Best practices for activating data, smarter marketing and leveraging local influence

A rebounding post-COVID economy and shifting consumer sentiment have put banks and credit unions on the hot seat. While banking’s stronger financial position likely means they now have the needed funding to reinvest in their financial institutions, where should they focus most of their efforts on improvements – in the brand or the branch? What kind of experiences really put banks and credit unions in the best position to create the most meaningful member and customer connections, and when is the best time to enact change? The reality is that consumers are reevaluating their financial relationships right now, as more than two-thirds of consumers look to consolidate accounts to a single provider.

While all of these intersecting issues make the banking industry’s investment decisions even more foundational to their future success, the good news is that there is no shortage of inspiration and insight from both inside and outside financial services. To support banks and credit unions on their quest to make smart decisions now that will yield rewards well into the future, we’ve rounded up the top five ways for financial brands to invest where it matters.

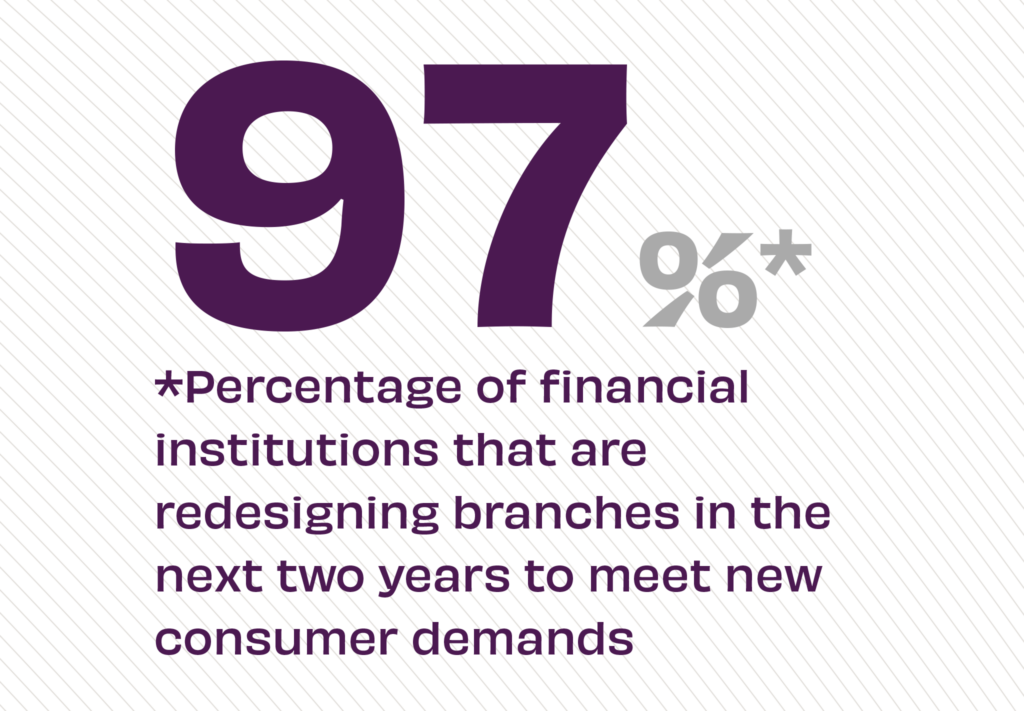

1. Drive Branch Design

Investments at the branch are critical to building the kind of experience consumers want to repeat. While there is undoubtedly an uptick in mobile usage, the branch channel continues to play a vital role, delivering high-value consumer accounts that significantly outperform those opened online. According to Believe in Banking’s article on data in decision-making: “Understanding how data informs brand experience is key to unleashing its power and potential, especially in the retail environment where direct interactions drive brand value. For brick-and-mortar, effectively leveraging data means knowing who is coming inside, understanding how they want to transact and creating a cohesive journey.”

