The Story:

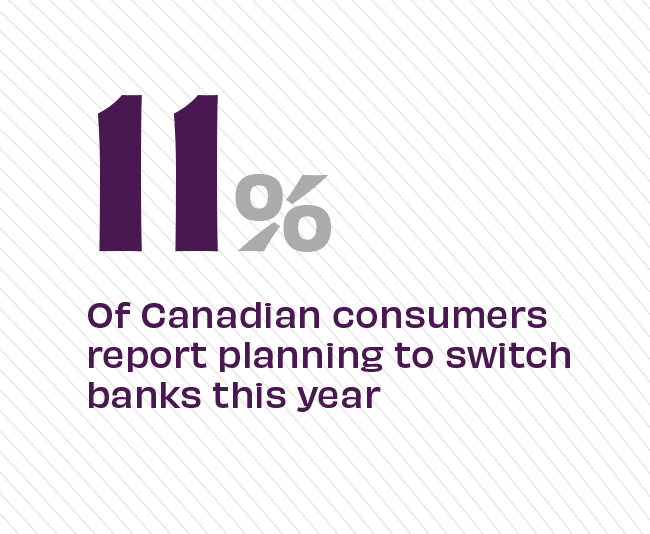

When money’s tight, people tend to reassess all of their financial relationships, but none more than the one they have with their bank. Beyond understandable reasons for switching, like the need to reduce fees, many customers are now also seeking enhanced benefits – including better rates and rewards, superior customer experiences, easily accessible branches and ATMs, and user-friendly transactions. In a market filled with financial options, banks can stand out by providing more personalized alternatives that meet customers where they are along their life stage.

The Takeaway:

Canadian consumers are calling out for support from their banks, according to the J.D. Power’s 2023 Canada Retail Banking Satisfaction Study. The consumer intelligence company says, “Higher interest rates, inflationary pressure and mounting debt continue to weigh on the wallets of bank customers in Canada.” But Canadian financial institutions can win over new customers – and keep the ones they have – by showcasing their existing expertise and offering personalized advice that speaks to where customers are in their life journey. “Canada’s banks should be more attuned to their customers’ financial state and needs, offering and tailoring advice that is aligned with their financial challenges and tied to their future financial goals,” says Jennifer White, senior director for banking and payments intelligence at J.D. Power. “During times of financial hardship, customers are looking for guidance.”

Sources: Finder.com, “How to Switch Banks in Canada,” April 2023, J. D. Power, “2023 Canada Retail Banking Satisfaction Study,” October, 2023, and Financial Post, “Bank Customers in Canada Seeking Financial Advice,” June, 2023