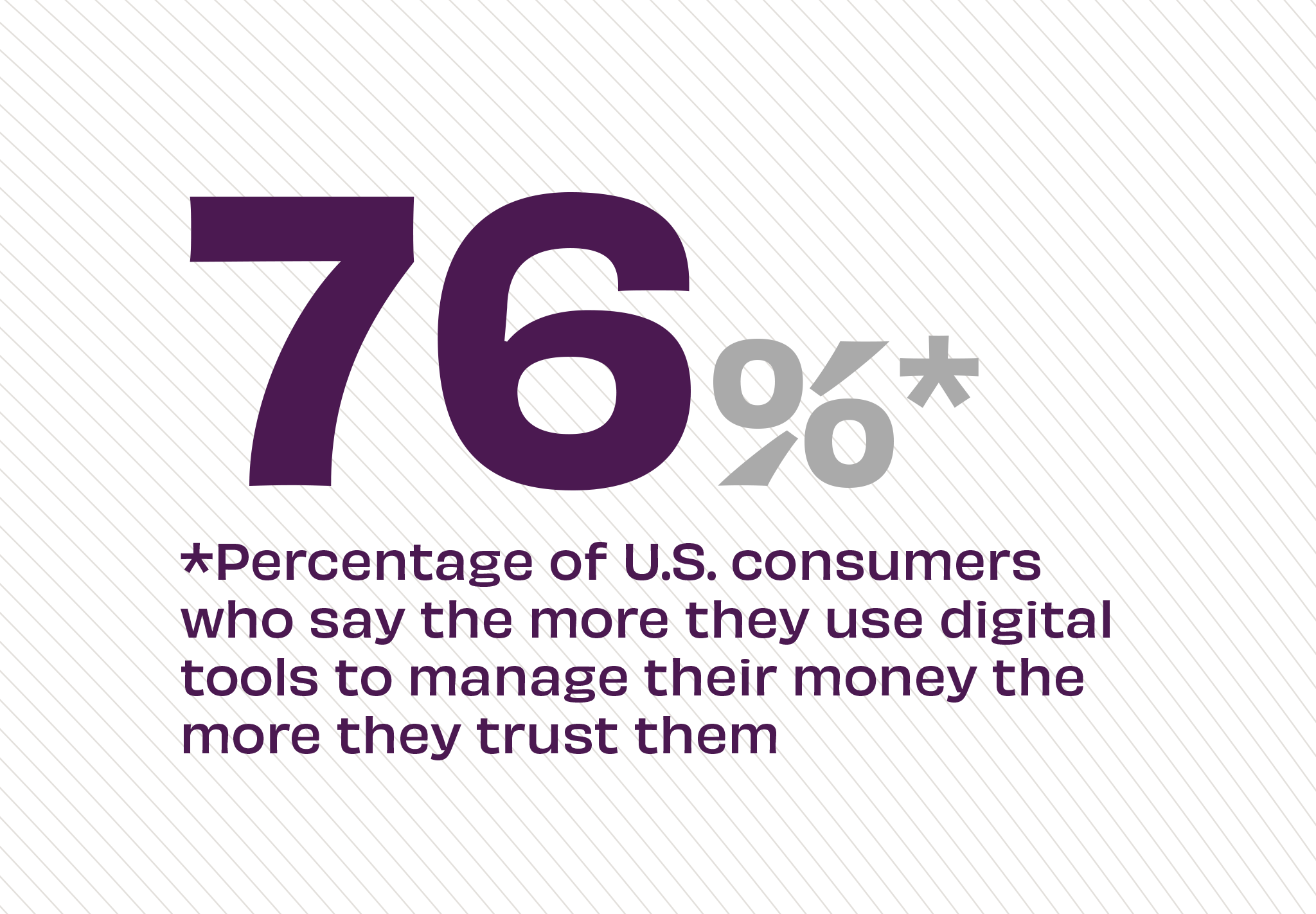

The Story: The pandemic saw late adopters latching onto fintech platforms, with U.S. uptake growing 30 percentage points between 2020 and 2021. As a result, today Millennials and Gen Z customers report they trust fintech and non-bank financial providers nearly as much as traditional banks, according to new data from Plaid and The Harris Poll. Additionally, the pandemic helped solidify consumer routines and behaviors with nearly 70% of respondents saying they use technology to manage their money on a regular basis.

The Takeaway: Consumers are now accustomed to a digital-first approach to banking, and it will likely stay that way. To keep a competitive edge, FIs need to strengthen their digital capabilities by investing in tech partnerships and modernizing their offerings. This also means educating customers how using digital tools will make managing money simpler and more convenient – before customers take advantage of competing fintech offerings. Finally, banks and credit unions can maintain their reputation of trustworthiness and credibility by being upfront about fees and policies, so customers are satisfied and stay with their bank.

Source: Plaid/The Harris Poll, featured in The Financial Brand, “Millennials Now Trust Banks As Much As Fintechs,” March, 2022