Understanding Post-COVID population trends to inform a data-driven branch strategy

The recent feature Reinvesting Resources: Optimizing the Branch Banking Channel explores how banks are capitalizing on the true value of branches – leveraging physical locations as the greatest source of consumer trust and new business opportunity for financial brands. Reinvesting for growth at all levels – but specifically at the branch – is at the heart of the next phase of the Post-COVID Roadmap to Reopening. Investing in the branch network empowers banks and credit unions to scale for growth, but determining the formats and markets to deploy in remains one of banking’s thorniest issues.

The Power of Population

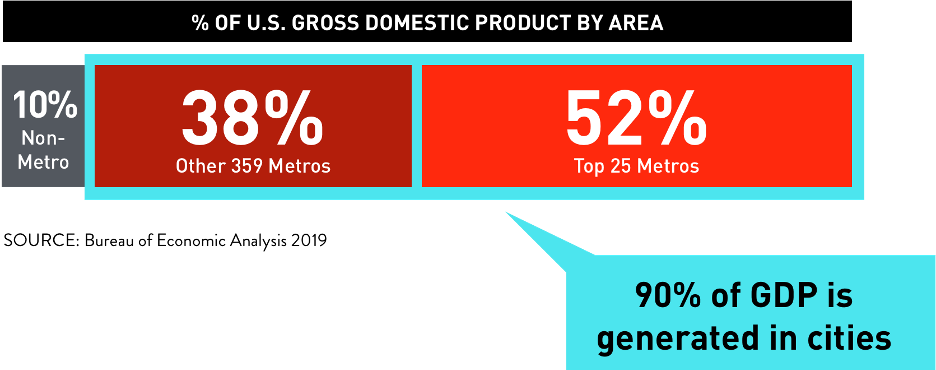

Since population growth leads to economic growth, all brands with physical distribution – stores or branches – naturally want to go where people are. As economic powerhouses, the top 25 U.S. cities generate over half of the nation’s GDP, and 90% is generated in metro areas overall. That’s why market analytics focuses first on evaluating market opportunity, with prospects for growth driven largely by population density and momentum moving into a market. Location is particularly important in financial services, though. Unlike other sectors, in banking, physical location is the #1 driver of consideration. Further, people relocating to a new market represents the #1 opportunity for new customer acquisition.

When people move to a new home, they are more likely to consider opening a new banking relationship than at any other time. What banks are looking for here is positive turnover. By aligning investment in branches in markets with the biggest growth potential, banks and credit unions will be in a position to capture the attention of incoming residents, leveraging perceived presence to their advantage. Using market intelligence, banking’s biggest goal is to prognosticate which markets will be growth markets in the future. In other words, skate where the puck is going.

