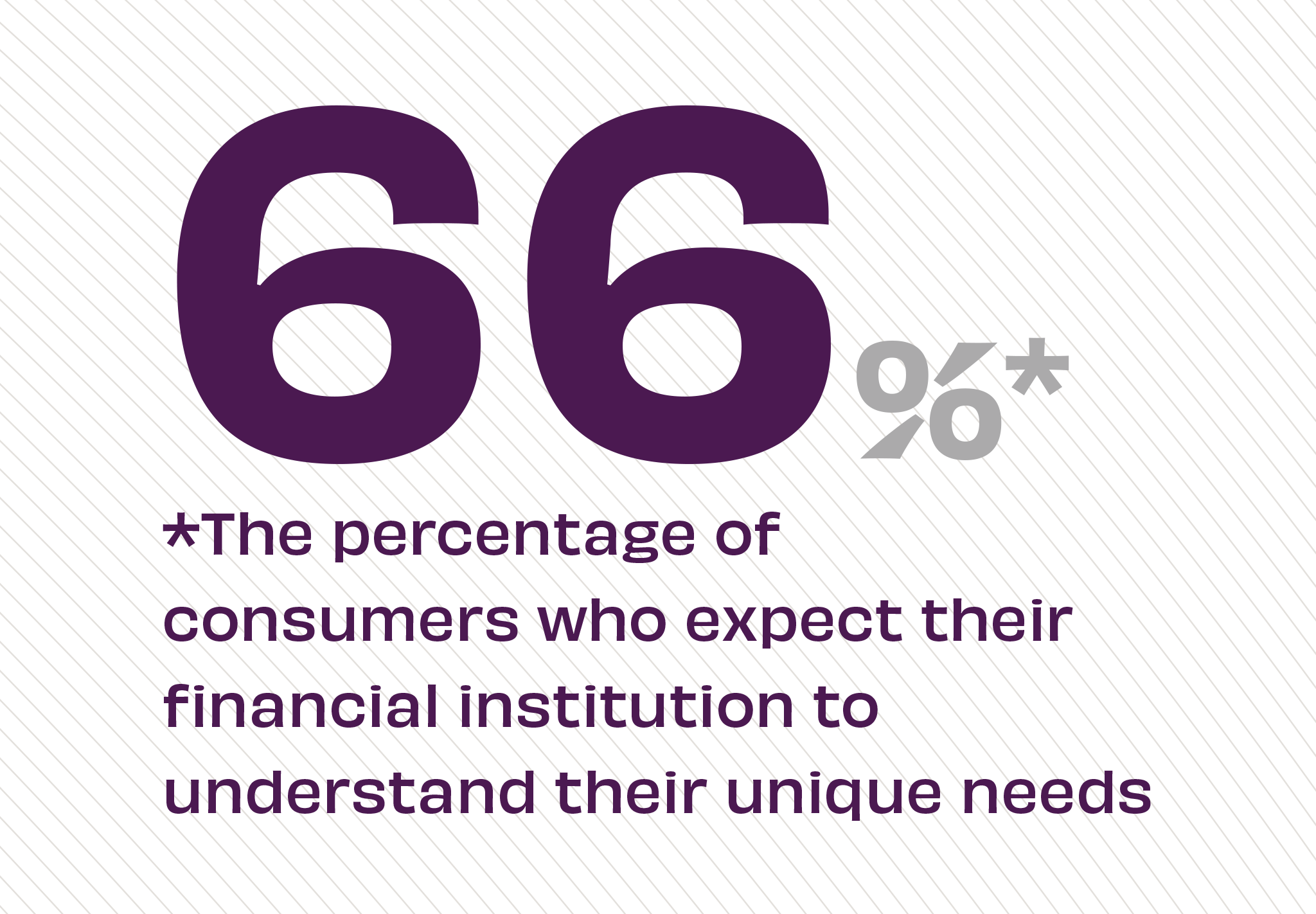

The Story: Among the many changes spurred by COVID, U.S. consumers are increasingly expecting better experiences from brands. As a result, they’re now actively seeking FIs who are able to provide truly personalized experiences.

The Takeaway: Equipped with more customer information than ever before, banks and credit unions can harness this powerful data and transform it into connected intelligence. With actionable insights, FIs can create more one-to-one customer experiences, personalize offers and advice and communicate consistently across every channel – from in-person and video chat to email, online and mobile banking.

Source: Salesforce, January 2021