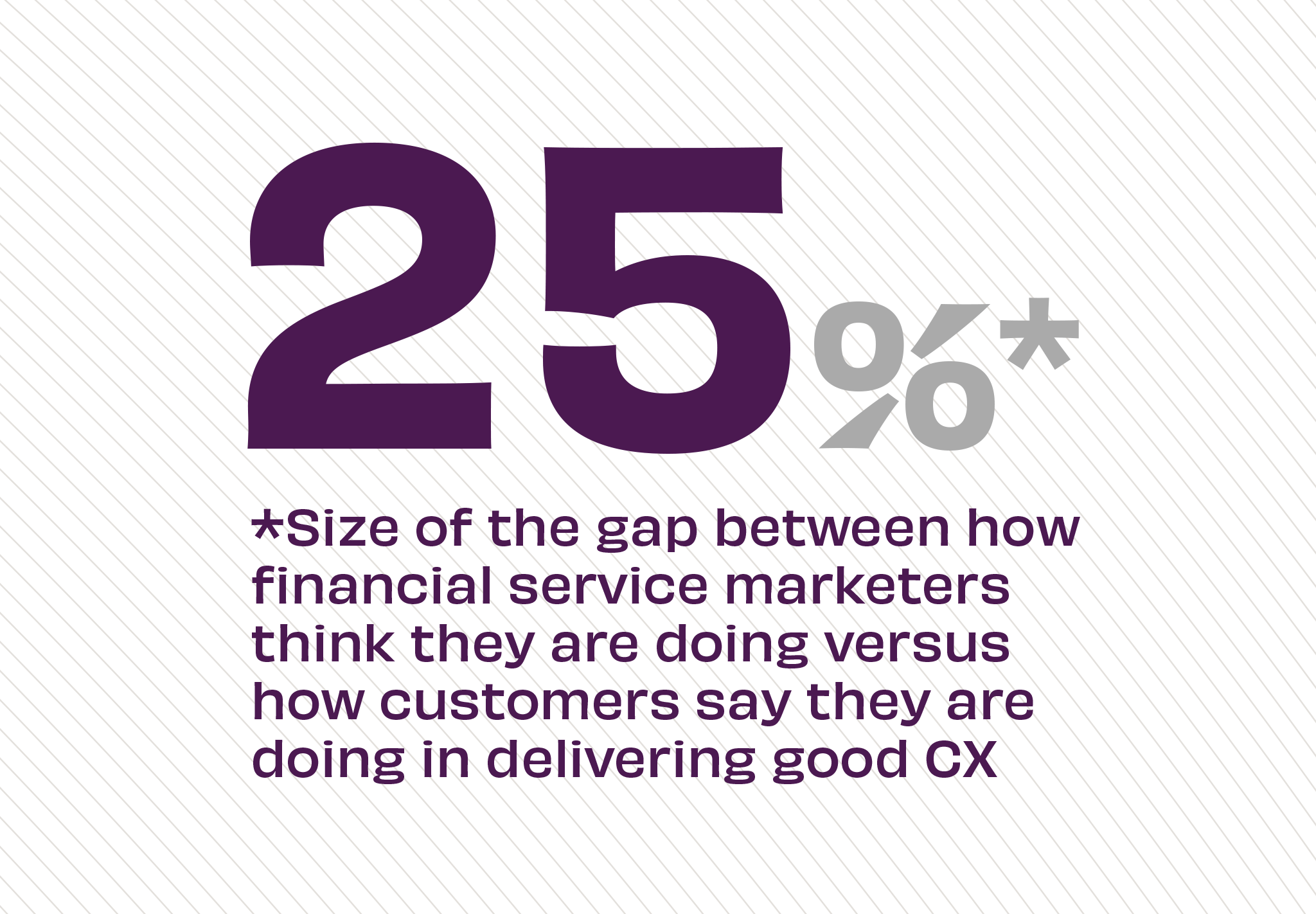

The Story: New data finds a persistent gap between marketers’ perception of the customer experience they are providing, and the service customers believe they are receiving. Specifically, the areas where FIs need improvement are in personalization, ease of product opening and engagement, ‘knowing the customer’ and empathy. Further widening the gap, when polled on CX priorities customers rated Omnichannel Consistency as the top priority, while marketers championed Customer Understanding. The most striking finding is that although customers feel brands don’t ‘know them,’ they ranked Omnichannel Consistency among the highest and Personalization the lowest of their priorities.

The Takeaway: The fact that consumers prefer a seamless omnichannel experience to personalization may be a signal that, by default, people are still accustomed to doing their own research. However, as brands across industries continue to use data and insights to personalize CX, consumers will expect FIs to do the same. The banks and credit unions that effectively close the CX gap will find success by investing in data analysis and activation, real-time engagement and personalization, and omnichannel delivery.

Source: The Harris Poll, “Revisiting The Gaps In Customer Experience,” February, 2022