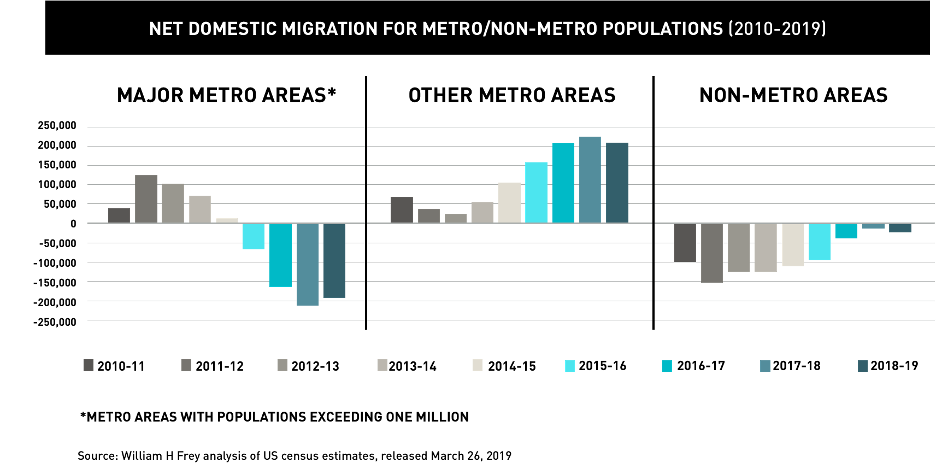

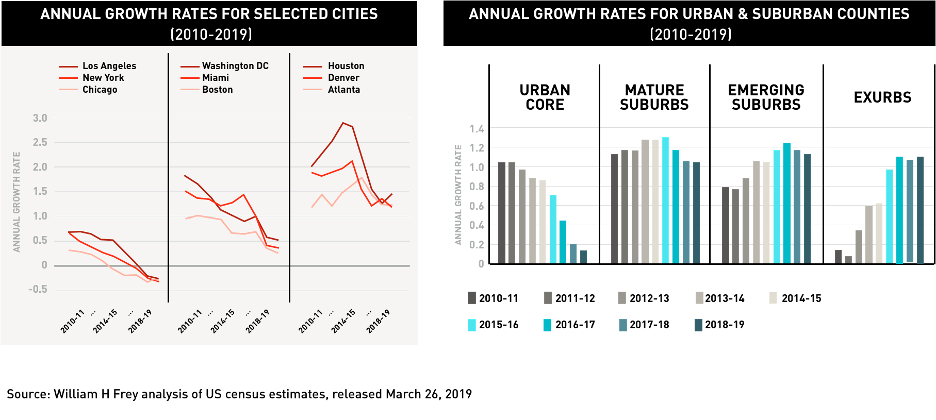

For decades urbanization has been persistent, with a staggering 83% of the world’s population currently residing in cities. Because there was so much big city growth, the 2010s became known as “the decade of the city.” While the urbanization march toward cities continued from the 1970s onward, the last decade has witnessed a slowdown of the largest metros and a splintering of population towards the suburbs and smaller metros. This waning of growth in urban areas actually represents a branch opportunity for community banks to get a foothold in areas of the greatest population growth that were previously unattainable.

Post-COVID Banking

With urbanization beginning to slow prior to the pandemic, what we’re likely to see post-COVID is a continued suburbanization, along with population spread to Tier 2 cities (for example: Charlotte, Orlando, Austin, and Boulder). Diving a little deeper into the markets just outside city centers, we’re now gaining a better understanding of mature versus emerging suburbs and exurbs, as differentiated from the urban core that’s still increasing but whose influence is shrinking. In the months ahead, we’re expecting to see accelerating movement towards emerging suburbs and exurbs—especially away from the hardest hit cities and densest urban cores, like New York—and growth in smaller cities.

For community banks and credit unions, this population shift couldn’t come at a better time. Community financial institutions were already struggling with core business drying up in long-standing legacy markets resulting in business imperative to branch out into new growing markets, which will now be exacerbated by post-COVID economic conditions. Sticking a stake in the ground in large urban areas hasn’t been feasible for some banks beyond commercial lending, because of existing retail competition and the cost to compete. Now, with suburbs, exurbs, and new smaller metros humming, there is an opening of opportunity for community banks and credit unions to expand their footprints in areas with significant acquisition potential.

Market Data

Unlocking this growth opportunity depends on utilizing and leveraging market intelligence to inform decision-making around branch strategy, understanding that the branch channel is where relationships begin and are deepened through trusted counsel. Historically, the financial industry wasn’t too focused on market dynamics in and around their branch locations. But now, it is the time to hyper focus on that since the silver-lining in our current COVID-reality is that some market dynamics have shifted in favor of markets in which community banks and credit unions can compete.

In an upcoming weekly feature, we’ll take a closer look at data around banking relationships and growth markets that are providing community institutions the growth opportunity to reshape their branch networks post-COVID. For more information on bank branch reopening in the post-COVID landscape, download our Roadmap to Reopening. If you need help preparing your staff for post-COVID branch operations, check out our Frontline Staff Engagement Training series. For financial institutions needing advice and expertise now, contact Adrenaline’s financial services experts at info@adrenalinex.com or call (678) 412-6903.