From evolving the role of the branch to investing in staffing, how banks are delivering exceptional CX even in the midst of challenging times

With all the ways COVID transformed nearly every aspect of our lives, knowing how to deliver a good customer experience (CX) in the midst of change is the banking industry’s charge – now and in our post-pandemic future. Brands that anticipate consumer needs and deliver on them are finding the most success during these challenging times. That’s because good CX is not just good business, it’s good for business. In fact, Forrester’s 2021 Customer Experience Index found that companies using COVID as a catalyst to evolve their CX saw a significant bump in satisfaction scores. “The increase in scores can be attributed to the goodwill the brands built with customers – their CX equity – in creating experiences.”

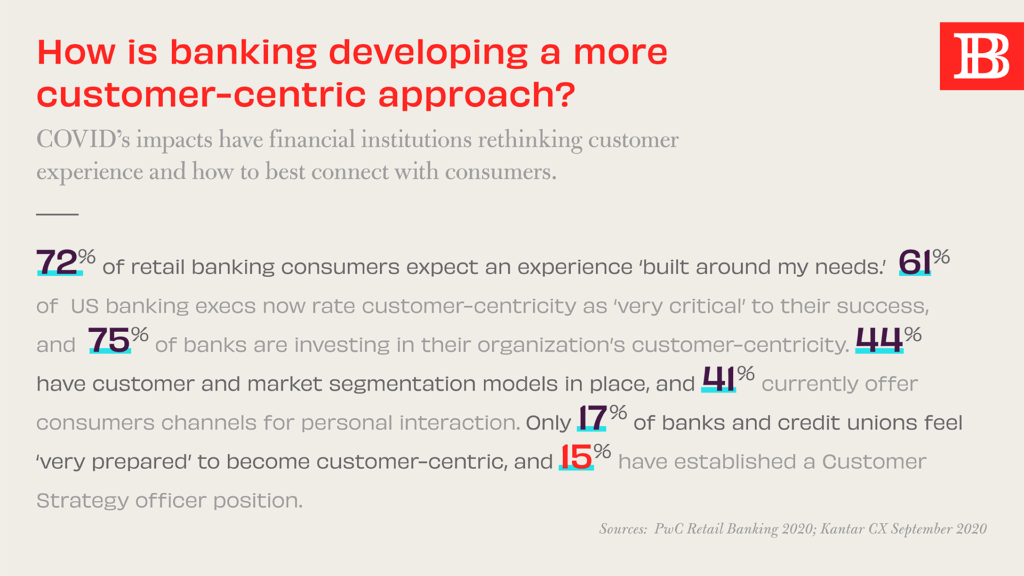

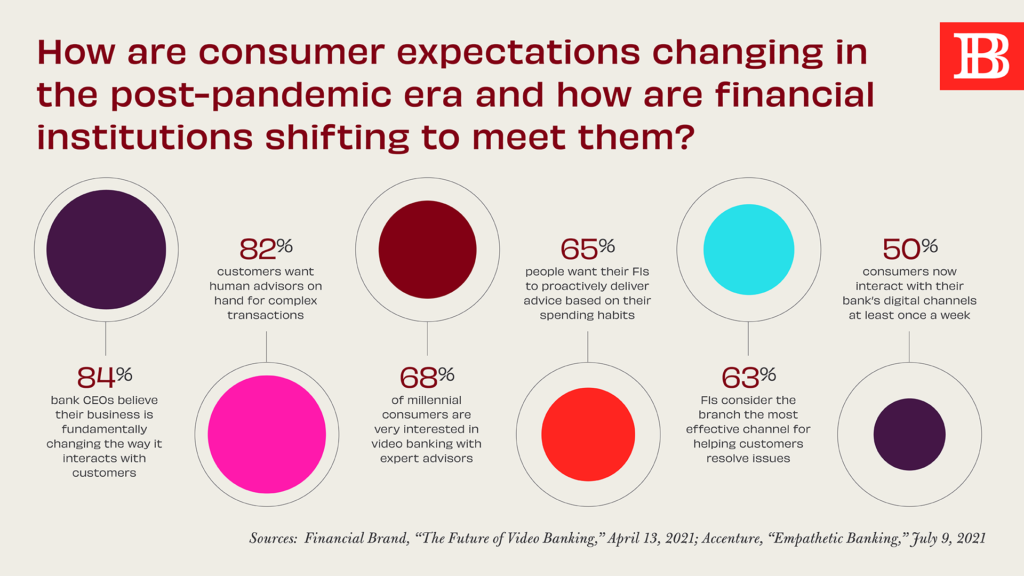

Lest we think brands can solve their CX challenges by simply speeding up their digital delivery, Harley Manning, VP and research director with Forrester reminds us that while technology is important for CX, at their core good experiences are customer-centric and human-based – made to deepen relationships with consumers. “We know this is important because experiences associated with positive emotions, such as resolving issues quickly and demonstrating empathy, create and sustain customer loyalty.” Relationships matter in creating good experiences. “To do this well, CX pros must have a disciplined approach to envisioning, designing, and delivering consistently high-quality experiences.”

How is banking meeting changing consumer demand for these meaningful experiences? We’ve rounded up five of banking best practices for providers to continually exceed customer expectations.

