Customer experience surveys reveal why financial institutions must prioritize personalization and localization while delivering a modern banking experience

Even as digital and fintech banking options gain traction, customers still prize personal experience from their primary financial institutions – according to three separate surveys on banking satisfaction released in just the past three weeks. Polling from community banking industry powerhouse ICBA in conjunction with Morning Consult finds across all 50 states that “69% of U.S. adults cite the importance of banking with a locally based financial institution while 70% cite the importance of personal banking relationships.” To further empower FIs with actionable data, ICBA has created an interactive dashboard on community banking at the state and district level.

In another new satisfaction study, J.D. Power finds that “online-only banks that offer more personalized customer service get higher satisfaction ratings than competitors that provide less individualized attention.” The customer satisfaction pioneer’s 2022 U.S. Direct Banking Satisfaction Study polled nearly 8,000 customers using “direct banking” – financial institutions with an only online presence and no physical locations. These direct banks have a higher mountain to climb in personalization compared to their more traditional peers, as they don’t have a local branch to humanize their offering or a platform for local relationship building.

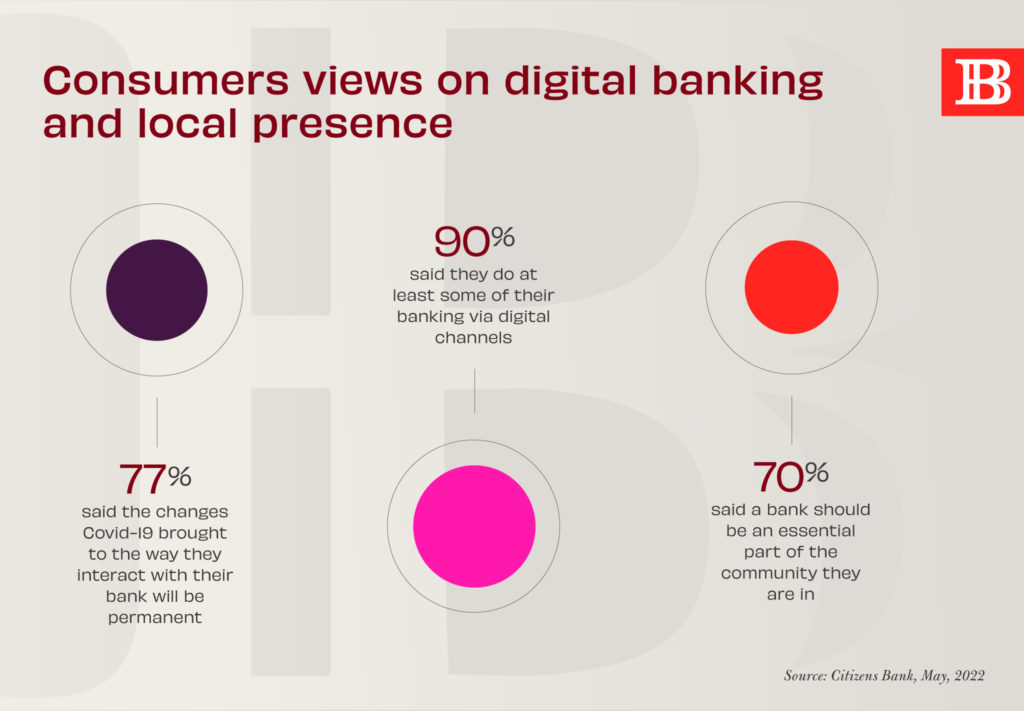

Finally, Citizens Bank’s second annual banking experience survey shows that “more than three-quarters of consumers expect the changes in their banking habits brought about by COVID will be permanent.” With consumer expectations continuing to evolve post-pandemic, financial institutions will have to grow along with them, offering the best digital experience plus the personalized attention customers crave. In a separate interview with PYMTS, Doug Brown, president of digital banking at NCR, says banking that bridges the digital and physical give even late adopters an “aha moment” about digital but that he still expects a “heavy lean” towards consultation.

The bottom line: For banks to prevent customer attrition, they must simultaneously provide: online and mobile banking; better customer service; and easily accessible branch locations. Stay tuned as Believe in Banking continues to provide news and insights on the industry’s latest developments, like omnichannel options and positive customer experiences. For insights on best practices in financial services, contact the banking and credit union experts at Adrenaline at info@adrenalinex.com.