The Story:

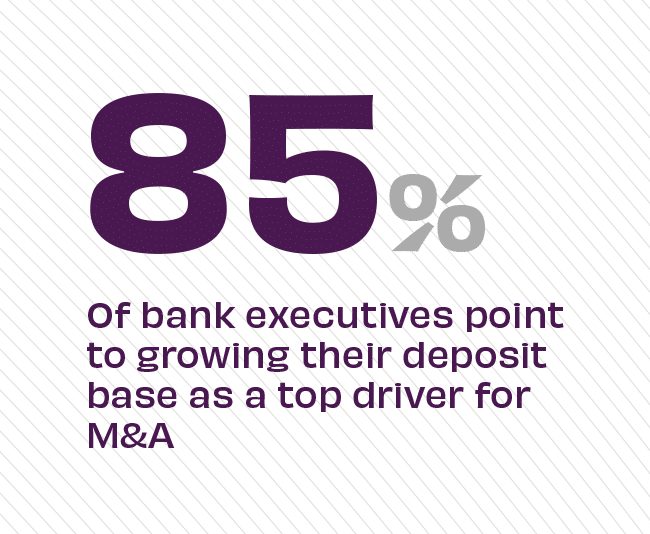

Growth is on the minds of bankers heading into 2024. New data from Bank Director finds more than eight in ten banking executives report that an attractive deposit base is a top attribute driving acquisition of another financial institution in 2024. That’s nearly thirty percentage points higher than the 58% who said the same just a year ago. Even more, a recent Ernst & Young survey of bank CEOs reports that more than half of them say they’ll start seeking out deals in the next year to get more scale, diversity and profits.

The Takeaway:

As banks continue to compete for customers, CEO confidence is rising about M&A as a path toward growth. “When we’ve had our highest volume M&A years, like in 2021, the highest quarterly M&A volumes correlated to the highest levels of CEO confidence,” says Vito Sperduto, global head of M&A at RBC Capital Markets in Business Insider. According to The Conference Board, CEO confidence continued to trend upward throughout 2023, reaching the highest point at the end of the year, with nearly six in ten executives predicting a better banking environment in the second-half of 2024, when the Fed is expected to start cutting rates.

Sources: Bank Director, “2024 Bank M&A Survey,” November, 2023; American Banker, “Banks Eager to Resume M&A Predict ‘Wave of Consolidation’ in 2024,” November, 2023; and Business Insider, “Investment Bankers Are Watching These 6 Signals for an M&A Rebound In 2024,” January, 2024