The Story:

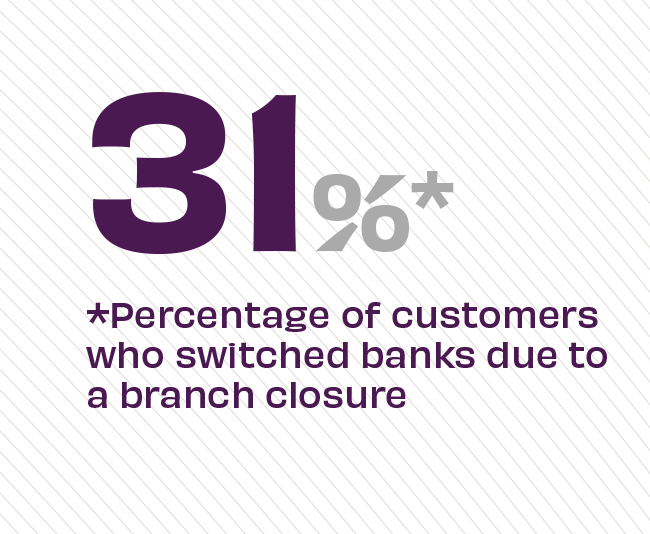

As bank branch closures drive customer departures, studies find that 60% of “mobile-only” customers in the U.S. and Canada are not so exclusively committed to just one banking channel, after all. In fact, up to 18% of those customers report they’ll visit a branch at least once per week. Moreover, nearly one in five said they would go to a branch more often if hours were extended and banking options were enhanced, including greater access to more advanced ATMs/ITMs and credible experts sharing financial advice.

The Takeaway:

As FIs do the important work of prioritizing opportunity markets and reimagining their retail networks, bank branch closures need to be judicious and well-planned, with an overall customer acquisition strategy in mind. By deciding which customer segments to go after, FIs succeed in acquiring and retaining the right mix of customers by investing in the right branches in the right locations. “Banks need to rethink the role of the branch in their ecosystem,” says Jean-Pierre Lacroix, president of Shikatani Lacroix, the company spearheading the study. “And about how they can drive more relevant engagement in the branches with advisors.”

Source: The Financial Brand, “The Right Way to Balance Digital and Branch Banking” with data from Shikatoni Lacroix Inc., November, 2022