The Story:

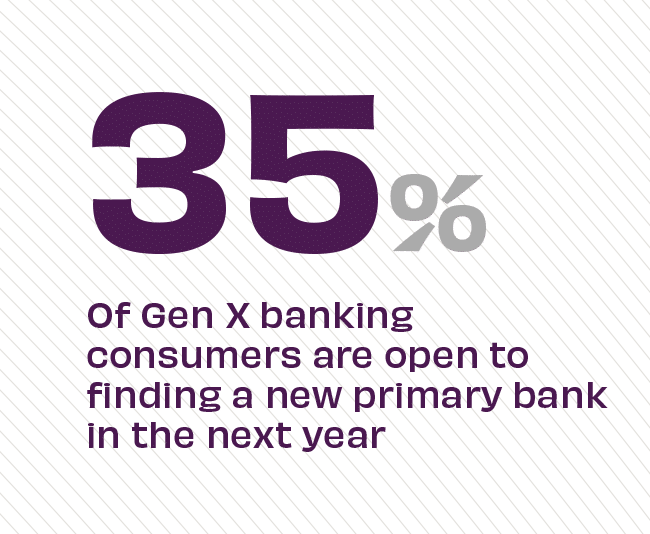

At a time where consumers of all ages report feeling financial pressure, one often overlooked generational cohort has risen to the top as an exceptionally stressed demographic. Data from Pew Research Center finds that 54% of Gen X Americans in their forties are wedged between two other generations and providing financial funding for both. This “sandwich generation” supports both an elderly parent over the age of 65 and a dependent or adult child. And although the generation is in their prime earning years, money takes a mental health toll on 60% of them, according to BankRate. These realities have Gen X looking at all of their options.

The Takeaway:

Given the strain on Gen X finances and time, banks have a real opportunity to deepen relationships with current customers and create new connections by providing real time, relevant and responsive solutions to their needs. “Life stage understanding and awareness is key to supporting Gen X in their banking experience in 2024,” according to the Financial Brand. “Banks should consider catering to this group to ensure they have both the customer support they need as they balance multiple checkbooks and timelines, as well as access to solutions that can make banking easier.”

Sources: Financial Brand, “Trends 2024: Four Banking Growth Strategies for a Challenging Year,” January, 2024, Pew Research Center, “Americans in Their 40s Are Sandwiched,” April, 2022, and BankRate, “Americans Say Money Negatively Impacts Their Mental Health,” May, 2023