The Story:

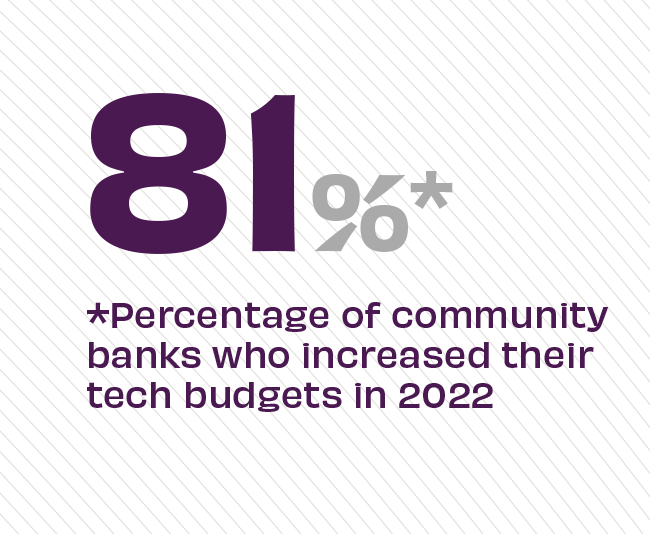

In 2022, community banks grew their technology budgets by an average of 11%, bringing the median yearly budget up to a whopping $1 million. The recent Bank Director survey found that most of those new dollars were earmarked for customer experience improvements, specifically on measures institutions felt would have the greatest impact on customer satisfaction and competitiveness of the bank. One area where FIs need more investment, though, is in CX technology at the branch.

The Takeaway:

While some banks focus increased dollars on digital banking, in-branch technology like digital signage can often yield greater satisfaction, as customers visit their local branch for high-value consultations. “Web and app-based financial planning tools are important for consumers to use on their own time, but retail banks may fail to leverage one of their most readily consumed channels,” says Adrenaline’s Rick Barrick. “Most banks use in-branch digital signage to promote products… but they may underutilize those same tools to provide customers with what they want most: easy-to-understand financial education.” As consumers prioritize post-pandemic fiscal wellness, smart FIs are fostering financial literacy at the branch to deliver deeper value.

Sources: Bank Director, “2022 Technology Survey,” August, 2022, and The Financial Brand, “Community Banks Fatten Tech Budgets to Enhance CX,” October, 2022