How delivering on transparency and consumer value help banks and credit unions mean more

As trust in all areas of life vacillates with society emerging from the grips of a global pandemic, trust in business continues its strong showing, according to recent data by several leading research organizations, most notably Edelman’s 2022 Trust Barometer. “In the face of persistent challenges, 2021 saw business solidify its position – for the fourth straight year, at 61 percent – as the world’s most trusted of the four collective institutions of government, business, NGOs and the media, with ‘my employer’ beating them all at 77 percent,” finds Edelman’s analysis on business trust. Even more, PWC’s recent survey reveals a significant gap between the trust consumers have in companies and how much business leaders think consumers trust them.

Trust in Banking

While we have dedicated a lot of our news and views to exploring the imperative and intrinsic role of trust in banking, current data underscores the need for fresh thinking and reassessing institutional priorities, post-pandemic. In general, recommendations for businesses from PwC include active listening and fostering an open dialogue with all stakeholders, most especially consumers and employees. “And while executives are focusing on being good corporate citizens to build trust, customers and employees rank it low in importance, according to Forbes’ reporting on the trust gap. “In other words, when it comes to trust, start with the basics and be sure to get them right, then build from there.”

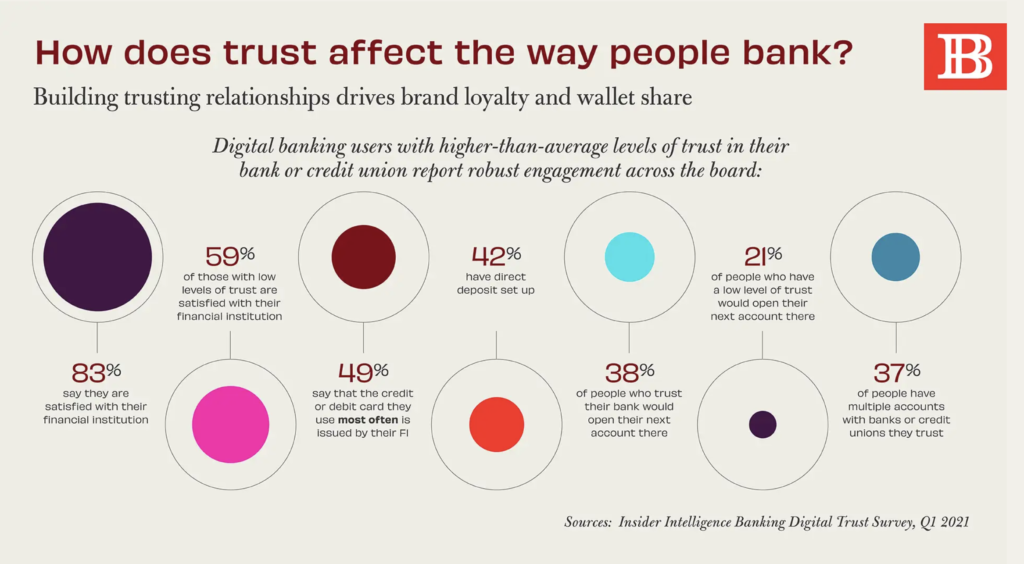

For banking, those basics stem from listening to what customers and prospects want from their primary financial institution, from financial advice all the way down to the products they offer. While trust is certainly critical to customer satisfaction scores, even more important is what trust can build into – for both customers and their banks – and that’s long-term loyalty. In fact, nearly four in ten of people who trust their bank would open their next account there AND 37% of people have multiple accounts with banks or credit unions they trust, according to Insider Intelligence Banking Digital Trust Survey. The bottom line: Trusting relationships drive brand consideration and deliver greater wallet share.

Transparency and Trust

Building trust with constituencies also means being transparent with them about issues that directly affect them. One of those consumer concerns is around overdraft and account fees. Pushed by challengers like fintechs offering low or no-fee banking, more traditional financial institutions met their competitor’s actions with their own commitment to lowering or banishing these unpopular fees. While moving away from fees makes sense from a consumer sentiment standpoint, it also means banks will have to replace considerable income coming into their bottom line. But that’s not the case for all charges.

An important consideration is the idea of value. While it’s certainly true that no one likes fees, customers don’t mind paying for subscriptions to things they LOVE – like Netflix, Spotify or Barkbox – because they see these as “services” that deliver for them and add to their lives in a positive way. Conversely, in financial services consumers have come to think of banking as a commodity they buy and use up, instead of a service that brings them value. Even more, consumers feel that fees penalize them for their behavior and typical transactions and 55% of consumers say their banks is less than transparent about fees.

Banking’s Bottom Line

Taken all together, these trust trends show consumers are calling out for transparency from their financial institutions. Just because consumers don’t like fees doesn’t mean that banks will have to banish them all, if they’re honest about what these service charges are for and demonstrate the value consumers get from them at the same time. Ultimately, banks and credit unions should prioritize a changed relationship with customers when it comes to trust and transparency and show a commitment to helping consumers at all stages of their financial lives – by providing valuable financial advice, local support for their communities and meeting people where they are.

Stay tuned as Believe in Banking continues to provide news and insights on the industry’s latest developments, like trust in banking. For insights on best practices in banking and customizing solutions from the brand to the branch, contact the banking and credit union experts at Adrenaline at info@adrenalinex.com.