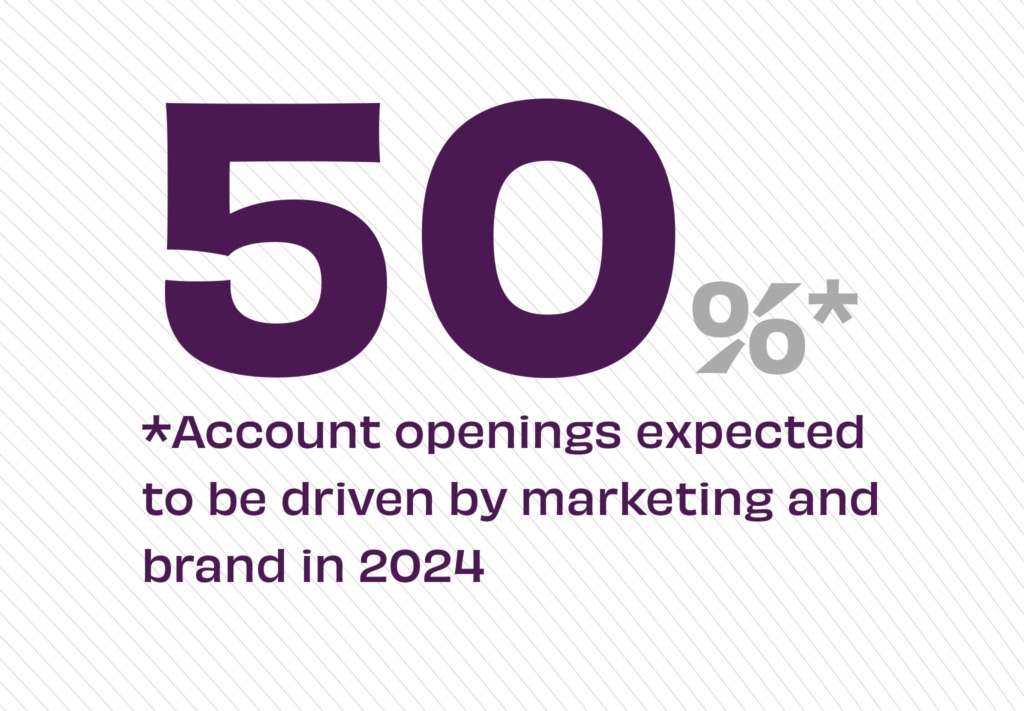

2. Create Meaningful Content

Whether a financial brand is just starting to lean into content marketing or it already has a robust and data-based marketing program, smart marketing matters. According to Juliet D’Ambrosio, Senior Director of Strategy at Adrenaline: “Marketing data affirms what we already instinctively know: That as transactions migrate to digital channels and branch purpose evolves, brand and marketing is the connective tissue between channels.” While consumers may seek out a branch to open an account, marketing is what drove them there in the first place – through its targeted, consumer-focused and relevant messaging. Demonstrating the value of brand and branch together, marketing is the thread that runs through and connects them both together.

3. Look Outside

Whether it’s brick-and-mortar models for resurgent retail or a thriving new sector, taking an outside view can provide a refreshed lens into financial services. From experiential, educationally-focused store environments to new formats for new consumers, looking at how other industries are building retail in our post-pandemic economy can help banking exceed consumer expectations. “As the financial industry faces a shifting post-COVID consumer landscape and reimagines the role of its physical branch networks, Cannabist and other examples like it can provide fresh insight and inspiration,” according to Believe in Banking’s article on what banking can learn from rising cannabis retail.

4. Best Practices from Peers

Not only is looking outside important, it’s also critical to assess how those within financial services are providing best practices that are setting the new industry standard. One area of significant growth during COVID was audience-first strategies based on a deeper understanding of consumer demographics, needs-states and life-stages. Next-stage digital strategies move well beyond search to a more savvy approach focused on creating connections. “Showing up in an authentic way to demonstrate you want to be part of the local community and knowing your neighbors feels both personal and personable,” according to Believe in Banking’s article on driving new member growth through insights-led marketing.

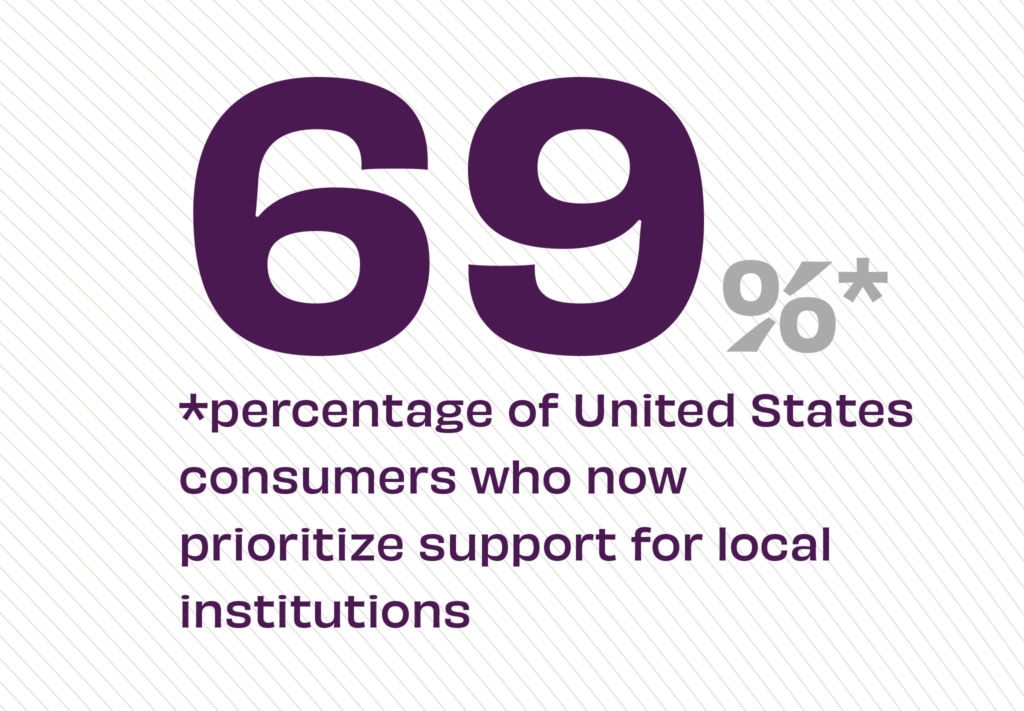

5. Put Community in Community Banking

As Todd Nagel, CEO from IncredibleBank, said in the recent Believe in Banking Podcast: “I believe in banking because I think it is the center of every community or it should be the center of every community, and if you’re a bank serving the community, you’re doing the right thing.” So central is the community to banking, ICBA launched its “Bank Locally” campaign to highlight all the ways community financial institutions help their local neighborhoods thrive. Leaning into their pivotal local role helps community FIs not only differentiate themselves from their big-banking competition but also helps demonstrate daily their commitment to ways that banking can help transform people’s lives.

For more insights on making investments that matter, stay tuned to Believe in Banking as it tracks the big trends that are impacting financial services. To develop meaningful experiences for customers and members, especially in the wake of COVID, contact Adrenaline’s experts at info@adrenalinex.com or (678) 412-6903.