The Story:

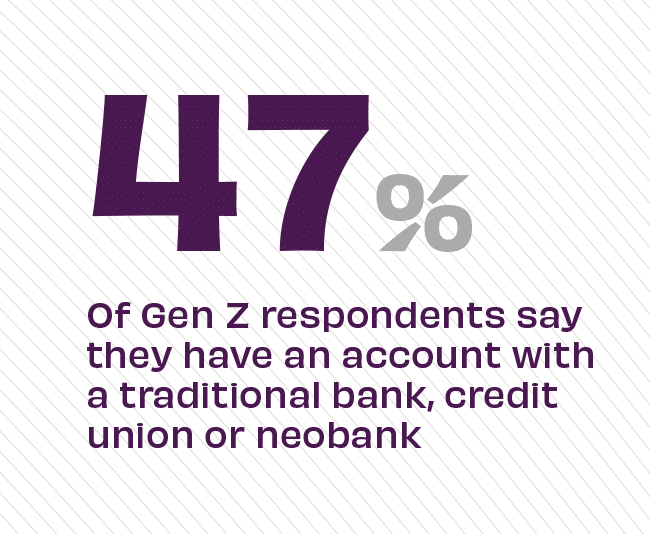

Making up nearly 20% of the population, Gen Z already boasts more than $360 billion in spending power. Yet many financial brands are just now catching up with this influential up-and-coming generation, and it shows. Less than half of Gen Z respondents in a recent survey report having an account with a traditional bank, credit union or neobank, compared to 70% of Boomers and Millennials. For banks and credit unions ready for growth, connecting with this largely underbanked and unbanked demographic is essential.

The Takeaway:

We all understand that financial habits vary by generation, with older demographics opting for more traditional banking products. But new generations call for renewed approaches, especially with half of the Gen Z population up for grabs. “The gap between what Gen Z wants from financial services providers and what is currently available means young people are turning to alternative solutions for their needs,” says David K. Donovan Jr. in BAI’s exploration of Gen Z Banking. “Banks should draw insights from other industries to provide personalization… This means simplifying products and services that are not built for scale, but rather, for their customers based on individual needs.”

Source: MX, Finn AI, Rival Technologies, and Q2, “Gen Z + Millennial Consumer Perspectives on Banking,” February, 2023