The Story:

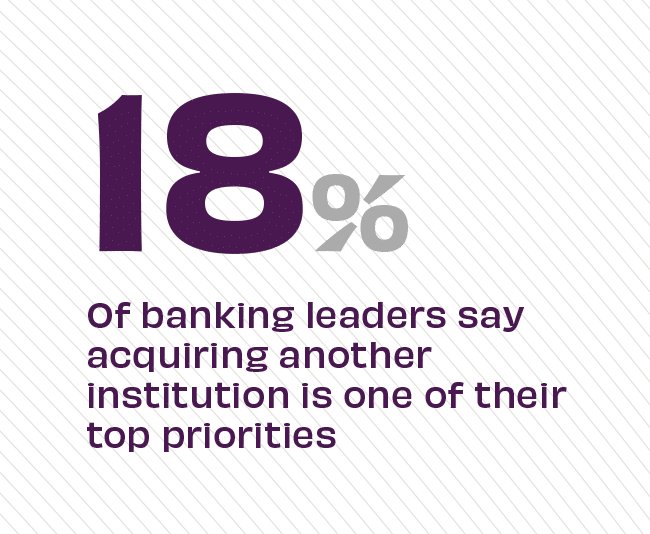

Data tracking financial institution priorities throughout 2023 finds that nearly two out of ten banking leaders rank acquisition as one of their top-3 priorities for the year. In the current rising rate environment, smaller community-sized financial institutions may find they have more difficulty competing on banking products alone. Following the regional banking challenges this spring, some smaller financial institutions may be experiencing deposit outflows and sluggish loan growth. For them, strategic mergers and acquisitions can provide scalable solutions.

The Takeaway:

While most banking leaders see themselves as the acquirer, mergers of equals (MOEs) may provide more immediate results. “Community banks can use MOEs to create operating leverage and spread their overhead costs across larger asset bases,” says Jeff Davis, managing director of Mercer Capital Partners in an interview with S&P on community banking mergers. “Such deals can also help smaller institutions manage rising technology costs or create larger and more attractive franchises as an intermediate step toward selling to a larger institution.”

Source: Jack Henry, “Strategic Priorities Benchmark Study,” May, 2023, and S&P, “Mergers Of Equals More Attractive to Community Banks,” August, 2023