The Story: Brick-and-mortar retail stores are evolving. With the vast adoption of e-commerce, stores with the highest foot traffic are the ones that offer compelling new experiences to customers. That’s why many brands are delving deeper into experiential retail – physical stores that offer experiences beyond browsing and buying products. This new approach merges the digital and physical worlds into a seamless omnichannel experience that delights and excites modern consumers.

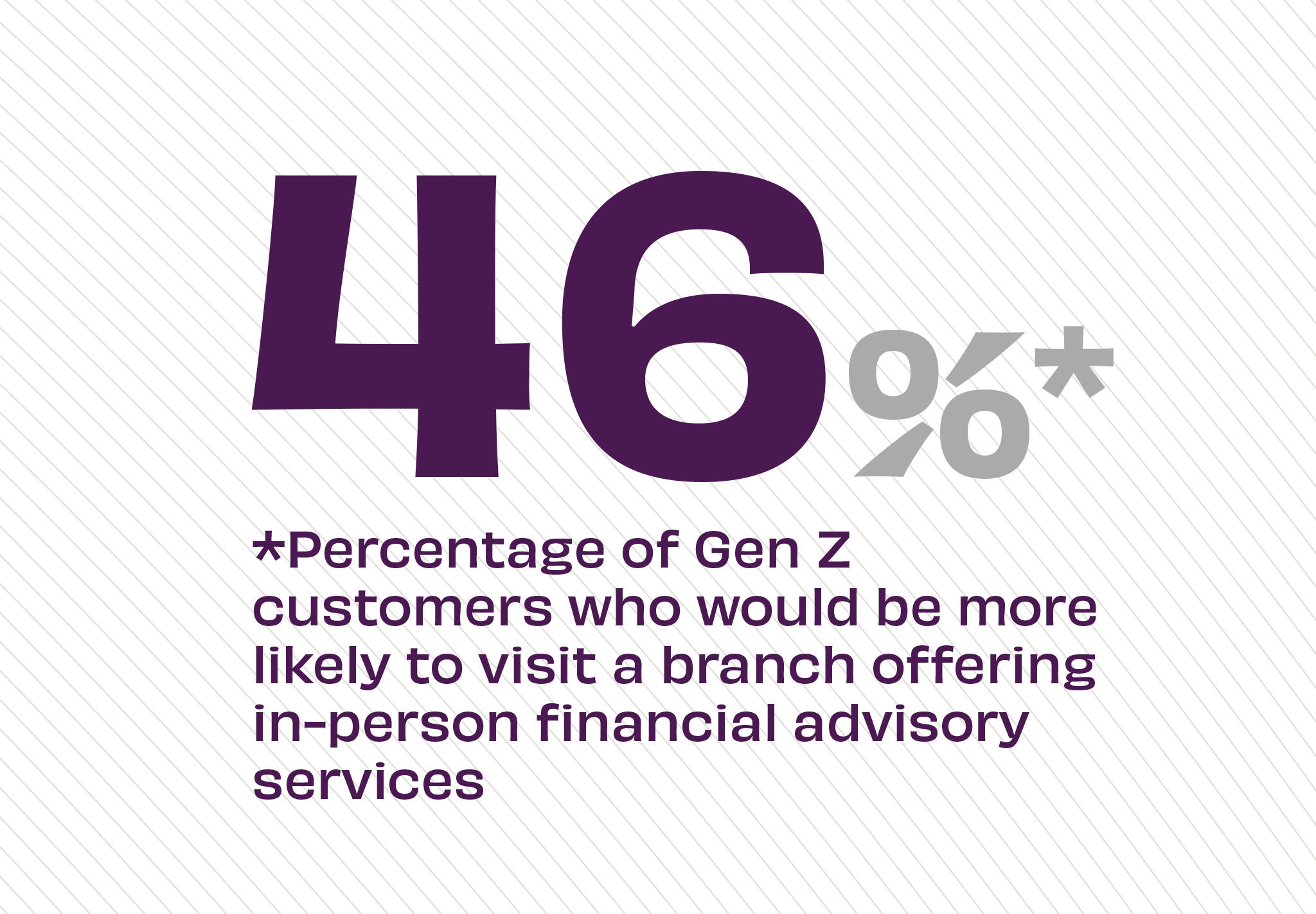

The Takeaway: So, how does this affect banking? When it comes to financial institutions, we know that 79% of banking customers visit a retail branch at least once a year – with 40% of Gen Z respondents reporting monthly in-person visits. However, those visits are predicated on branches delivering real value through good experiences. Gen Z respondents said they would be more likely to visit their bank branch if they offered:

- A Community Hub (38%)

- Financial Education Services (40%)

- Financial Experience Center (43%)

Further, 30% of Gen Z customers said that having a physical branch became more important to them over the past year – during the pandemic, no less. In order to provide the personal interaction piece of the experience puzzle, traditional FIs should take advantage of this opportunity to differentiate themselves by offering services consumers demand.

Source: EPAM Continuum, “Consumer Banking Report 2021,” October, 2021