1. Evolving Branch Purpose

As consumer demand evolves, branch purpose is changing. With new branch prototypes, forward-thinking financial institutions like First Horizon are designing and delivering unique banking experiences to connect all parts of the bank, so “bankers are empowered to engage with clients on a journey as they build their financial futures.” These new formats are usually arrayed in hub and spoke clusters, providing a series of options across markets, with most full-service options in growth markets. According to McKinsey’s In Banking, Location Is Everything Again: “While global growth trends are complex, banks can benefit from anticipating a dynamic, shifting relationship between growth and location.” They recommend prioritizing “high-demand products and services and profitable customer segments” for expansion markets.

2. Investing in People

As the branch grows into a new consultative role, financial institutions are staffing differently. That means moving away from teller lines and transactions, toward a more universal banking model that provides more human-based service and needed financial counseling for consumers. With customized products and services that meet customers at the point of need, banks and credit unions will need to have skilled, experienced staff to match customers with the best banking solution for them. Getting staff onboarded and trained during a “perfect storm of market conditions” makes it “difficult for banks to address higher customer service expectations and manage increased demand,” according to a new staffing survey. But banking is making those investments in people and doubling down on humanity.

3. Leveraging Locality

In her recent ABA Bank Marketing presentation Leveraging the Local Branch through Proximity Marketing, Gina Bleedorn, CXO of Adrenaline, addressed the role of the branch. Even if they don’t need to go to a branch often, consumers of all generations want one nearby. She says, “Eight-two percent of consumers across demographics – both business and retail – say that the presence of a local branch is extremely or very important to them.” It’s a critical linchpin in their decision for choosing a primary financial provider. While consumers are using a host of channels to engage with their banks, knowing that a branch is nearby represented convenience and counsel available right around the corner. But just because you need to be local, doesn’t mean you have to have a full-size branch.

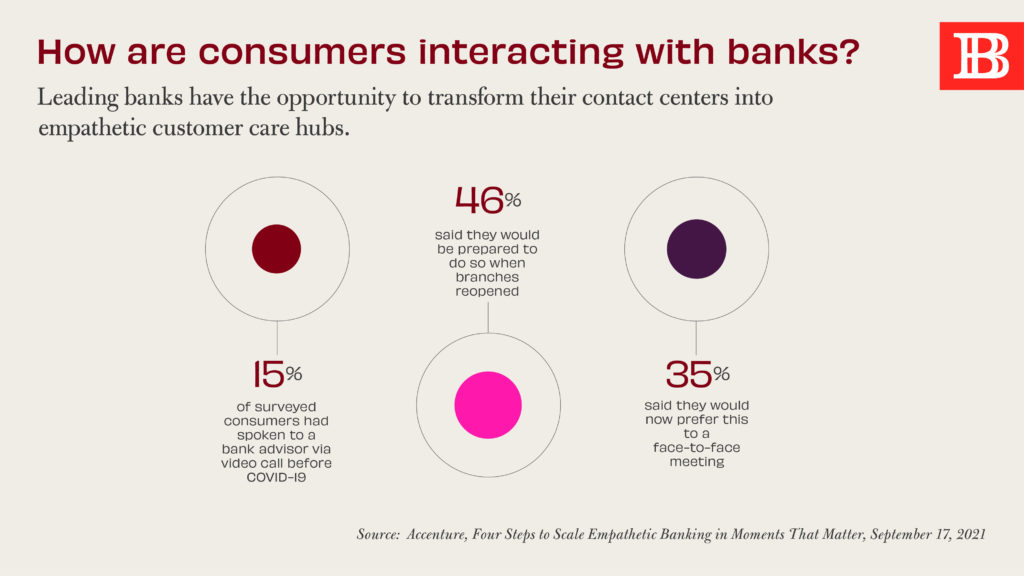

4. Transforming Customer Channels

Another way banks are creating better experiences for customers is by humanizing technology channels like chat to solve customer problems. Prior to the pandemic, many banking consumers used customer service lines, but very few – only 15% in fact – had used banker-staffed video calls to get support for their accounts. Now, 35% of consumers say that video chat is preferable to meeting in person at the branch. “Leading banks are transforming their contact centers… investing in capabilities that promote empathetic experiences,” according to Accenture’s article on empathetic banking. “It also includes making human chat the primary way customers interact with contact centers, augmenting with digital capabilities to promote an empathetic banking experience without physical face-to-face interaction.”

5. Deploying Self-Directed Banking

Finally, organizations are embracing a rise in self-directed banking through tools like ITMs. Differentiated from Finally, organizations are embracing a rise self-directed banking through tools like ITMs. Differentiated from purely self-service, banking channels that are self-directed empower consumers with higher-tech when they want it and higher-touch when they need it. “For financial institutions, the benefit is clear –ITM technology serves as a bridge between the physical and digital, improving customer experience and increasing revenue per customer,” according to Juliet D’Ambrosio, Adrenaline’s Managing Director of Strategy. “It can serve dual purposes – automating routine banking activity while providing access to bankers for higher-value consultations.” For consumers, ITM as part of a bank’s omnichannel offering gives them more ways to interact on their own time and their own terms.

For more insights on driving better CX in banking, stay tuned to Believe in Banking as it tracks the big trends that are impacting financial services. To develop meaningful experiences for customers and members, contact Adrenaline’s experts at info@adrenalinex.com or (678) 412-6903.