As consumers continue navigating a challenging economic environment – with its persistent inflation, rising interest rates and ballooning credit card debt – news comes that Gen Z is accruing debt faster than any other generation. “Navigating the world of personal finance is a daunting task for anyone, but it is a particularly pressing concern for Generation Z as they begin their careers and become financially independent,” according to Bankrate’s exploration of the younger generation’s financial outlook. “Gen Z is grappling with new financial challenges at a time of high inflation, expensive college costs and a competitive job market.”

While all generations are experiencing at least some financial strain due to persistent economic pressures, Gen Z is reporting significant stress and need knowledgeable sources of financial support. But, they want solutions and advice to be personalized to their situations, not generic guidance they have to search for. Not only do financial wellness programs benefit individuals, institutions reap the rewards, as well. “Customers who believe their financial institution cares about their financial health are three times more likely to be ‘very satisfied’ and three times more likely to recommend their primary financial institution,” according to the Financial Brand.

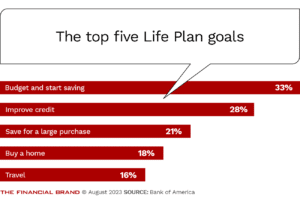

One successful effort is Bank of America’s Life Plan, a digital tool the bank launched in late 2020 to help customers work toward their short- and long-term goals. Embedded in the bank’s mobile and digital banking, nearly 80,000 people have used the financial wellness tool to date. Another cool tool is Truist’s gamified approach Long Game that encourages savings and financial literacy through arcade games, puzzles and trivia. “Financial wellness tools like the one Truist is offering have begun to warrant a second look as consumers dip into their savings,” according to a PYMNTS article on the bank’s efforts.

To drive the most engagement, however, financial wellness shouldn’t just focus on digital tools inside mobile apps or serving up the right financial products at the right time to customers. Instead, holistic programs incorporate more human-supported efforts. Astera Credit Union in Lansing, MI has just that kind of approach. EmpowerMe! is a powerful and personal financial literacy program that connects members “one-on-one with credit union counselors certified through the CUNA Financial Counseling Certification Program,” as outlined in CUNA News. “It’s outcome-based,” says CEO Martin Carter. “We’re not just throwing education at people.”

These more well-rounded efforts move beyond pushing digital solutions to consumers, when human expertise is what they require. It’s what Bob Meara, principal analyst at Celent calls for in his International Banker article, “Why a Bank Needs More Branch in Its Digital and More Digital in Its Branch.” He says digital self-service is good, but customers want it to go deeper. Likewise, in the branch, consumers want both high-tech and high-touch support. “Automation has a very important role to play, says Meara. “But even the most advanced AI can’t replace a helpful conversation that addresses a consumer’s particular request in a moment of need.”

If you’re a banking leader looking for effective brand strategies customized to your financial institution, get in touch with the experts at Adrenaline. And, don’t forget to subscribe to Believe in Banking to stay up to date with the latest news impacting the banking and credit union industries.