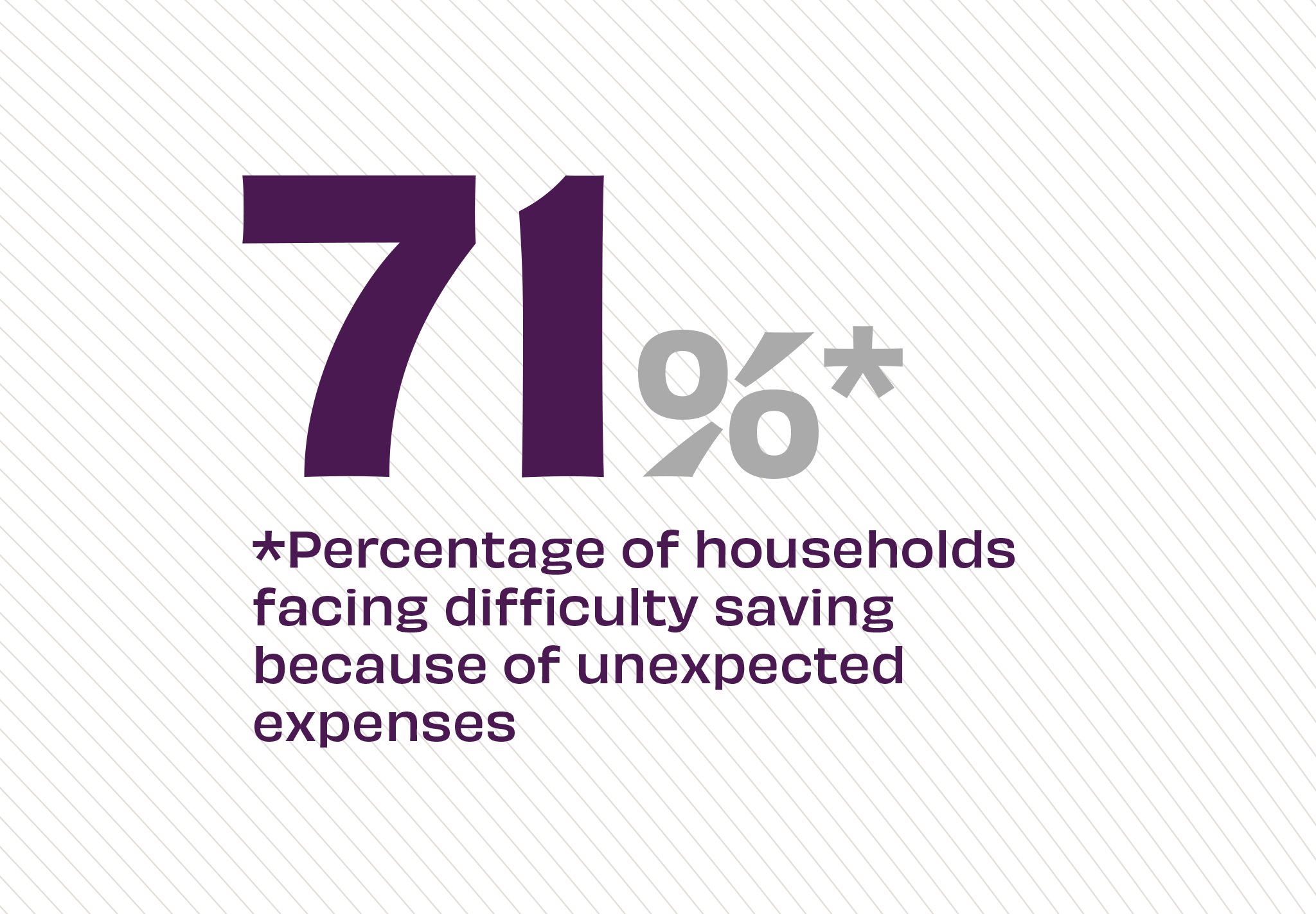

The Story: Even before the pandemic, the average American struggled to overcome unforeseen and unplanned for expenses like “car repairs, medical bills or even a broken phone,” according to the Consumer Financial Protection Bureau. The economic impact of COVID-19 has made saving even more difficult for hard-hit families, resulting in a pressing need for financial tools and support.

The Takeaway: Banks and credit unions are not only expected to acknowledge these global pain points; consumers want action from their primary FIs. Financial literacy programs are critical in supporting consumers through their financial challenges. And banks like Wells Fargo are not only taking notice, they are stepping up to the plate with localized resources for communities that foster goodwill and trust so necessary in forging lifelong customer relationships.

Source: Consumer Financial Protection Bureau, September, 2021