels — and some of the digital payment options put in place during lockdown are actually fueling the trend,” according to American Banker’s exploration on consumer use of cash. “While cash use dropped severely during the start of the pandemic, it remained more resilient in the U.S. compared to other countries,” with only just over a third of consumers reducing their reliance on cash, according to Visa. Further, Cash Connect, a division of WSFS Financial, reports that for consumers who regularly use cash, COVID had no lasting impact on their habits.

Interestingly, cash-based businesses and consumers are driving interest in new physical currency hybrid technologies like Cash Connect’s “smart safes.” With functionality not entirely unlike TCRs (Teller Cash Recyclers) or self-service ITMs, cash is counted, digitally integrated into a core system and deposited to accounts via ACH. This smart safe technology is available to consumers via kiosks at high-traffic retail locations and incentivizes cash over credit through lower fees for using cash.

What all of this means for financial services is that there will be a continuing need for banks and credit unions to efficiently handle cash deposits and withdrawals – often through self-service technology – even as their demand for digital tools continues apace.